Retail FX deposits at US brokerages, which have been struggling to eke out a profit in a strict regulatory environment, rose in January by $3.3 million, CFTC data showed on Thursday.

The brokers, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, saw a total positive change month-over-month from December, though differences amongst each broker were more pronounced.

The prospect of loosening regulations began to revive interest in the US market among foreign brokers. Last month, London-based IG Group officially launched its United States subsidiary, IG US, the first broker to enter the US market since 2009. The move could help brighten the outlook for a retail industry that has struggled for quite some time under the provisions of the Dodd-Frank legislation.

However, the exact timeline for revised rules is unclear, but it would likely take several months at the earliest, given the scale of the reform the regulators will be implementing.

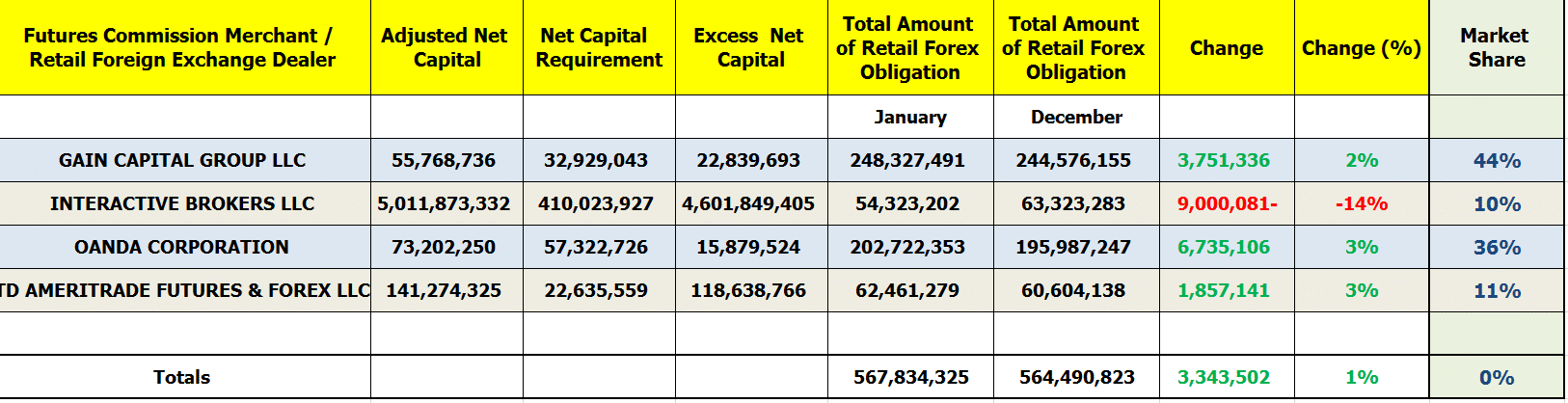

Back to the figures, the FX funds held at registered brokerages operating in the United States came in at $567.8 million in January 2019, which is one percent more than the $564.5 million reported in December 2018.

According to the CFTC dataset, three of the four FX firms listed notched increases in Retail Forex Obligations including GAIN Capital, OANDA Corporation, and TD AMERITRADE.

The best performer for the month was OANDA which saw an overall rise of $6.7 million to $202.7 million at the end of January 2019, compared to $195.9 million at the end of December, or an increase by three percent month-over-month.

Meanwhile, the single loss was made for the third consecutive month by Interactive Brokers, which saw a drop of $9 million, or nearly 14 percent month-over-month.

Looking at the market share of different brokers, the distribution slightly changed in January relative to the month prior. GAIN Capital remained the leader in terms of market share, commanding a 44 percent share. OANDA also solidified its stance as the second largest in the US with 36.0 percent market share – TD Ameritrade and Interactive Brokers retain an 11 and 10 percent share respectively.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on January 31, 2019 – for purposes of comparison, the figures have been included against their December 2018 counterparts to illustrate disparities.