The first full trading day of 2019 concluded in an unexpected fashion. A relatively quiet trading session in New York got shaken after the market close as Apple downgraded its earnings outlook. The move reinforced risk-off sentiment and caused a four figure drop in the USDJPY pair in a matter of six minutes.

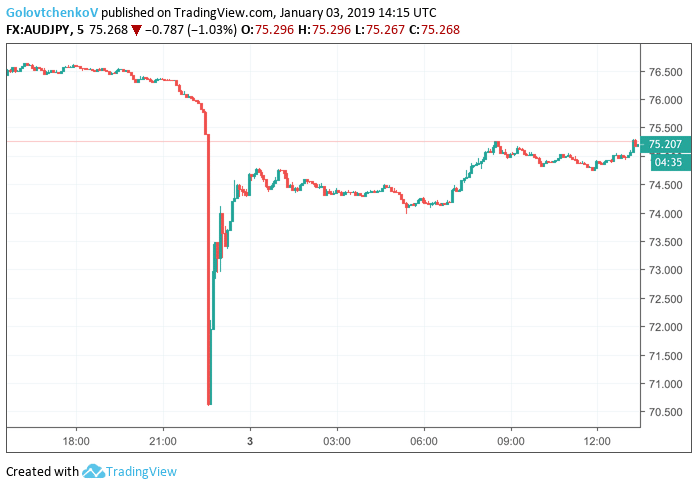

The Japanese yen crosses mirrored the move with the AUDJPY being hit the hardest. Apple’s message about a contraction in Chinese demand sent the company’s shares down by seven percent in after-hours trading.

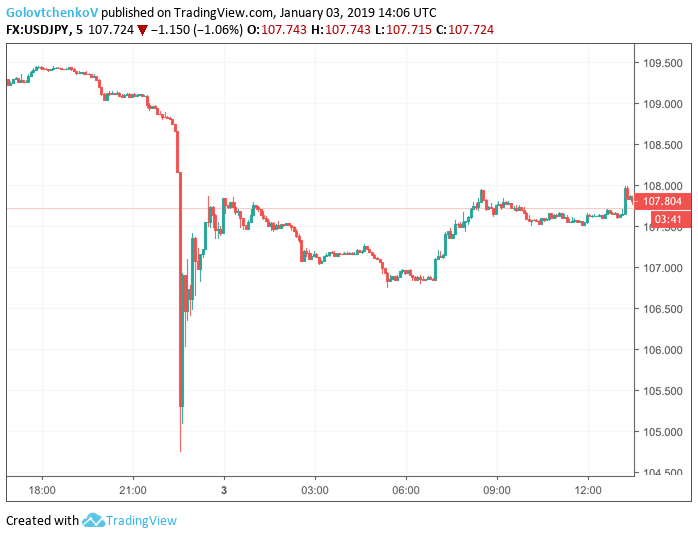

Just after 10 PM GMT, during the New Zealand and Australian trading sessions in thin Liquidity the Japanese yen rallied from 108.80 per US dollar to 104.80 in about six minutes.

USDJPY 5M Chart, Source: TradingView

The move was exacerbated by the thin liquidity conditions at the time, but also by the massive amount of liquidation in AUD and TRY crosses. From a fundamental standpoint, the market’s short JPY positioning, Apple’s cut to Chinese demand and slowing PMI figures globally contributed to the move.

AUDJPY 5M Chart, Source: TradingView

Reminiscent to 2016

The flash crash of the Japanese yen reinforced a somewhat forgotten rule when it comes to financial markets: anything is possible. The move was reminiscent to the GBP flash crash in October 2016.

The Japanese yen’s rally was the sharpest move for the currency in the past ten years. The Japanese holiday on Thursday might have also played a role as bids of options players protecting certain levels didn’t materialize.

In any case, if the first full trading day of the year offers any clues to the rest of the year, we could be in for a big spike in Volatility in 2019.

Cyclicals Favor FX Volatility Rise

Since February 2018, when the US stock market tumbled sharply over a couple of days to erase much of the Trump tax cuts rally throughout 2017, the first hints of the end of the expansionary phase of the economic cycle were put in place.

Today’s move of the Japanese yen crosses signifies that further market uncertainty is around the corner. Coupled with continuing stock market uncertainty, the risk sentiment indicators are signaling that we are close to the end of the economic cycle.

This part of the cycle is traditionally associated with increasing volatility and more unexpected events. The flash crashes that we’ve observed over the past several years have been traditionally linked to uncertainty.

The Chinese economic outlook, coupled with a divided US Congress and a significant dent to revenues of the largest company in the world are all signaling a shifting market outlook.

According to comments from TS in Singapore thin liquidity, poor data and edgy markets are at the core of the move.

Preventing an Algo Trading Mayhem

A number of respected analysts have been predicting a 1987-style stock market crash. The era of fast high-frequency trading has been advancing every year since. As a result, the magnitude of a one-day crash in the stock market could well be much more aggressive than over 31 years ago when the Dow tanked over 22 percent on Black Monday.

The increasing reliance on computerized trading has proven its central role over eight years ago when the Dow plunged nine percent in a matter of minutes. Brokers should be well prepared for more volatility this year and manage risks adequately.