MahiFX which has done a very good job in preparing the market for its launch has now official gone live.

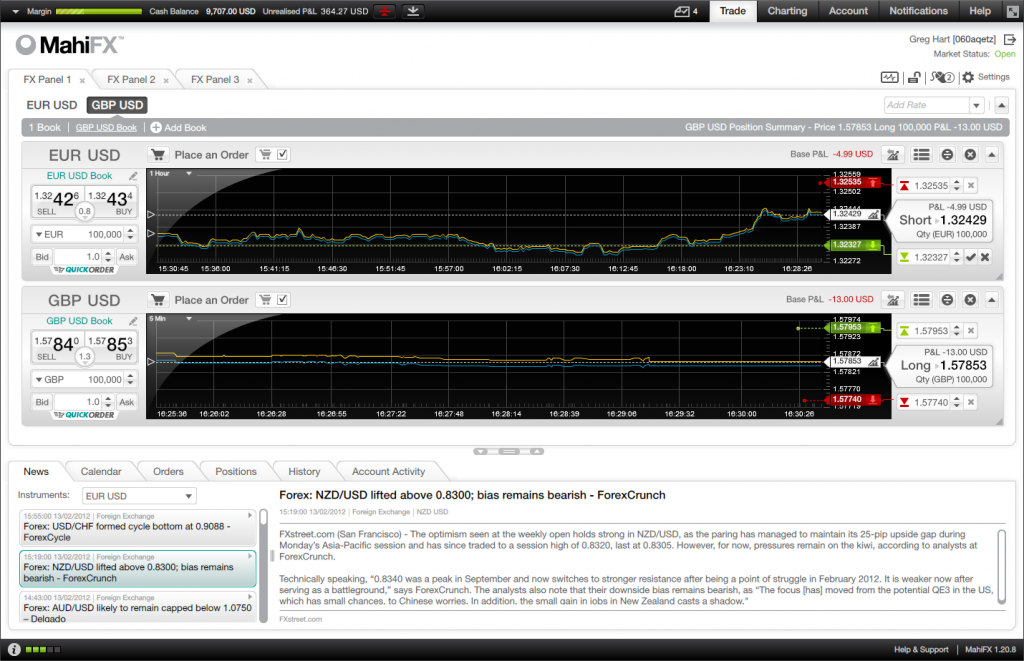

I've had the chance to get a sneak preview of the platform with the founders David and Susan Cooney who both arrive with an extensive FX background and I have to say I'm impressed. The platform is very intuitive and well designed. Being browser based GUI is especially important and it's clear MahiFX put a lot of emphasis on it.

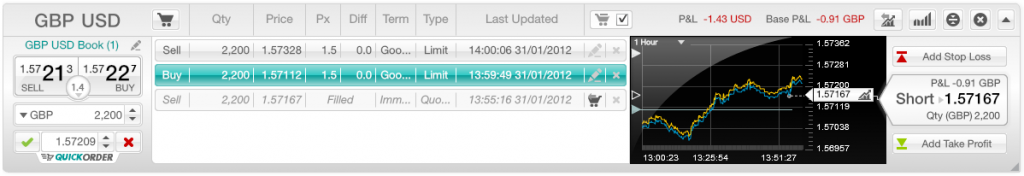

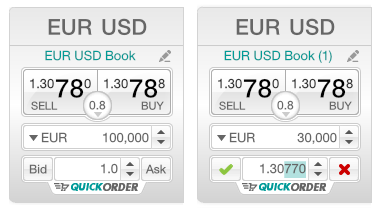

The trading GUI part itself is customizable (i like it in platforms) and very flexible with dynamic stop losses and take profits and many more other advanced features.

MahiFX operates as a market maker providing continuous, dealable FX rates to retail customers that wish to trade on a margin/leveraged basis. The platform’s sophisticated proprietary software systems have been designed to execute retail customers’ orders with no human intervention; and aggregate and manage the resulting FX risk. By removing the brokerage layer and its costs, MahiFX is able to offer its retail Forex clients unrivalled direct access to highly competitive market maker rates.

Below are some images of the platform:

The MahiFX platform has officially launched, giving retail FX customers access to same tight spreads and cutting edge technology as institutional FX traders

05 March 2012, London, England – MahiFX, the new proprietary-built foreign exchange (FX) Trading Platform , has officially launched to retail Forex traders worldwide.

The platform, developed by ex-interbank traders, analysts and developers, is headed by David Cooney, former global co-head of currency options and e-FX trading at Barclays Capital and Susan Cooney, former head of electronic FX institutional sales in Europe for Barclays Capital.

The web-based MahiFX platform, now fully-launched after one year of intensive research, development and testing, offers retail traders new and enhanced trading functionality that includes:

- Institutional level pricing: e.g. EUR/USD 0.8 pips, EUR/GBP 0.8, USD/JPY 0.8

- Details of MahiFX spreads in all time zones can be viewed here on the spreads page together with historical data.

- Tradeable Prices: no 'from' prices, hidden costs, slippage, re-quotes or minimum trade size

- Quick Order: feature to leave bids and offers very close to or inside the market

- Auto Sizing: enables traders to control their position – automatic resize of stop losses and take profits

- Mahi Books: set up multiple books each with its own currency pair, apply multiple strategies and keep track of them all at a glance

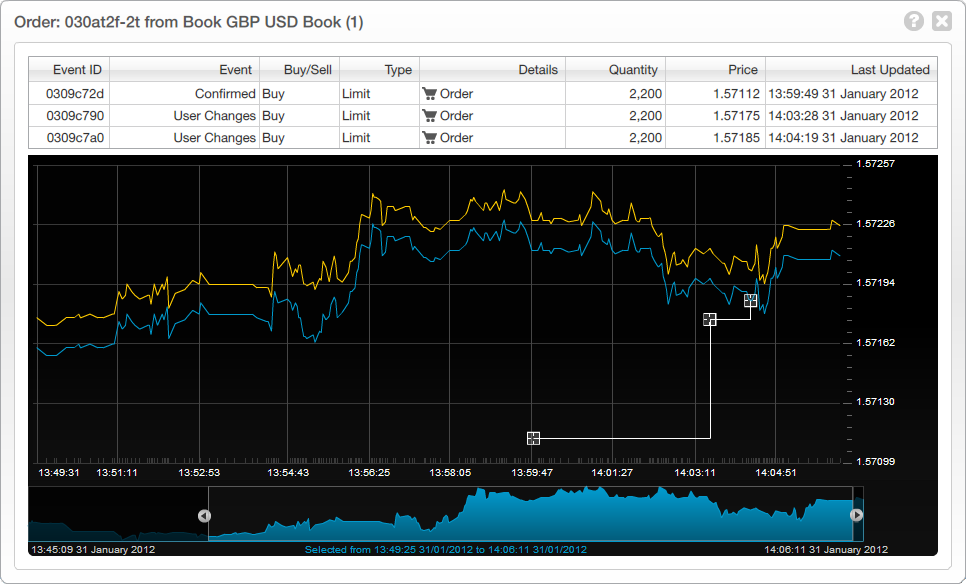

- Graphical Order History: gives fully transparent view of exactly where and when orders were filled

- Market responsible leverage: of up to 50:1

- 24-hours streaming news and economic calendars

- Customisable Charting feature with a wide range of indicators and overlays

- Clean, modern design and intuitive user interface

- Full customer support: 24 hours per day, 5 days per week

- Demo Account: free $100k practice account

The MahiFX platform trading requires no minimum deposit.

To view an introductory video detailing MahiFX platform attributes and functionality please follow this link.

MahiFX’s core offering to the retail market is based on transparency, technology, pricing and design.

“Our aim is to bring genuinely tight institutional level pricing direct to the retail FX trader through a richly informative, elegantly designed platform," said David Cooney, MahiFX CEO. “As a market maker we are able to offer our customers access to consistently tight spreads previously unavailable in the retail sector.”

MahiFX is headquartered in New Zealand, with offices in London. The Company is regulated by The Australian Securities and Investments Commission (ASIC), Australia’s corporate, markets and financial services regulator.