One of the overwhelming themes of the iFXEXPO was that binary options are a hot product in the market. Not only did platform providers make themselves very present at the show, with large booths and sponsorships, but among attendees there were quite a few binary option brokers looking for networking opportunities and new ideas. During the conference, Forex Magnates prepared a questionnaire to canvas conference-goers about their opinions on several topics. With regard to binary options, the overwhelming consensus was that respondents were bullish on the industry. This included opinions from established FX players who appeared to believe in the opportunities of the binary options industry.

Forex Interest

With binary options playing a large part of the show, it wasn’t surprising that we spotted FX brokers talking with binary providers. Over the last year we saw the likes of several mid-size brokers such as Markets.com and VantageFX launch binary products. At the iFXEXPO we witnessed some deeper discussions taking place, with FX brokers putting in time to do due diligence on associated operating and marketing costs involved with binaries. As opposed to 2012 where it seemed that binary options and forex was serving two different types of traders, there appears to be more interest in cross-selling of the two products.

New Products

Networking by the SpotOption Booth

Before the show, there was an abundance of firms releasing new products in advance of presenting at the iFXEXPO. Products included an updated trading platform from SpotOption, Tradologic's new user interface skins, 'all in one' FX and binary trading from Techfinancials, and social binary trading from Tradesmarter. In addition, to the standalone platforms, there has been an emphasis on creating products to integrate binary options on FX platforms. This was seen by Panda TS acquisition of Polar IO and their binary options platform software. The deal is expected to provide increased efficiency in merging binary options trading with Panda’s existing binary/MetaTrader integration. The deal also comes as it was recently reported that TradeToolsFX has launched a non-plugin product to provide binary options on MT4 to allow it to be compatible with MetaQuotes licensing.

Not presenting at the iFXEXPO, but attending, were other firms that spoke to Forex Magnates about their new products. Among them, was a new broker called CTOption which has recently launched using its own proprietary platform. While the industry is currently dominated by firms using turnkey white label solutions from a handful of binary options providers, we are beginning to see more brokers work on creating their own products. Having a proprietary product can provide brokers with greater flexibility in terms of adding new products, tweaking the user interface, and handling demands from affiliates. There are also long term financial benefits to be gained by cutting out third party firms. Of firms with proprietary products, AnyOption has had success with its product, and was currently ranked as the number two binary options broker in terms of deposits in Forex Magnates Q1 Forex Industry Report. CTOption CEO Zacky Pickholz explained to us that their goal when developing their own platform was to put an emphasis on client usability.

Although cost intensive to launch a proprietary product and beyond the means of many new binary brokers, it is expected that more firms will begin to develop their own products. Specifically, deep pocketed binary options companies, as well as forex brokers that are currently dipping their toes in binaries with white label platforms are likely candidates to launch proprietary offerings.

Social Trading & Signals

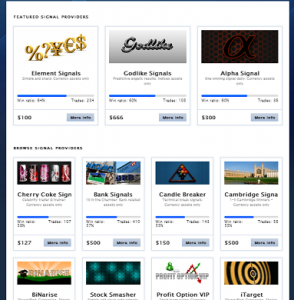

SignalIndex Marketplace

Another area that is seeing innovation take place is in regards to copy trading. Earlier this year we wrote about SignalPush, a signal trading marketplace for the binary options industry. The firm provides products for traders to purchase signals and trade their accounts automatically. In addition to SignalPush, Forex Magnates was introduced to a competing product called SignalIndex shortly before the expo. Recently launched, SignalIndex connects with GOptions with further brokers expected to be added in the future. According to Stefan Pajkovic, Founder of SignalIndex “we are creating an ‘app store’ for signals. We want to be the delivery channel for anyone that is sending alerts.” In addition, Pajkovic explained to Forex Magnates that they are looking to add value to the signal providing space by creating a ‘branded’ marketplace which will “allow brokers to offer a white label version of the signal index that offers inventory of signals “.

Brokers are also looking to work directly with signal providers. At the iFXEXPO, we spoke with Pavel Bykov, Chief Development Officer of Faunus Analytics whose signals are being offered through SignalPush. He explained that individual brokers have been showing interest in their product with discussions about direct signal connections without the need of middlemen marketplaces. On this, Bykov referred us to a direct hookup with binary options broker Cititrader that has recently been formulated in addition to their existing partnership with iOption.

What it interesting about the demand for binary options signals are the low probabilities of success. With binary payout in the range of 70-85%, it forces signal providers to require a 58-70% win rate to be profitable. As such, both brokers and signal middleman have admitted that long term gains are difficult with signal providers. In this regard, Pajkovic mentioned that their product provides the opportunity for users to manually accept signals. Therefore, if a provider is doing poorly or sends a signal for an option that looks interesting, users can elect to trade or reject the trade. Overall, despite the low probabilities, signals continue to be in demand from traders and are being priced in the hundreds of dollars.

O-Systems Social Trading Wall

Following on the concept of signals, social trading is becoming more popular. Earlier this year we wrote about a new binary provider called O-Systems which launched social trading tools. Although initially having a rudimentary look and features, the product was a start. At the event O-Systems Co-CEO’s Haim Lagziel and Tzahi Nachmias showed us an update of their social trading interface 'Trading Wall' . They mentioned that that product, as well as a 'limit trading' feature has allowed them to distinguish themselves from other providers and they have launched with several brands recently.

Overall, with the launch of new platform interfaces, social trading, etc, we are seeing binary firms beginning to separate themselves from the competition. Specifically in regards to mobile products, providers are showing differing interfaces to appeal to varied users. As such, what initially appeared like multiple providers all launching similar products, firms are beginning to carve out their own looks and features.

Crowded Space

In addition to proprietary products mentioned above, at the event we also learned of another binary options provider set to launch this year. Despite the huge interest taking place for binary options, the question becomes whether the space is becoming too crowded. Including third party technology firms like Panda TS, there are around ten firms that currently provide binary trading solutions for brokers. With more proprietary platforms coming, it could lead to decreased businesses from established binary providers.

Tradologic Branding Was Everywhere

In terms of a ‘funding crunch’ Forex Magnates has heard from sources that the recent bank haircut in Cyprus caught several providers and brokers off guard and led to them absorbing losses as a result. Additionally, among the leading binary providers, there are reportedly at least one or two firms facing financial difficulties, causing them to seek further funding, partnering with another company, or exiting the market. Such instability would be a boon for well-funded providers, as new binary brokers may be more inclined to work with firms that have a lower risk of folding. Also, the exit of one of the players could lead to existing brokers re-evaluating their solutions providers for possible changes. In this regard, it was interpreted that Tradologic’s mass presence and spending during the iFXEXPO was their way of letting the industry know that they are well capitalized for the future.

Cyprus, Regulation & Gambling

As mentioned above, several firms took a hit due to the financial crisis in Cyprus recently. It was explained to us at the iFXEXPO by several payment providers, that many binary firms were using Laiki Bank, which was the hardest hit bank in Cyprus. As a result, brokers that may not have spent much time evaluating the differences between payment solutions are now taking the product more seriously and looking for more diversity. However, regardless of the financial effects, Cyprus continues to be the main destination for binary options brokers seeking regulation. The island offers one of the easiest paths to ‘legally’ (see Italy bans binary IPs) market to mainland Europe, as well as providing accommodating tax rates. In addition, there is an ample supply of employee candidates with FX experience which is driving employment costs lower in the Cyprus’s forex/binary options industry. For these reasons, providers of accounting, legal, and regulatory services in Cyprus singled out binary brokers as a critical driver of their businesses.

Despite the availability of regulations to binary options firms, at the iFXEXPO we also met with a quite a few brokers that have chosen to stay unregulated. These firms are typically targeting specific regions where the company founders have previous experience in online marketing. Our speculation is that binary options are being viewed as an online turnkey solution for them to leverage their existing marketing and sales teams, while having a low cost of entry. Most firms though mentioned that regulation was an area that they would evaluate in the future. However, the feeling that we received is that many of the unregulated brokers aren’t in it for the long term, and the expenses related to regulation are cost prohibitive until their businesses grow.

Talking about regulation, it is quite evident that the trend among binary platform provider is to offer shorter expiration durations and more trading activity. As a result, many of the ’60 second’ options have more of a resemblance to gambling than trading. This is occurring even as it looks nearly 100% apparent that Japan will soon outlaw short term options and set a minimum two hour time period for contracts. The two hour minimums are part of the JFSA’s goal of creating binary option regulation to distinguish it from online gambling products which are mostly all illegal in Japan. As such, Japan is setting a regulatory precedence in regards to shorter durations which could lead to restrictions being proposed in more regions. The definition of where binary options fall was also debated recently by the Maltese financial regulators that decided to regulate it as opposed to including it as a gambling product.

However, brokers and providers don’t appear to be too concerned about their products resembling gambling and the emphasis is solely on optimizing trading volumes. Whether this bites the industry in the future remains to be seen. What is apparent, is that like it or not, binary options are very much a active and important part of the FX industry today.