According to the latest press release from London Capital Group Holdings plc, (LCG), released ahead of the LSE AIM market open today, LCG has provided a trading update for its financial year ended 31 December, 2013, and will publish its results on April 1, 2014.

Group revenue for the year was £28.0 million (M) and down slightly by £600,000 from 2012 revenue of £28.6m, and Group revenue from the continuing operations of UK financial spread betting and CFDs and institutional FX business was £25.2m down £1.4m from 2012 figures of £26.6m, or 5.3% lower Year-over-Year (YoY).

FX and CFD Business Line Revenue Lower, Business Still Well Capitalized

For the second half of the year ending 31 December, 2013, Group revenue was £10.9m down 700,000 from 2012 figures of £10.2m for the latter 6 months of the previous year, and the adjusted profit before tax is expected to be in the region of £2.4m, and up from a 2012 loss of £200.000 for the prior period.

This [profit before tax] does not include share-based payment charges, impairments and certain regulatory and legal claims such as with the Financial Ombudsman Service (FOS) for £1.6m, and the Life Settlement Consulting Limited (Integrity) claim for £1.6m announced in November (both of which have been paid already ) with a provision of £4.9m for the FOS claim as of December 31, 2013, which will be paid in January 2014, as well as restructuring costs, profit on disposal of subsidiaries and costs related to change in IT platform including accelerated amortization, as noted in the press release.

FOS Provision Payment of £4.9 in January 2014, New Platform Coming

Despite the one-off charges as noted above including the £4.9 FOS claim to be paid in January 2014 and accounted for in 2013 figures along with the other claims, the Group is said to remain well capitalized with net cash resources and amounts due from brokers amounting to £21.8m on 31 December, 2013, as highlighted in the announcement.

Kevin Ashby, CEO, LCG

Commenting in the official press release regarding the results, Kevin Ashby, Chief Executive of LCG said, "2013 was a year of refocusing and reorganizing the business as well as resolving a number of legacy issues. The company has moved forward with the deployment of its new Trading Platform which will be completed by the end of Q1 2014, from which point we plan to release a number of new trading tools and applications which will attract new users to our platform. I am also pleased that we have been able to conclude the Integrity claim to our satisfaction and that the settlement of the FOS claims will be materially completed in Q1 2014.”

Mr. Ashby concluded, "The business is now in better shape to capitalize on any improvement in market conditions."

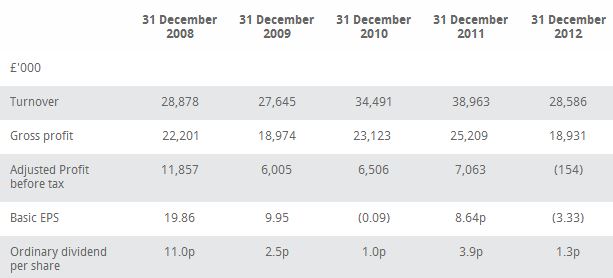

While the update is preliminary ahead of the official figures to be released in April, shares of LCG closed down 2.29% yesterday on the LSE's AIM, and poised to neither open higher nor lower (as of yet) according to opinion of a UK stock brokerage as can be seen by pre-market interest from market makers, as told to Forex Magnates' reporters around time of publication, as the press release came out at 7am GMT today. The company's market capitilization stands around £18m. A copy of the last five years can be seen below in the performance excerpt from LCG's corporate website. Subsequent to coverage by Forex Magnates, shares of the company were up half a pence (0.50) in the current trading session.

Source: LCG