Monex Group Inc, the Tokyo-based brokerage, today reported trading volumes and metrics for September 2014.

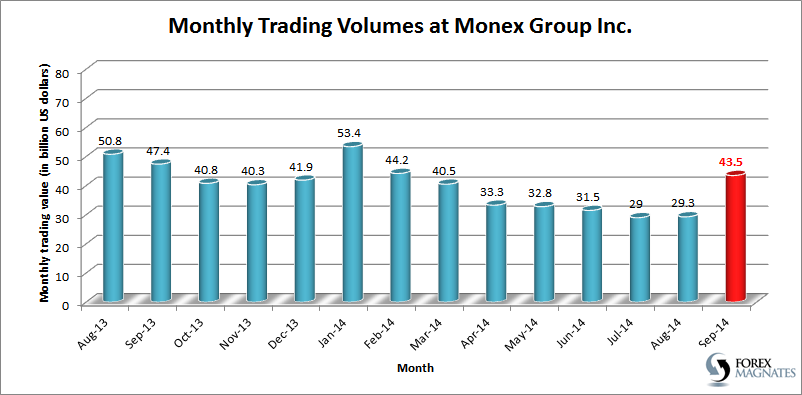

The broker transacted $43.5 billion in Forex transactions during the past month and continues a string of strong volumes announcements from the vast majority of trading venues around the world.

The number of DARTs (Daily Average Revenue Trades) rose from 289,854 in August to 323,299 in September (11.5% increase). In the same month last year, Monex reported 356,631 DARTs - a year-on-year decline of 9.3%.

Monex Forex Trading Volumes Since August 2013

Global FX trading volumes in September rose 48% compared to August and arrested a broad trend of declines going back to January 2014. However, from a year-on-year perspective, Monex recorded an 8% decline in September. So although business conditions have taken a turn for the better, they have not returned to their same comparative levels as this time last year.

One of the more eyebrow raising facts about Monex's September trading results is the 'trade value per business day'. The broker recorded an average of ¥138 trllion ($1.3bn) in September compared to ¥65 trillion ($593 million) in August- a 112% increase.

It is worth noting that as Forex Magnates reported in early September, the broker will be terminating its service for the MT4 platform by the end of October, having shifted its focus and backing behind Tradable’s platform.

The Wider Ocean

Today’s results from Monex mirror several other positive performance reports specifically for the month of September. The FX market has burst into activity across the board among all retail brokers. The reasons have been multifaceted but directly linked to macro-economic and geopolitical developments including central bank manoeuvring (and expectations of), monetary policy diversion and the Scottish referendum.

With the third quarter of 2014 now complete, brokerages and trading venues across the trading industry have experienced particularly strong trading volumes, new client numbers and business activity.

Forex Magnates has recently published volume metrics for MOEX, DMM, Saxo Bank, CME and KCG Hotspot, all of which show particularly strong performances over the past month and broadly stronger metrics for the third quarter.