In congruence with the direction in which monthly FX volumes appear to be heading across the entire industry as the year 2013 enters its final month, Japanese electronic trading company MONEX Group's announcement of its results for November 2013 demonstrate the continued waning of trading activity within the FX division of the business.

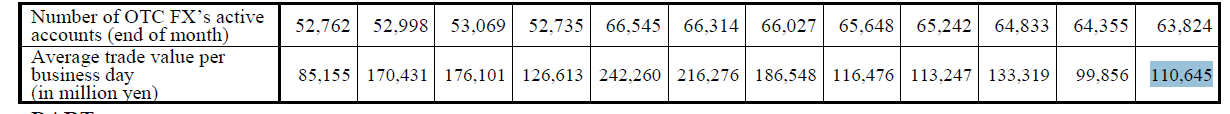

With an average trade value per business day of JPY 110,645 million, an increase from the previous month's JPY 99,856 million was achieved, but the overall figure is still significantly down when compared with the highs achieved between February and August this year, peaking at JPY 242,260 million in April.

The number of active FX accounts held by MONEX Group at the end of November this year, excluding duplicate accounts held at MONEX Inc, had decreased to 63,824, representing the lowest number of accounts since April this year, and down by 531 accounts when compared with October this year.

The company recently underwent a restructure within its senior management, in a move to optimize the talent which steers the firm ahead, as well as creating a series of new business units in order to keep pace with the evolving requirements of its client base.

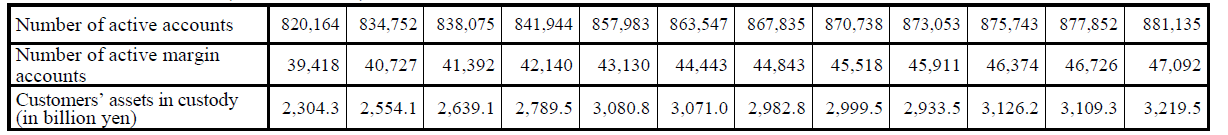

Despite the downturn in active FX accounts, the company has experienced an increase in client assets in custody and active client accounts when bearing in mind all asset classes rather than just FX, with total client assets under management standing at JPY 3219.5 billion in November compared with JPY 3109.3 billion one month previous, and a total of 881,135 active accounts across the entire business compared with 877,852 in October.

In total contrast to the direction of the FX division, the number of accounts held across the entire business for November is the highest so far this year.

US Division Continues Strong Performance

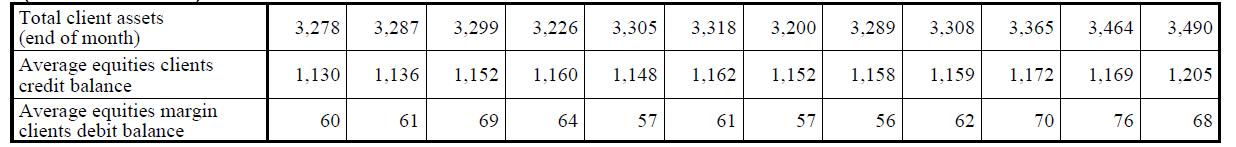

Tradestation continues to post steady results, with an increase in client assets under management from $3,464 million in October to $3,490 million in November, and an increase in daily average revenue trades from October's $161,556 million to $161,694 million in November.

Although these figures are not in the realms of those achieved during the summer, a steady upward direction is becoming apparent since the first half of the year gave way to much lower trading activity this August.

MONEX Group FX Metrics - December 2012 to November 2013

MONEX Inc Total Number Of Accounts - December 2012 to November 2013

TradeStation Metrics - December 2012 To November 2013