UK-headquartered IG Group Holdings Plc (IG), which operates global Online Trading brokerage businesses under its IG related brands, has today filed a trading update for its fourth quarter (Q4) with the London Stock Exchange (LSE), ahead of the start of its new financial year that begins tomorrow on June 1st 2016.

IG said that its performance during its Q4 period - which ends today on May 31st - had strong financial metrics across all key operating results which remained in line with its prior Q3 update, thanks to increased ROI for its marketing expenditures.

The new world of online trading, fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Q4 to help lift FY earnings

The company said it expected full-year earnings to be slightly ahead of forecast, as an increase in marketing spend is returning what it described as a compelling result, and with the ongoing robust performance coinciding with higher variable operating costs which were more than offset by the resulting trading revenues.

Financial results for IG’s full year including Q4 will be released on July 19th, 2016, and the company will hold a presentation for institutional investors at its London office on that day.

Recent share price momentum

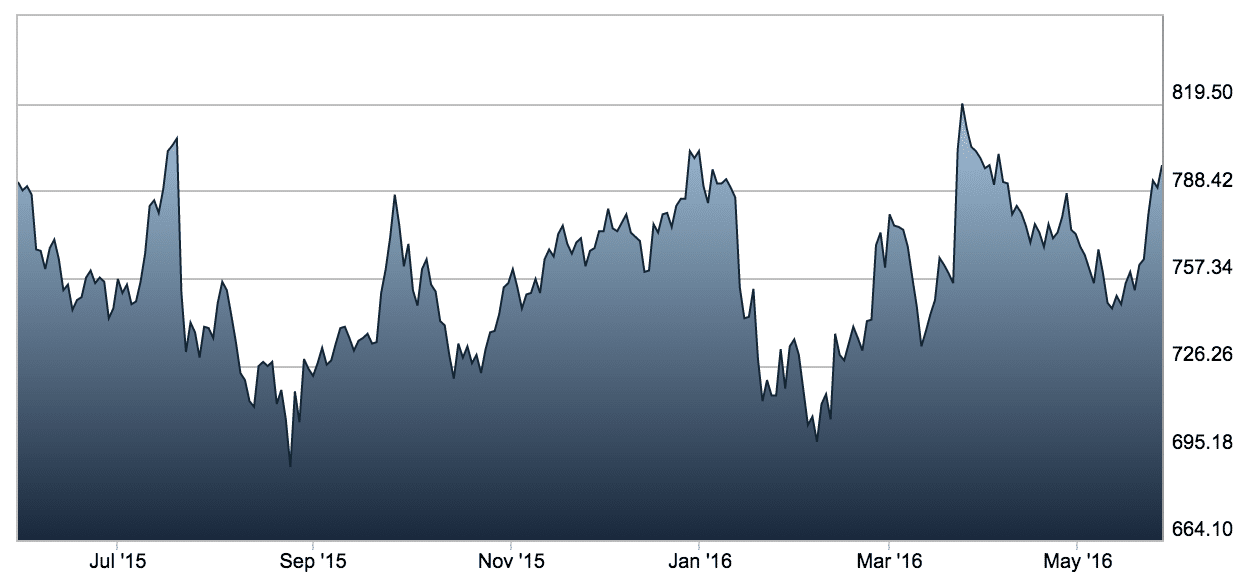

Shares of the company in London traded under ticker IGG have continued to press up against the 800 pence (GPX) resistance line, with several breakouts above that level in the last year. It could soon turn into a support line with current prices hovering nearby around the time of publication today.

This follows the pullback from March's all-time-high near 820 GPX per share, thanks to periods of sharp bullish momentum for IG's stock price that has been followed by gradual periods of consolidation within a trading range down to nearly 700 pence, as seen in the chart below.

Chart of IGG Recent Stock Price

Source: LSE