Nadex (formerly known as HedgeStreet) is a US regulated futures exchanged and a fully owned IG Group's subsidiary. Nadex just received CFTC approval to allow intermediated access to brokers. What this means is that FCMs and brokers will now be able to start offering binary options and spread betting contracts to their clients, through Nadex.

Now I'm not that excited as I view binary options/spread betting as pure gambling:

These products allow unsophisticated traders to bet on indices, stocks, commodities and currencies in short term intervals and profit if the bet was successful. It's very simple because all you need to do is pick whether the underlying asset will be above or below current price. Payout is typically 70% on top of your bet, meaning that the market maker always profits anyway. Without any doubt most of the traders lose all their money. It's even more aggressive than leveraged Forex because here it's pure gambling while forex traders can trade the markets over longer period of time and using several strategies can at least make some profits.

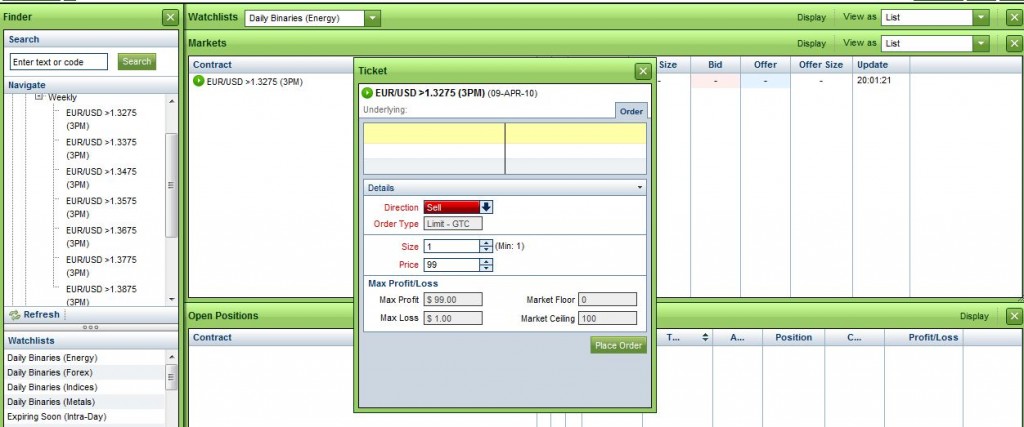

Nadex's platform however is different than this because it's more sophisticated and offers only weekly bets, thus reducing the risk for clients as well as allowing more control over positions. Clients can also pick their prices and amount of contracts unlike what the more simpler binary option firms offer. In this way, Nadex positions itself as a more sophisticated platform than all the new platforms that sprung up lately like mushrooms and all they do is let you click Up or Down and watch your money disappear. On the other hand, it will appeal less to the traders who simply look to gamble.

Whatever is the case, IG Group made an important move here by opening a huge market for itself as US FCMs will be able to offer their clients a new type of instrument from now on. Meaning that Nadex will become, at least for now, the only spread betting/binary options provider in the US for all retail traders and I don't expect anyone to rival this any time soon.

A bit more about this:

Forex and futures brokers can become Members of Nadex and offer their customers access to the Exchange ’s entire product line of binary and spread contracts: equity index contracts (Wall Street 30, US 500, US Tech 100, Germany 30, Korea 200, FTSE 100®), energy contracts (crude oil, natural gas), currencies (EUR, GBP, CAD, CHF, JPY), metals (gold, silver, copper), and agricultural (corn, soybeans), as well as event contracts (initial jobless claims, Fed Funds, European Central Bank rate announcements, nonfarm payrolls, unemployment rate).

“Nadex is the first and only regulated, retail-focused futures exchange in the United State that allows FCMs to offer trading in small-size, limited-risk contracts to their clients,” notes Yossi Beinart, CEO and President of Nadex. “Retail clients will benefit from simple investment options with full transparency. Unlike the large, relatively risky products offered by traditional futures exchanges, Nadex contracts are fully-paid upfront and have limited risk/reward profiles that appeal to both start-up and seasoned traders. Clients never need to worry about a margin call, even if the position moves against them.”

Nadex’s binary contracts are all-or-nothing contracts that pay out a fixed amount to the side of the trade that finishes in-the-money. Nadex’s spread contracts have a variable payout, a trader’s potential loss will not exceed the amount invested, and the potential gain is limited by the contract’s cap (for buyers) or floor (for sellers).