IG Group is one of the largest retail brokers in the world, and as such, it is closely scrutinized by its investors. When the new CEO of the firm, June Felix, outlined the firm’s restructuring plans back in May, IG Group's position as a global leader in the retail Forex and CFDs space was confirmed once again with investors buying its stocks at the multi-year low of around 475 pence per share.

Since then the stock has rallied materially, reaching over 600 pence in July. After the company published its annual report yesterday, the firm’s stock lost five percent of its market value as traders digested the bits and pieces of the document.

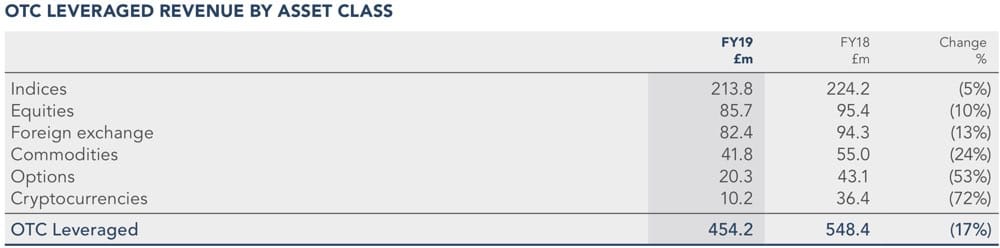

Looking at specific data points, it's worth noting a continuing transformation in the company's product mix. IG Group's leveraged revenues by asset class continued to shy away from FX. During fiscal 2019, equities continued to outpace foreign exchange.

IG Group's OTC Leverage Revenue by Asset Class

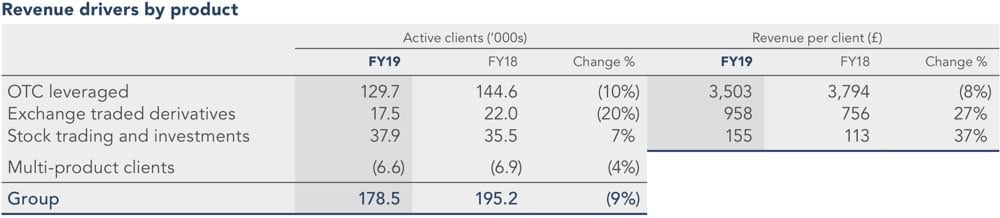

Looking at revenues by product, OTC leveraged products and exchange-traded derivatives declined, while stock trading and investments increased materially. That said, revenues from the latter two product categories are still dramatically lower when compared to the classic OTC offering.

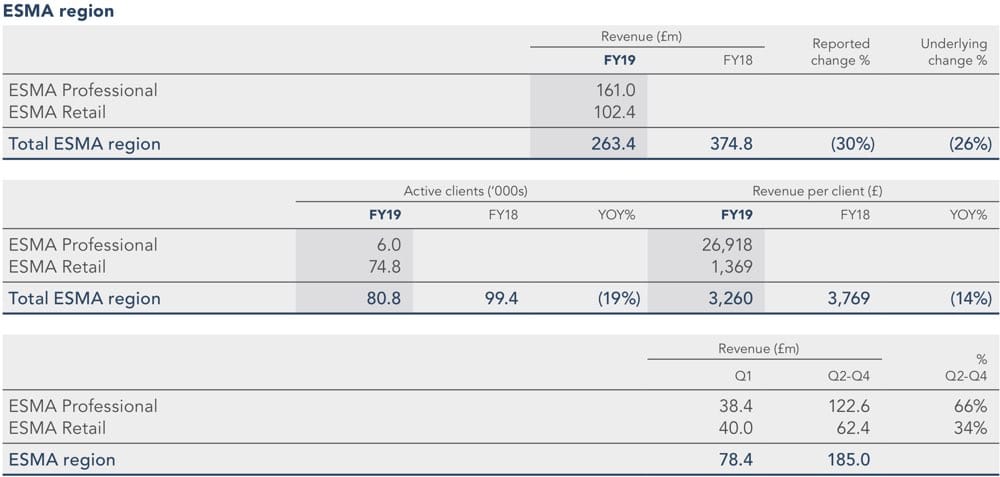

When it comes to retail and professional revenues distribution, we also see material differences.

New Distribution Channels

With the ongoing shifts in the market, IG Group is banking on a change to its product distribution channels. The firm has outlined that the majority of its business has been based on a direct relationship with its clients. Regardless of the region, the company has been actively present across multiple markets and on-boarding clients hands-on.

The move of the firm into new geographies, however, is promoting IG Group to rethink its strategy. The firm is preparing to accelerate its growth by working with a wide range of partners that enable it to increase its market penetration.

The company has also identified new markets where it hasn’t been operating until now and plans to enter there depending on local characteristics. While there is no mention which specific markets the company is considering, the obvious answer is emerging as Asia, albeit Africa and Latin America could be on the table down the road.

While some smaller brokers have been successful in targeting some emerging markets, IG Group has not been as pro-active in diversifying its revenues away from traditional regulatory jurisdictions like Europe, Australia, and Japan. That said, the company was among the first to recommit to the US market and started operating there earlier this year.

Revenues of the firm from the UK, EU, Australia, Singapore, and EMEA outside of the EU totaled £417.4 million. Meanwhile, the company generated £59.5 million from markets it identifies as potential growth areas.

DailyFX, the US Market and Japan

As previously highlighted by Finance Magnates, the main reason for IG Group to enter the US market is its ownership of DailyFX. The firm acquired the asset from FXCM for $40 million in the aftermath of the SNB-induced shock for the US brokerage.

The company also highlighted that it plans to increase its marketing spend in Japan in order to increase its market share. The firm’s commitment to increase the number of high-value retail and institutional clients was also boosted with some new product partnerships.

The firm has integrated content from financial media powerhouse Real Vision, a company co-founded by Raoul Pal and Grant Williams. In addition the company aims to increase the value of its offering by delivering to its clients an ever-expanding list of assets to trade and easy-to-use Risk Management features.

The firm also mentions increased investment in machine learning, while the company’s clients are said to benefit from access to the company’s tier-one prime brokers. Overall, IG Group has committed to continuing to evolve its offering for each segment.

New Leveraged Products in the EU

IG Group’s plan to launch a new Multilateral Trading Facility (MTF) in the EU is identified as one of the key opportunities for the firm. It is aiming to take a meaningful share of the on-venue turbo market which it has not previously addressed.

Spectrum will launch with turbos on equity indices, currencies, and commodities, and the aim is to expand that product set to include single-name equities in the future. The Group also expects to attract other brokers to the Spectrum offering. The company already launched the offering in Germany.

Emerging Markets

IG Group is also looking to delve deeper into emerging Asia, by striking partnership deals with licensed entities in the region. While no specific names have been mentioned, the market is lucrative enough for the company to take a patient approach when discovering its reliable partners in the area.

The firm is considering its offering and quality of the product set and technology to be enough to position IG as an attractive partner in emerging Asia. The company is in the process of establishing a solid local business development presence in order to facilitate partner relationships and to investigate opportunities in the leveraged securities market.

Revenue Targets

The new strategic plan which IG Group unveiled in May did set some aggressive targets. At the time June Felix aimed to deliver revenue growth in its core markets of around 3-5% per year over the medium term.

In the meantime the target for new markets which have not been the focus for the firm stood at £100 million, to reach £160 million by 2022. With these targets in mind, the company said it is focused on delivering a revenue figure that is 30 percent higher than in 2019.

In its annual report, IG Group also highlighted that it aims to increase its cost base by a significant amount. Operating expenses, excluding variable remuneration, were £259.6m in the 2019 financial year, and are expected to increase by around £30m in the 2020 fiscal year.

This is primarily due to additional investment in prospect acquisition to continue to promote the IG brand, to grow the size and quality of the client base, and to establish the new businesses in the EU and the US. In subsequent years the Group expects its operating expenses, excluding variable remuneration, to increase at a lower rate than revenue.