The Commodity Futures Trading Commission (CFTC) has released its monthly composite of key figures and data for Futures Commission Merchants (FCMs), this time for the month ending in September 2016. The latest data shows a total marginal change MoM from August, though differences amongst each broker were more pronounced.

Don't miss your last chance to sign up for the FM London Summit. Register here!

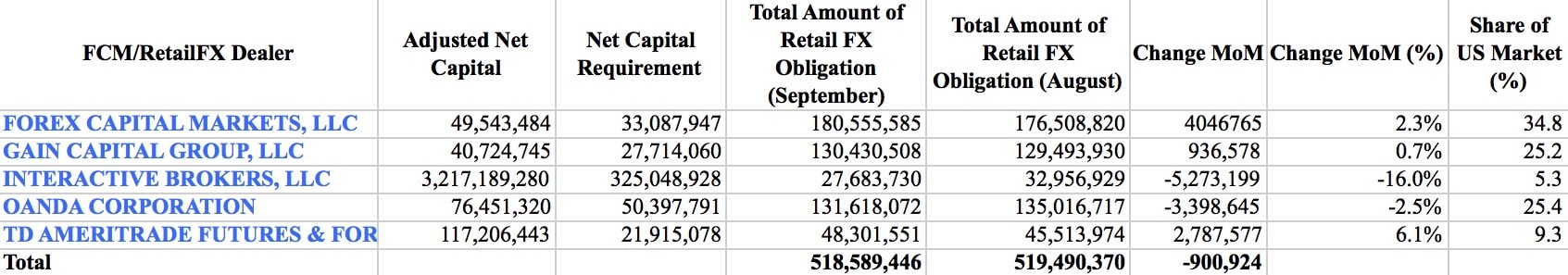

The statistics entail a variety of findings, notably data for FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those also included as broker dealers that file and hold retail Forex obligations in the United States. According to the CFTC dataset, over half of the FX firms listed notched increases in Retail Forex Obligations in USD – collectively, this entailed an overall fall to $518,589,446 at the end of September, compared to $519,490,370 at the end of August, or a marginal difference of less than -1.0% MoM.

Half of FCMs Witness Rise in Retail Forex Obligation MoM

Out of the ten reporting FCMs that hold Retail Forex Obligations, three of them (Forex Capital Markets LLC, GAIN Capital LLC, and TD Ameritrade Futures and Forex, LLC) reported higher figures in September – the largest single increase was made by TD Ameritrade, which saw a climb of 6.1% MoM.

Conversely, OANDA Corporation and Interactive Brokers LLC both yielded declines MoM in Retail Forex Obligations. The single largest drop was held by Interactive Brokers, falling -16.0% MoM – OANDA Corporation saw its Retail Forex Obligation drop -2.5% MoM.

The chart listed below outlines the full list of all five FCMs that held Retail Forex Obligations in the month ending in September – for purposes of comparison, the figures have been included against their August counterparts to illustrate any disparities.