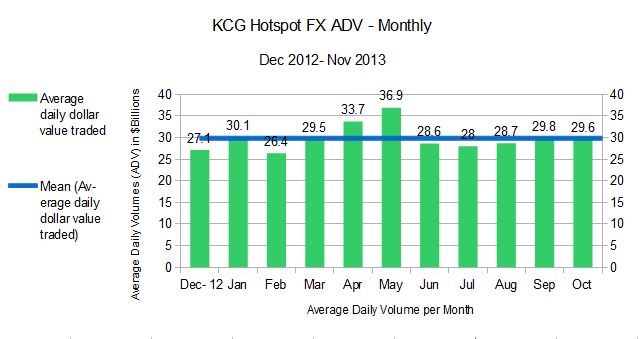

New Jersey headquartered KCG Holdings, Inc. (KCG), has today released trade volumes for the month of November 2013, where average daily FX volumes were $29.6 billion, and thus dropped Month-over-Month (MoM) by $200M, or barely seven tenths of a percent from $29.8 billion reported in October.

The multi-asset independent securities firm offering investors a range of services in market-making and agency business across asset classes, product types and time zones, averaged $26.8 billion dollar volume traded, 4.7 billion shares traded, and 4.0 million trades per day in U.S. equities. Foreign Exchange trading through its KCG Hotspot brand saw $29.6 billion per day in notional dollar volume, as noted above and over 21 trading days in November, and was up 37% when compared to the same month last year, according to the official press release.

November FX figures are higher by $600M than the monthly average of ADV which stands at $29 Billon calculated over the last twelve months (Mean Average) including November.

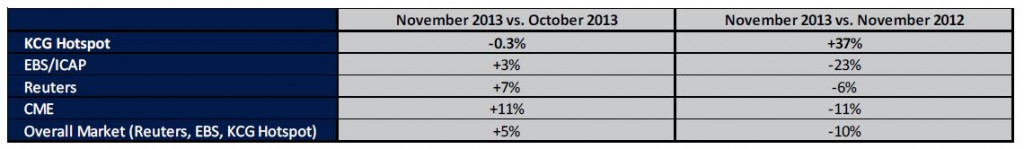

According to its latest monthly statistics information, KCG Hotspot market share accounted for 13.9% of publicly reported spot FX volume in November 2013. While MoM volume was virtually unchanged (-0.3% single-count) year-over-year (YoY) ADV grew by +37% for November.

In the report, KCG Hotspot was again the spot FX reporting venue to post year-over-year growth according to its description against other major reporting interbank and interdealer platforms.

November 2013 Statistics (Single Count, USD):

KCG Hotspot posted an ADV of $29.7 billion. (Based on 21 trading days)

• ADV decreased by 0.3% versus October 2013. (October 2013 ADV: $29.8 billion)

• ADV increased 37.1% versus November 2012. (November 2012 ADV: $21.6 billion)

Total November Volume: $622.9 billion (/by 21 trading days =$29.66 bln)

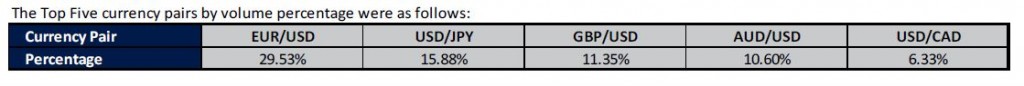

The top 5 currency pairs (as can be seen in the graphic above) remained unchanged from the prior month. EUR/USD and USD/JPY saw slight decreases from October, dropping off by 0.05% and 0.85% respectively, while the latter 3 pairs have slightly increased in concentration. AUD/JPY dropped off 4 spots to the 17th traded pair versus 13th in the prior month for KCG Hotspots volumes traded on its ECN, while USD/ZAR pair set a record high at 1.42%, and EUR/SEK, USD/SGD and EUR/NOK all exceeded 1% for the first time.

As per figures compiled in its monthly statistics information report for November 2013, trading activity in Asia and the Europe sessions increased by a respective 0.7% and 1.2% in November, while the Americas session decreased 1.9%, as can be seen in the excerpt below:

![KCG Monthly Volumes Statistics 2013 November [Source:KCG ]](https://www.financemagnates.com/wp-content/uploads/fxmag/2013/12/Vols-by-Timezone_Hour_KCG_nov13-1024x584.jpg)

KCG Monthly Volumes Statistics 2013 November [Source:KCG ]

Interestingly, while KCG had YoY increases in November compared to YoY decreases reported by other major competitors, its MoM decrease in November (albeit a slight one) fares with increases from those same competing providers MoM. This could indicate an inverse trend of flows during that static-snapshot of time, that since changed, as can be seen in the excerpt from KCG's November compiled statistics:

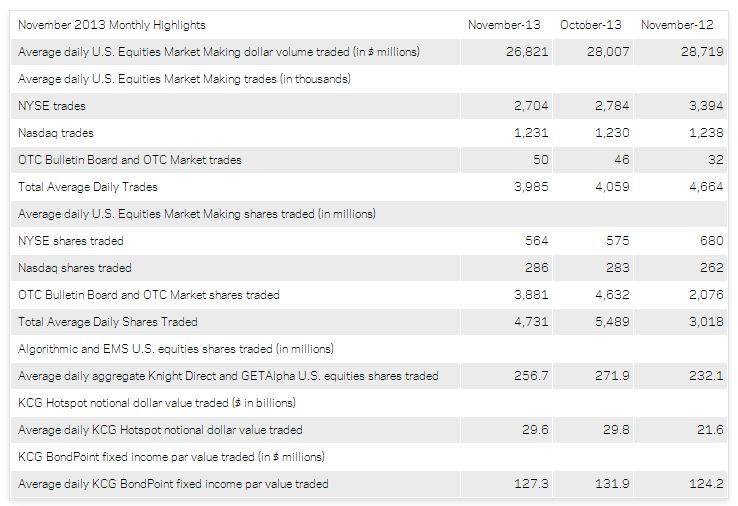

Under its Group through the reported press release on the KCG corporate website, the company reported the following metrics across its Global Execution Services segments:

- Agency-based algorithmic and EMS trade volumes through KCG EMS, Knight Direct and GETAlpha averaged an aggregate 256.7 million shares traded per day in U.S. equities

- KCG Hotspot averaged $29.6 billion per day in notional foreign exchange dollar volume

- KCG BondPoint averaged $127.3 million per day in fixed income par value

As for the overall market conditions in November, consolidated U.S. equity volume averaged $226.6 billion in dollar volume and 6.1 billion shares traded per day.

The press release noted that the CBOE Volatility Index (VIX) averaged 12.9 in November , and there were 19.5 trading days in U.S. equities, 21 trading days in foreign exchange, and 18.5 trading days in fixed income. An excerpt from the press released comparisons to October 2013 MoM, as well as YoY with November 2012 :

Source: KCG November 2013 Monthly Highlights