Over the last 24 hours, a half-dozen or more foreign exchange brokers around the world have announced changes to their margin requirements in an effort to reduce the risk associated with the financial market volatility expected around the time of the UK’s Brexit EU referendum vote next week.

The latest brokers to make announcements to margin changes ahead of Brexit week include Australian broker Vantage FX, Cyprus-based IronFX, and LiteForex, Finance Magnates reports in this update as Brexit week approaches.

The new world of online trading, fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Vantage FX update

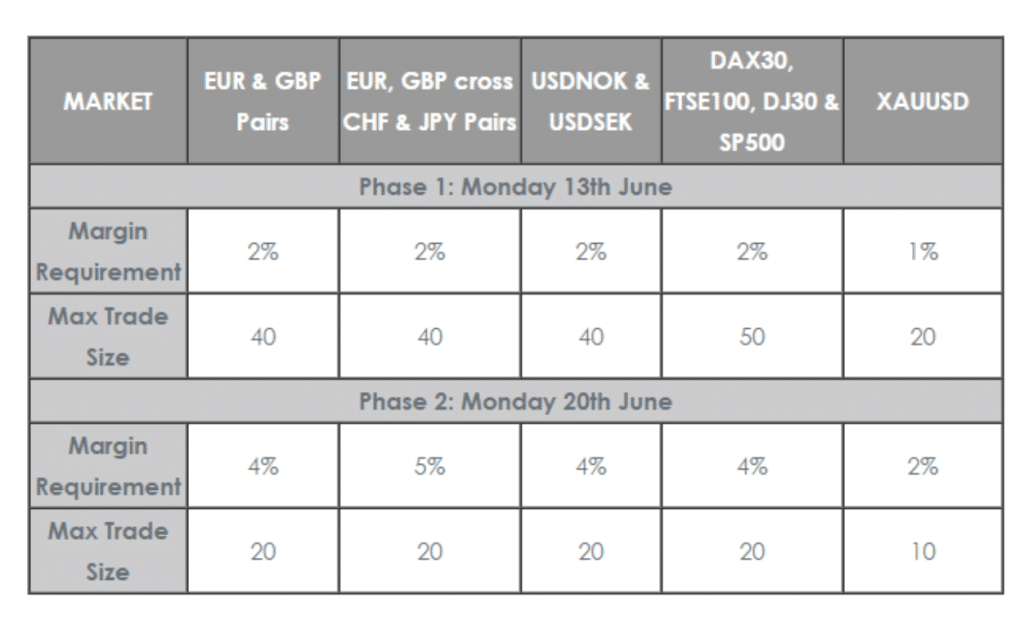

Sydney-based Vantage FX also announced a two-stage change to its trading conditions as a temporary measure leading into next week’s referendum, after the firm conducted a review of its risk-management policies.

As part of the changes scheduled to go into effect for next week's trading schedule, VantageFX is doubling the margin requirements across some of its related products that could be most affected, and also reduced the maximum trade size by at least half for the products referenced in its update.

An excerpt of the changes as of the time of publication can be seen below .

Source: VantageFX

The company emphasized the possibility of what it described as ‘violent whipsawing price action’ especially in the GBP-related pairs.

IronFX update

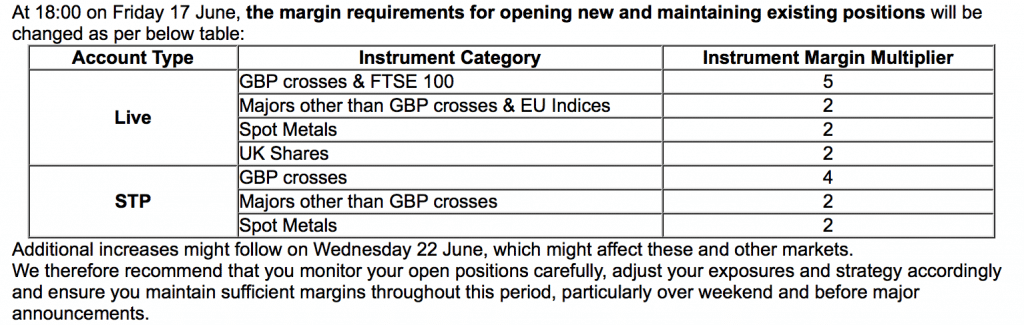

IronFX, an online brokerage and brand with several regulated entities in different jurisdictions - including the UK and Cyprus - has shared an update to clients outlining changes ahead of the vote, as seen in the table below.

The company explained in its update that the event could potentially create unprecedented market volatility, including the possibility of significant price gaps and periods of illiquidity, and said that the measures it was taking were an attempt to help protect clients by minimizing the potential impact from abnormal market conditions.

The changes noted by IronFX are set to go into effect at the end of the trading week at 18:00 this Friday June 17th, and the company added that on June 22nd additional changes may follow.

Source: IronFX

LiteForex update

LiteForex announced that it is implementing changes from June 20th next week through to the 27th, after the trading week finsishes, according to an official update.

Along with the changes noted to several of its trading products that will be affected under the new margin changes, LiteForex said that expects a lack of Liquidity , sharp price movements, and gaps.

Increased margin requirements for all LiteForex will hike margin requirements for all GBP and EUR pairs, along with oil, commodities and major indices, and will implement a fivefold increase in margin for ECN, NDD, and PAMM accounts, a tenfold margin increase for CLASSIC accounts, and a twentyfold increase in margin requirements for CENT accounts, during the period.

LiteForex will suspend the opening of new trades in a number of related currency pairs that will be put into ‘close-only’ mode which means that clients with existing open positions that were initiated before the change went into effect will be able to close those trades but not open new ones in the related pairs during the time period of 00:00 (GMT+3) June 20th through to 12:00 (GMT+3) June 27th.

FXTF update on spreads

Online brokerage FXTF, based in Japan, announced changes to trading conditions for 8 of its GBP-related currency pairs: GBP/USD, GBP/JPY, EUR/GBP, GBP/AUD, GBP/CAD, GBP/CHF, GBP/NZD, and GBP/ZAR, including exceptions for some of the pairs across several of its platforms such as MT4 and high-speed FX.

However, the changes were with regard to spreads and how bid/ask prices could widen, and that options premiums for binary options trade would be inflated due to volatility. FXTF explained that spreads may widen for the pairs ahead of the EU referendum, as described in an update from the firm, translated from Japanese. The changes it noted for the above pairs went into effect as of June 14th and will last until July 1st. The update followed the company making a similar announcement on June 7th, warning clients of the risks associated with the upcoming vote.