The brand operated by online brokerage Topic Markets Ltd., under its Invest.com offering, and regulated by the Cyprus Securities and Exchange Commission (CySEC ) as a Cypriot Investment Firm (CIF), today announced the launch of a portfolio management service in the United Kingdom aimed at giving retail clients access to alternative investments, according to a company statement.

The company is passported through Europe - including in the UK - through its license by CySEC, and has been regulated since 8/1/2015 as per the CySEC register. The new launch appears to be a smart-fund, using aspects similar to those found in robo-advisor solutions, yet with dynamic approaches to alternative investments.

Automated portfolio advisor

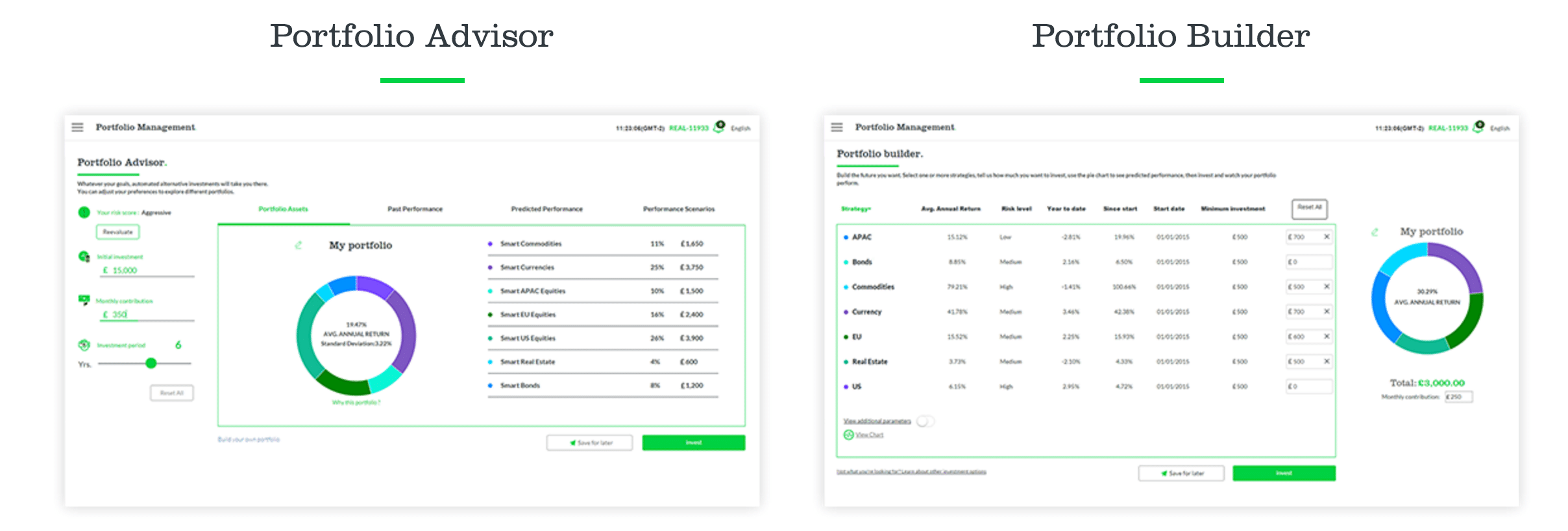

As part of the new offering aimed at giving retail investors more investment options, there are seven investment strategies that the fund employs that are algorithmically traded, and provide next-day Liquidity to investors while optimizing the trading approach to changing market conditions. A portfolio advisor and builder are available on the dedicated site as seen in the screen-shot below.

Source: Invest.com

Alternative investment fund

The invest.com website describes the use of active hedging, rebalancing and leveraging, as part of its approach to maintaining a dynamic portfolio, and offers different levels of risk-tailored profiles to cater from conservative all the way to aggressive risk/return investors.

Robo-advisors and related automated investing tools continue to gain interest among various investment providers, including managers and self-directed online brokerage accounts and across nearly all asset classes. The firm invest.com is not to be confused with its present participle of the verb and website brand investing.com - which is a different company.

A description of some of the alternative investment strategies employed on invest.com in the fund includes across currencies, commodities, bonds, US equities, EU equities, and Asia-Pacific (APAC) equities, and the firm uses a robo-style approach to tailoring client's options via the use of a questionnaire that investors complete electronically.

Customers are able to build portfolios for both the long and short term investments depending on their different investment goals.

$20m in recent funding

The domain invest.com is described as one of the top-25 most expensive in the world, according to the company, and the update noted that the firm received $20 million in funding from several global investors including technology venture capital (VC) fund Singulariteam.

Although the firm normally charges up to a 1.5% management fee, as part of the launch the company is waiving that fee on a perpetual basis for clients that sign up during the first month, and is offering the programs for as little as a £1,500 minimum investment, as per the update. In addition, the firm charges a performance fee of 15% of any new net profits.

Ophir Gertner

source: LinkedIn

Commenting on the announcement, Ophir Gertner, founder of invest.com, said: “By giving customers access to alternative investments, we are enabling them to build smarter, more diversified portfolios that are equipped to perform better when major asset classes, such as equities, fall. Customers are able to build portfolios for both the long and short term investments depending on their different investment goals.”

Mr. Gertner added: “Alternative investments is an asset class that has seen extremely high growth in recent years, more than doubling in size since 2005. However, hedge funds and many other alternative investments have typically been very elitist - available only to very wealthy investors, despite the obvious benefits they would give all investors. invest.com is therefore bringing a hedge fund for the people to market.”