Etana Custody is a firm that offers custodian services, payment solutions and administrative back office services. Finance Magnates sat down with CEO Brandon Russell to discuss the industry and his firm's place within it.

Please tell about yourself and how you reached your current role

I started with Liberty Life Group in the early '90s with a focus on investment products before moving into forex markets as a trader with a London based hedge fund. In 2004, I moved to New York and shortly thereafter found myself wound up in the Refco debacle, which in hindsight, would prove to be a valuable lesson for the future.

a unique propriety online platform

This was a major learning curve and afforded me the opportunity to consult to various market participants about the risk associated with the forex market. I worked closely with various technology, Liquidity , banking and payment providers with the goal of providing sustainable solutions for small to midsize businesses.

[gptAdvertisement]

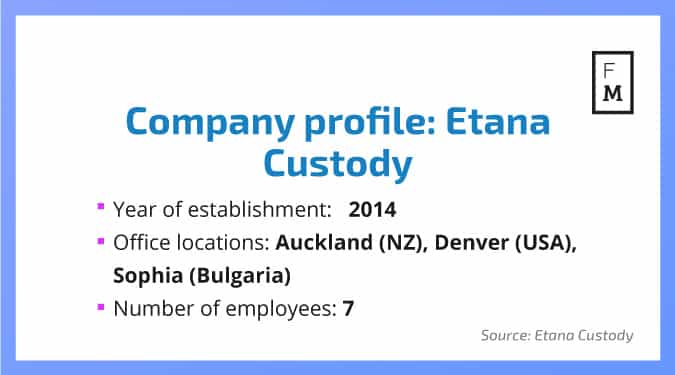

Having worked closely with startup brokers for over a decade and having a very good feel for the growing pains they experience, I co-founded Etana Custody in 2014 with the goal of providing accountability, transparency and credibility to the retail FX market.

What are your goals for the company in the next few years?

Etana has a rather altruistic ethos. The goal is to provide a 'safe space' by acting as a mediator of sorts between various market participants. We currently face traders (end-users), brokers, liquidity providers and introducing brokers.

We realized early that to price our model on trading volumes would be counterproductive to our ethos and would create an additional conflict of interest where there is another party participating in the volume. Ultimately, this simply makes it harder for traders to be profitable, a task that is already a challenge for them.

Etana does not have any direct competition at this point

Consequently, we settled on a fee based model which affords every participant on our platform the ability to budget their costs. It’s certainly not the most efficient model for Etana to make money but our goal is simply to get as many traders using our platform where they will be able to select from as many brokers as they like that are on the platform through our e-wallet platform, which is designed to reduce fees associated with traditional account funding mechanisms.

What do you think sets you apart from the competition?

Custodians are not common at all in the retail side of forex. Historically, custodians are associated with wealthy individuals or institutional funds. As such, Etana does not have any direct competition at this point.

We do see regulation coming into play that would mandate brokers to use custodians and we expect with that will come direct competition. Right now, traditional custodians would have to figure how to price themselves in a manner that is affordable to retail traders. Etana has already figured this out.

Etana has also differentiated itself by offering two other services. One is a compliance module which we have partnered with a leading Risk Management provider. Etana can offer this to brokers as a stand-alone product or inclusive of the full custodian solution. This is a godsend for smaller brokers who must manage the costs of meeting regulatory requirements and the man power deployed to that end.

binary options...don’t fit the definition of a financial product

The other service on offer is Etana acts as an aggregator of payment providers, which affords brokers a gateway for their traders to fund their custody accounts. Etana passes the volume discounts directly to brokers and traders ensuring a more affordable mechanism to fund trading accounts.

Etana delivers its services through a unique propriety online platform which allows various market participants to seamlessly interact with each other. This technology is linked directly to the trading server of the broker and is updated on a 20-minute delay which allows Etana to detect anomalies and verify trade activity.

How do you view the current state of the industry?

No one likes to be labeled. Unfortunately, retail forex hasn’t developed a reputable reputation. This is evidenced in brokers of all sizes acting against client interests and in many instances regulatory requirements. Some brokers struggle to maintain banking relationships in many cases due to misrepresenting their business model. In other scenarios, brokers circumvent regulatory requirements.

The UK’s Financial Conduct Authority has been really open to collaboration

Etana took a view early on with binary options, determining that they don’t fit the definition of a financial product and that the risk associated with them was not aligned with our internal philosophy. We do see regulators continuing to tighten and we perceive this as a welcome development as the evidence for brokers to self-regulate is rather scarce.

Of course, there are many providers that do align themselves with best practices and meet regulatory requirements but the polarization represented in this reality is what creates a negative perception and is one that Etana seeks to address.

What new fields or opportunities do you see as growth potential in the market?

We are seeing regulators embracing new technology aimed at assisting the regulatory environment. The UK’s Financial Conduct Authority has been really open to collaboration with companies who are able to bring market participants together and act as agents of change.

Larger brokers are increasingly looking at data-driven companies as a solution. We perceive that this will remain a driver for the next few years as regtech addresses the efficiency, stability and transparency that everyone from traders to brokers wants.