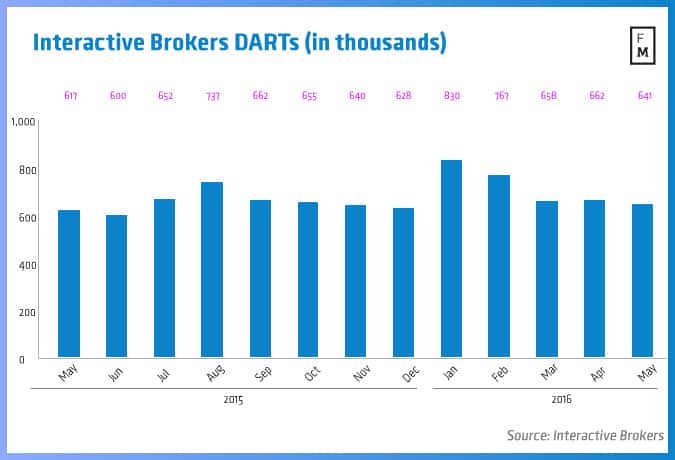

Interactive Brokers, LLC (NASDAQ:IBKR) has reported its consolidated trading volumes for the month ending May 2016, having witnessed a marked decline of DARTs MoM – thus far, only April has seen rising figures in this space, with every other month in 2016 incurring a decline to varying degrees, according to an Interactive Brokers’ statement.

The new world of Online Trading , Fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

During May 2016, the number of DARTs were reported at just 641,000, correlating to a fall of -3.2% MoM from 662,000 in April 2016, setting a new 2016 low in DARTs. The latest figures did allay this weakness by besting its 2015 counterpart – indeed, May 2016’s DARTs were 3.9% higher YoY from 617,000 DARTs in May 2015.

Looking at Interactive Brokers’ other monthly metrics of note, the group’s equity balance across customers’ accounts during May 2016 totaled $72.5 billion, continuing to inch higher MoM, this time by a factor of 1.0% MoM from $71.8 billion in April 2016. Additionally, this uptick was reinforced by a growth of 9.0% YoY from May 2015.

Interactive Brokers’ ending client margin loan balances were unable to capture a higher level in May 2016, yielding just $15.1 billion for the month, moving lower by a margin of -3.2% MoM from $15.6 billion in April 2016. However, over a yearly timetable this figure was lower by a much higher figure, -22.0% YoY from May 2015. Moving to its customer accounts, Interactive Brokers disclosed a figure of 352,600 during May 2016, edging higher by a slight 1.1% MoM from 348,700 accounts in April 2016.

Finally, Interactive Brokers reported its net new accounts of 3,900 during May 2016, which compares to a figure of 4,100 back in April 2016, -4.8% MoM. This figure was pared against its 2015 equivalent by seeing a 5.0% growth YoY in the number of net new accounts from May 2015.