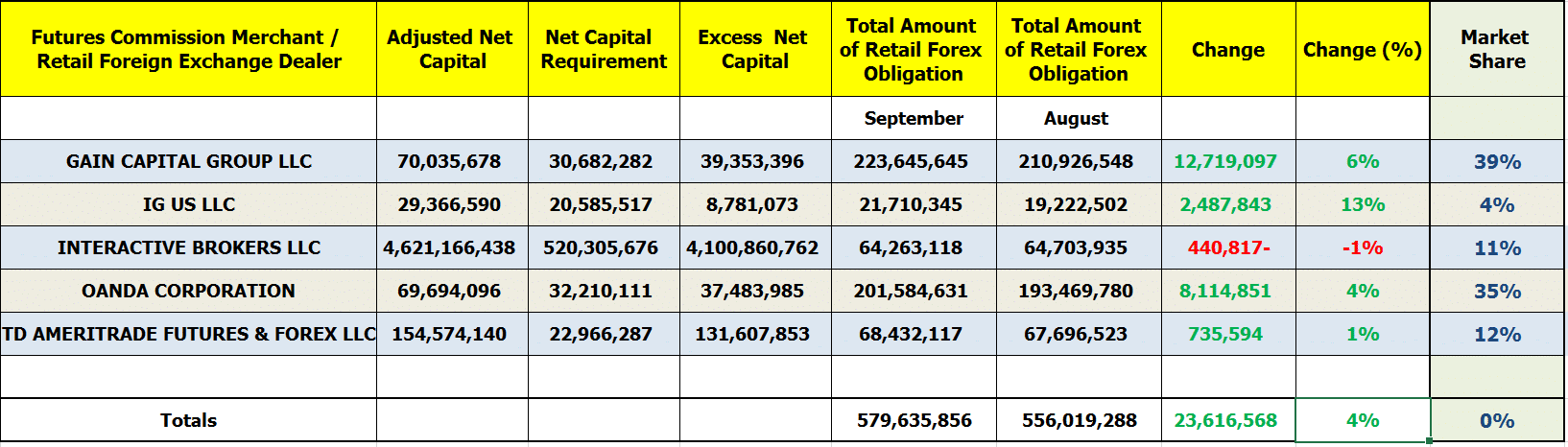

IG US was the best performer among retail FX brokers in the United States, after racking up $21.7 million in customer deposits in September 2020. This figure is higher by 13 percent from the previous month and was also six times bigger than the $3.5 million it collected when the company re-launched its operations a year ago.

IG US has been taking market share away from traditional big players, but the US subsidiary of the London-based spread better still has a long way to challenge the likes of GAIN Capital and Oanda, which command nearly 75 percent of the US retail market.

Overall, the CFTC’s latest monthly report shows that balances of US retail traders have skewed higher during the reported period.

According to the agency, the FX funds held at registered brokerages operating in the United States, including FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers, came in at $579 million in September 2020, which is a mild increase of 4 percent month-over-month compared with the $556 million reported in August 2020.

Interactive Brokers Shines Elsewhere

GAIN Capital’s clients’ funds grew by $12.7 million, or nearly 6 percent month-over-month. Further, retail deposits at TD Ameritrade also rose by nearly $735K in September while OANDA added more than $8.0 million in the same month.

Interactive Brokers lost nearly $440,000 in retail Forex deposits, or less than 1 percent compared to the figure of August, which stood at $54 million.

The Connecticut-based company was the worst performer in August after recording an overall drop in FX traders’ deposits by $6.3 million, or 9 percent. In contrast, the electronic brokerage segment at Interactive Brokers, which deals with clearance and settlement of trades for individual and institutional clients globally, experienced a rush of activity with volumes rising by 132 percent year-over-year and nearly 12 percent on a monthly basis.

CFTC data