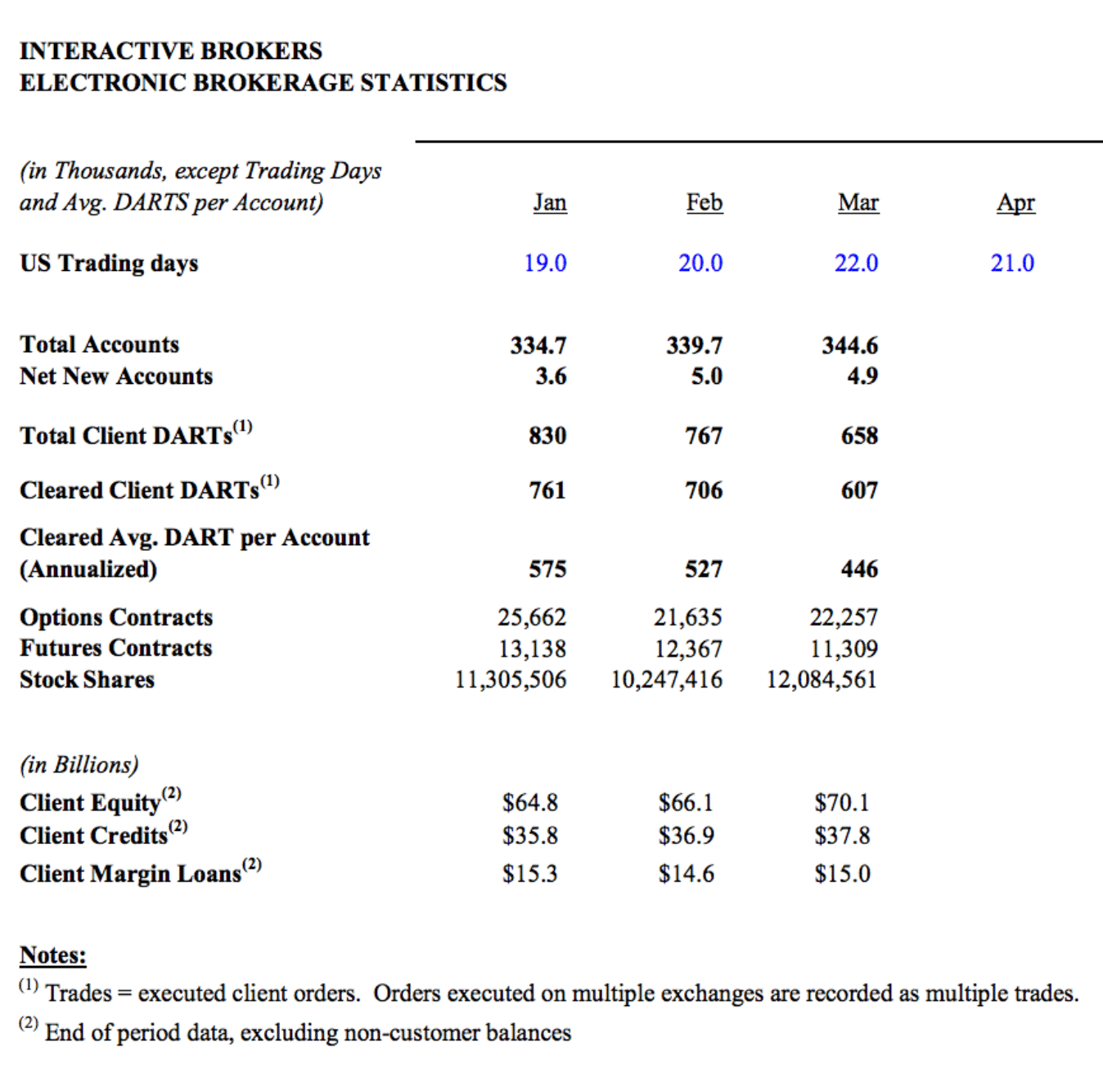

The Connecticut-headquartered online brokerage operator, Interactive Brokers Group, Inc., catering to clients globally including in foreign Exchange , and Equities - including in the U.S. Stock markets, today reported March trading metrics showing a 14% fall from the prior month.

The Nasdaq-listed operator, under ticker IBKR, saw the 14% fall in the Daily Average Revenue Trades (DARTs) which it said totaled 658,000 during each trading day in March, while was higher by 3% comparing the same month in 2015.

Client equity ending the month near $70.1 billion, up 6% from February’s total, and higher by 15% year-over-year (YoY). The number of client accounts grew by 1% to 345,000, and was also higher YoY by 16% compared to March 2015, yet the number of net-new accounts added was slightly less by a hundred accounts from the 5000 new accounts added in the prior month.

Credit balances were reported at $37.8 billion, up 2% month-over-month (MoM), and higher by 19% YoY, according to the company’s press release. On an annualized basis, the number of average cleared DARTs per client account totaled 446, whereas, the average commission per cleared client order was $3.89 including pass-through costs such as exchange, clearing, and regulatory fees.

Number of Shares Traded Jumps 20%

The extra two trading days during March, compared to the previous month, didn't appear to help the reported figures much, as the last two months have trended downwards from the volumes reported for the 19 trading days in January.

The number of shares traded was higher along with options contracts, yet futures contracts had lower aggregate volume during March, when compared to the prior month. Despite the dip in DARTs during March, the number of stock shares traded rose nearly 20% to over 12 billion shares up by 1,837,145,000 from February's total. The number of option contracts traded was also higher during March, up nearly 2.9% to nearly 22.6 million from 21,635,000 contracts reported in February.

An excerpt below of one of the accompanying documents updated today by the company shows key figures for Q1, including the March totals just reported. Shares of IBKR pulled back to $39.50 from session highs, following the news, yet is still up so far as the trading session comes to a close this Friday afternoon in New York.

Source: Interactive Brokers March 2016 trading metrics