IG Group today published its "pre-close trading update" for the year ending 31 May 2011. Overall trading revenue was 7% higher than the previous year and this despite increased competition and challenging conditions such as its Japanese business's revenue falling by 14%. IG explains that the Japanese drop is due to leverage decrease but it's not very accurate as most Japanese brokers actually reported volumes growth despite the leverage.

It's amazing to see this company grow in double digits in Europe, Singapore and Rest of the World (triple digits growth) - this is a major sign that online financial trading is far from being a mature market and still has much room to grow. IG Group is a pretty large Forex broker, although it doesn't separate its forex reporting from overall financial reporting, it does approximately $120-160 Billion a month in retail forex trading. IG Markets is a clear leader in several European markets and in Australia. IG used to have indirect presence in the US through its IG Markets subsidiary but this ended a few months ago and now IG is present in the US through its US binary options trading exchange - Nadex.

IG Group Holdings plc (“IG” or the “Group”) issues the following trading update relating to the financial year ended 31 May 2011. The Group expects to report trading revenue of approximately £320m (2010: £298.6m) and adjusted profit before tax of approximately £163m (2010: £157.6m). These figures represent increases of 7% and 3% respectively. Despite an extremely challenging comparative, the Group achieved year-over-year growth in the final quarter of the year. Excluding Japan, the remainder of the Group’s financial business grew revenue at 6% in the final quarter and 9% for the year as a whole. Client activity levels in the final quarter of the year were mixed. In March high levels of volatility, particularly in the yen, the Nikkei, gold and oil resulted in both revenue per client and the number of active clients being elevated, producing record monthly revenue. Activity was subdued in April when dull markets were combined with Easter and an extended holiday period in the UK before recovering to more normal levels in May, aided by increased volatility in commodities and precious metals.

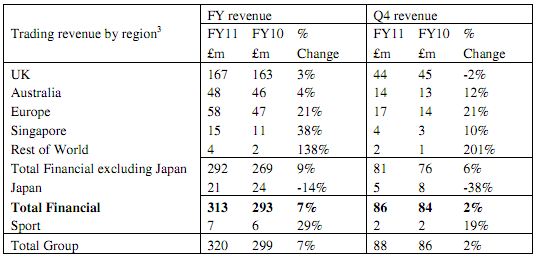

A geographic analysis of trading revenue is set out below:

The Group’s UK business achieved record monthly revenue in March but had an extremely quiet April due to the extended holiday period. As a consequence, revenue for the quarter was slightly down on the corresponding quarter the previous year despite 4% growth in active clients.

The Group’s Australian business achieved 12% revenue growth in the last quarter, driven by an 11% growth in number of active clients and a 1% increase in revenue per client. The Group’s continental European businesses achieved 21% revenue growth in the last quarter, driven by 29% growth in active clients, offset by a 6% fall in revenue per client. Revenue per client increased in Germany, but fell in the majority of other countries, where revenue per client is typically considerably higher than the group average.

As previously announced, PFGBEST, a substantial US broker, has become a member of the Group’s US exchange, Nadex. The IT work which PFGBEST has had to undertake before being able to offer Nadex products to their clients is nearing completion and it is expected that they will begin to offer Nadex products shortly. Alongside its strategy of distribution via brokers Nadex has continued to pursue a direct to retail model and has enjoyed a temporary spike in client recruitment, largely driven by one market commentator. During May 2011 approximately 800 direct retail members traded on the exchange, compared to around 100 in May 2010.

In the final quarter of the period the Group’s Japanese business delivered revenue of £5m. While this was an improvement on each of the previous two quarters, it was 38% lower than in the corresponding quarter last year, reflecting the impact of leverage restrictions introduced during the year.

Sports business

The Group’s sports business, extrabet, now represents less than 2.5% of Group revenue and, due to its substantial fixed cost base, a much lower percentage of profits. During the financial year, the directors decided that the Group should investigate selling or closing the business in order to allow management to focus exclusively on the continuing expansion and development of its financial business.

The Group has conducted a detailed process, but has been unable to secure a sale of the business in its entirety as a going concern on acceptable terms. Consequently, the Group has commenced a redundancy consultation process with the employees of extrabet and will incur certain one off costs which will be recognised in the year ending 31 May 2011. These comprise the write off of goodwill associated with the sports business of £5.25m (non-cash) and likely cash closure costs including potential redundancy and lease-related costs totaling approximately £2.5m. These cash costs have been recognised within adjusted profit before tax. The Group has, however, reached agreement to sell the majority of the client list relating to extrabet’s sport spread betting and fixed odds betting business to Spreadex Limited on terms where the Group will receive semi-annual Payments for the next three years, calculated by reference to the revenue that the acquirer generates from clients on the list. This transaction is expected to conclude by the end of June. The Group is also seeking a buyer for its pricing engine software, used for market making into betting exchanges.

Grab your latest copy of the Forex Magnates Retail Forex Industry Report for Q1 2011.