Financial services firms operating in the US margin derivatives segment have reported their November operating metrics through the CFTC. The emphatic end to a moderate year, with a wave of Volatility impacting global financial markets, triggered a rise in the total value of funds held at Forex providers.

The value of funds increased by 4.3% on a month-on-month basis, thus signalling positive sentiment among traders due to the spike in market volatility.

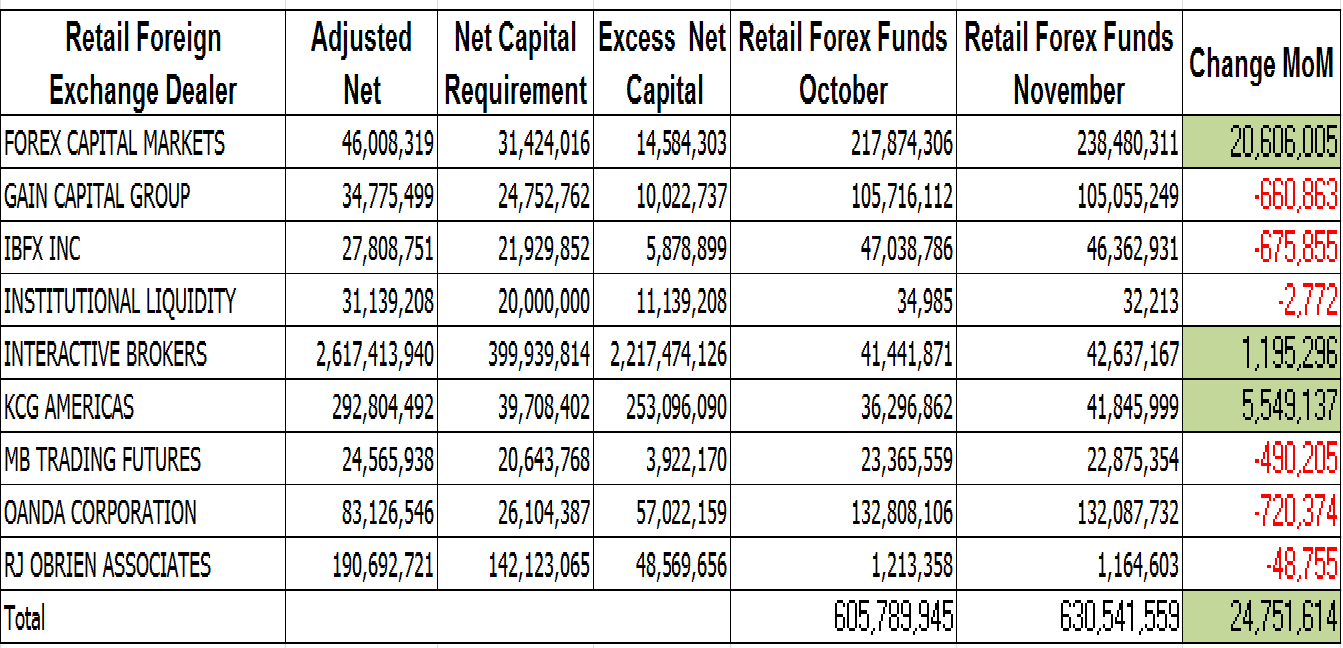

The CFTC authorised that firms report monthly data to the watchdog, a practise that came into place post the 2008 recession. Of the nine broker-dealers, three saw an increase in the value of funds which supported the overall figures. Listed broker, FXCM, saw the largest increase with over twenty million dollars in new client funds, the firm taking over FXDD US in May 2014 business, however, according to October’s figures there were no pending funds awaiting migration, thus indicating that FXCM’s MoM increase was all fresh funds.

Apart from FXCM, only Interactive Brokers and KCG saw figures in the green, with both players mainly dealing with institutional business. The remaining six brokers, with three of them holding pure retail books, saw low value reductions in their monthly client deposits. GAIN Capital saw a 0.52% decline with October figures showing $105,716 million in forex funds dropping by $660,863.

The once thriving US forex broking space has taken a sharp U-turn with only nine participants remaining. In the latest CFTC repro, FXDD was removed as the final integration with FXCM took place. The North American FX market has suffered immensely following the 2008 recession which resulted in new rules taking shape and driving brokers away from the world’s largest economy.