Interactive Brokers UK Ltd. (IB), the British branch of the American company Interactive Brokers LLC, has recently released its end of the fiscal year results for 2016. Overall, there have been several increases in several factors, but they were quite minimal.

The London Summit 2017 is coming, get involved!

[gptAdvertisement]

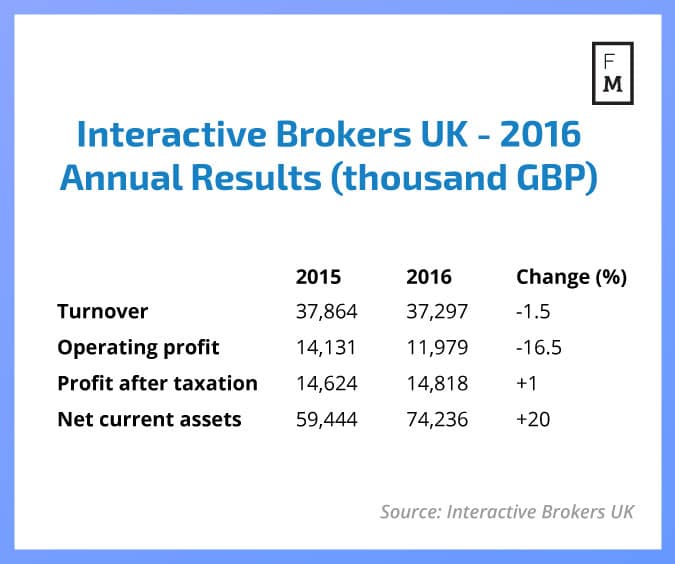

In 2016, the turnover and revenue per geographical location were estimated at £37,297,000, down 1.5 percent from the £37,864,000 turnover reported for 2015. The pre-tax profit, however, showed a small increase from £18,353,000 the previous year to £18,297,000 in the current one, up 3 percent.

The after-taxation profit for the year of 2016 stands at £14,818,000, up 1.33 percent from the £14,624,000 disclosed in 2015. The operating profit, on the other hand, decreased to £11,797,000, down -16.5 percent, from last year’s £14,131,000. The net current assets were reported as £74,236,000, up 20 percent from the £59,444,000 in 2015.

The number of trader accounts in 2016 amounted to 31,189 portfolios, up 16.4 percent from the 26,785 portfolios reported in 2015.

Interactive Brokers UK is the London-based child company of Interactive Brokers, which claims its headquarters in the United States of America. The first operates as a brokerage, providing trading solutions for individual investors and financial institutions from around the world.

Recent Reports from the Interactive Brokers Child and Parent Companies

Nearly a year ago, Finance Magnates reported that the FCA issued a warning against a clone company trying to confuse clients by impersonating Interactive Brokers UK. Earlier this month, Finance Magnates covered Interactive Brokers LLC, the parent company and Multi-Asset market making firm, disclosing its mixed monthly results for April 2017. Moreover, FM covered the latter’s Q1 2017 drop, despite client trading accounts increasing by 18 percent.