There has been something of a disparity between the volumes traded during 2012 and 2013, whereby an industry wide set of extreme parameters have been demonstrated. 2012 was a year of volumes languishing in the doldrums, and as the year ended, it gave way to a new year of what has turned out to be record all time volumes for a number of firms across the board.

Today, British FX company IG Group Holdings has released its preliminary results for the business year ended May 31, 2013, which in many respects reflect this dynamic.

In May this year, Forex Magnates spoke to IG Group Holdings Chief Executive Tim Howkins, who gave a background into a period of growth for the company, and significant expansion of electronic trading and use of mobile devices. Mr. Howkins joined the firm as Chief Financial Officer and effected the IPO for IG Group.

“When I joined IG less than 20% of transactions were online. Now 99.5% of our client orders are online, almost a third of them using mobile applications. I expected to be challenged and mentally stimulated by what was clearly a highly successful rapidly growing business. I certainly wasn’t disappointed” said Mr. Howkins.

Tim Howkins,

CEO,

IG Group Holdings PLC

“During my time as CFO we IPO’d the business on the London Stock Exchange, did a private-equity backed management buy-out and then re-IPO’d the business. I think I might be the only CFO who has done two IPOs of the same business. We didn’t let those transactions distract us from growing the business. When I joined IG we had annual revenue of just £12m and at our first IPO in 2000 the group was worth £125 million. Now we have annual revenue of around £360 million and are worth over £2 billion.”

Challenges In 2012, Satisfaction In 2013

IG Group’s announcement included a set of parameters by which the firm could compare its performance during the course of the year. The company surmises that it achieved satisfactory overall results after a challenging first half, referring to the period between May 2012 and December 2012.

Decrease In Net Trading Revenue

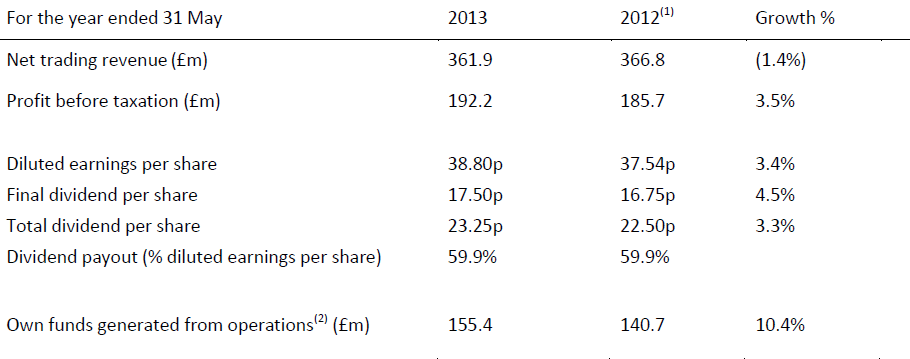

Concurrent with the results posted by many other firms, business responded very well to the upturn in the trading environment during the second half of the fiscal year. Despite this however, net trading revenue experienced a reduction of 1.4% to £361.9 million.

The firm exercised very strong cost control and focused on ensuring that its operations were economically run following the subdued first half of the fiscal year, and despite a reduction in net trading revenue, the firm made a pre-tax profit of £192.2 million, which is 3.5% up from last year.

Diluted earnings per share (EPS) increased 3.4%, arriving at a figure of 38.80p, and the firm has 155.4 million of its own funds generated from operations. The final recommended dividend was 17.50p per share, and the full annual dividend increased by 3.3% to 23.25p.

Although 2012 provided results concurrent with the rest of the industry for what was a poor year all round, IG Group experienced remarkable performance in the 2011 financial year.

Mr. Howkins explained to Forex Magnates: "During 2011 as a whole, we increased revenue year over year by 17.3%* with a strong growth of 28% in the first half of the year. High levels of market Volatility in August 2011 resulted in record monthly revenues."

"We saw fast growth of 26% in Europe, with our Iberian business accelerating to become the fastest growing of the European businesses, 22% growth in Australia and 49% growth in Singapore, mainly driven by a 30% increase in revenue per client."

IG Group Chairman Jonathan Davie made a statement today regarding the preliminary results: “I am pleased to report another year of record profitability for the Group, a significant achievement given the particularly challenging trading environment in the first half of the year.

We remain committed to delivering superior technology, innovative products and the best trading experience, putting the needs of our customers at the forefront of everything we do.”

Mr. Howkins commented: “Along with delivering higher earnings after a difficult first half, we have made considerable progress over the last year with our rebranding, the launch of IG.com and the development of our platform offering.”

“Our additional investment in the next financial year will focus on specific initiatives aimed at further enhancing the Group’s offerings for active traders, including introducing MetaTrader, development of our mobile platforms, and further geographic expansion.”

“This is a business in which we need to continue to invest for the longer-term. The investments we will make in the coming year should leave us well placed for future growth. I am confident in the prospects for the business going forward” concluded Mr. Howkins.

Note: All amounts are stated for IG Group's continuing operations. The Group's Sport business was discontinued in the year ended May 31, 2012.