Publicly-listed retail foreign exchange and CFDs brokers have started disclosing their metrics for the final quarter. While the current quarter appears to be more challenging than Q4 due to very low Volatility , the final quarter of 2018 was the first full quarter after the ESMA changes. GAIN Capital is the first brokerage to reveal a detailed breakdown of the shifting trends in the industry.

In an earnings call last week, the CEO of the company Glenn Stevens highlighted one of the themes that are prevalent across the reformed retail brokerage space: “quality over quantity.” What he means by that is the shifting mix of trading activity across EU-based clients.

GAIN Capital appears to be one of the companies which successfully transitioned to higher value clients. While the firm shared that only 24.5 percent of applicants got approved as professionals, the increase in client value is actively offsetting the decline in the number of active clients.

GAIN Accounts and Volumes

While the firm didn’t manage to retain some of its customers due to the ESMA changes, the overall theme is that higher value clients are going to lead to sustainable growth. Looking at the detailed breakdown, active accounts at GAIN Capital declined by 33 percent year-on-year, but have been mainly in the lower value segments.

UK/EU trading volumes in the final quarter of 2018 were two percent higher, while client revenue was lower by three percent over the same period. Over the final quarter of last year, a whopping 59 percent of all revenues came in from UK/EU clients who have been reclassified to professionals.

Global Revenues Rising

While the UK/EU segment at GAIN Capital generated a two percent increase in trading volumes, the global business of the company fared much better. With a 15 percent increase, the total figures rose ten percent when compared to the same period in 2017.

GAIN Capital also upgraded its long-term outlook for Revenues Per Million (RPM) to $106. The range which the company has previously provided was between $100 and $105. The bump higher is related to a shifting product mix where clients are trading higher margin products, such as index CFDs.

GAIN Capital also credits its quantitative models for higher efficiency that leads to more revenue capture. The company first implemented the new model into its Forex product mix and is shortly going to transition to it across other products.

DMA Accounts and GAIN Capital Brand

With the announcement that GAIN Capital will be phasing out its City Index brand, the firm is focusing on the premium segment of the retail clients base. Stevens elaborates that the launch of the new brand, the GAIN is not focusing on “legions of new customers, but it actually needs high-quality customers.”

The company is combining the launch of the new brand with a new Direct Market Access account. This represents a major shift in the strategy of the company as it gears up to deliver better service to premium clients. Stevens elaborates that GAIN aims to “grab market share for that higher profile, active professional type customer.”

The shift to a market making model for GAIN Capital is a new step for the company.

Industry-Wide Takeaways

Once again, we are seeing the forex and CFDs brokerage industry changing in front of our eyes. GAIN Capital is next among the many brokers that are looking for ways to reduce client churn and service higher-value clients that stick around for a longer period of time.

The news is welcome for the industry, and clearly is signaling a changing landscape, at least when it comes to established firms. With the additional shift in the product mix that may include zero-commission stock trading, futures, and options, the business model of retail forex brokers is changing in front of our eyes.

As the market continues adapting, more and more companies appear to be committed to diversifying their product mix. With the leaders in the industry changing their focus, the regulated part of the industry is likely to follow through.

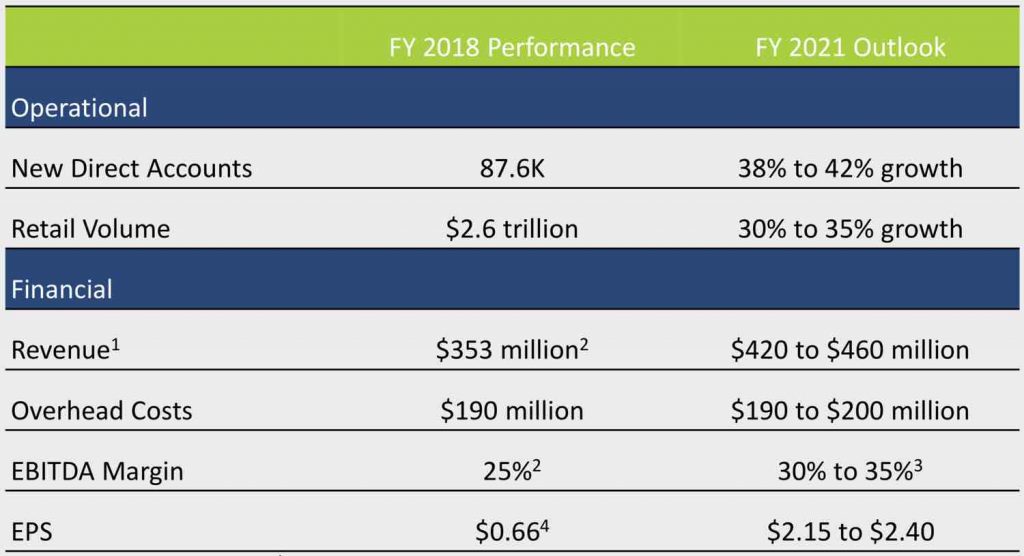

GAIN Capital's outlook for 2021

In the meantime, GAIN Capital has a very positive outlook for the future of its business. Only time can tell whether or not that can translate onto the broader industry.