Japanese FX and Online Trading firm MONEX Group has today announced its corporate results for the first half of the fiscal year ending March 31, 2014.

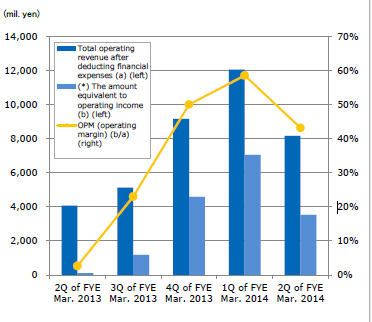

With the full consolidated figures, the company clearly depicted its sterling start to the year, in which an immediate upturn in fortune was achieved compared to 2012's protracted volumes, however during the second quarter of this year, the overall corporate result has not matched that of the first quarter.

In numerical terms, the first half of the fiscal year ended March 31, shows a year-on-year total operating revenue for the Group after deducting financial expenses of JPY 27,085 million, up 93% over the same period during the previous year.

Quarterly net income attributable to owners of the Company for this period was JPY 6,715 million, up an astonishing 437%.

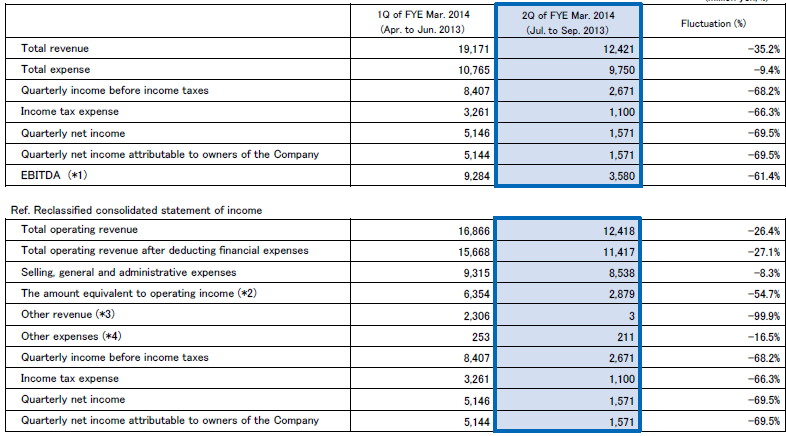

During the second quarter of this year, total operating revenue after deducting financial expenses amounted to JPY 11,417 million which is a downturn of 27%, and quarterly net income attributable to owners of the Company weighed in at JPY 1,571 million, representing a decline of 70% compared to the previous quarter.

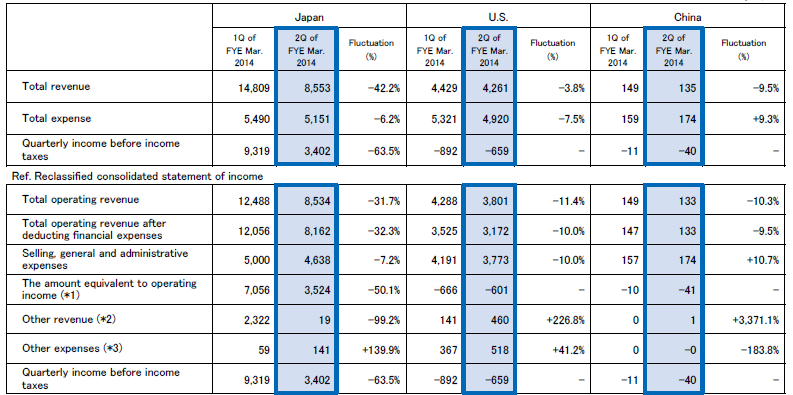

Japan Segment Results

The company announced that it capitalized on the booming market since last December, and the resultant record high in trading value of equities hit a new record high of JPY 3.76 trillion in May 2013.

Additionally, month-end customer assets in custody reached a record of JPY 3.13 trillion as of September 30, 2013

Results By Local Segment (x Million Yen)

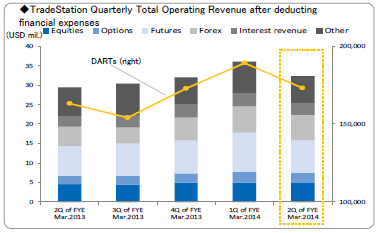

US Retail Subsidiaries Remain Strong Lynchpin

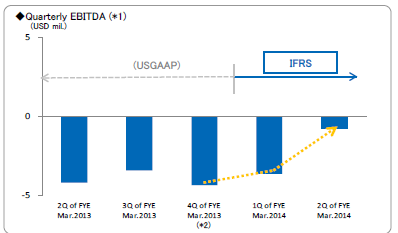

MONEX Group's North American subsidiaries continue to build a steady upward picture. Whilst the second quarter of this year resulted in a protraction compared to the first quarter, the EBIDTA of U.S. business has been making steady progress toward recovery from last year.

TradeStation Quarterly Operating Revenue

The US operations have demonstrated an improvement in the profitability of FX business from integrating the Liquidity pools of IBFX and TradeStation FX volume since this fiscal year, and the firm introduced the ”Option Flat Ticket” new commission rate in June this year.

Meanwhile, IBFX has concentrated on expanding its white label service, which now operates across 16 companies in 7 countries, and has embarked on a corporate inititative to penetrate Asian & Middle Eastern markets with its equity, futures and options platform.

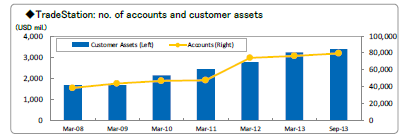

Within the US business units, the Group considers the two revenue drivers of this segment to be brokerage commissions and net interest income. Despite the historically low volatility environment, a steady increase in number of accounts and customer equity have materialized and the revenue per trade has been maintained.

Quarterly EBITDA (North America)

Corporate Direction

As the second quarter of the fiscal year draws to a close, China and Hong Kong remain important growth markets for MONEX Group. BOOM, MONEX’s subsidiary in that region is continuing to implement its strategic plan to tap into the market in mainland China, and offers access to over 15 equity markets in the Asia-Pacific region.

The domestic market paints a different picture to that of the Group's anticipated growth in other Asia-Pacific regions, MONEX having listed a series of factors which have contributed to decrease in overall revenue, citing margin transaction decreases in Japan and significant financial income decrement as two of such factors.

Shareholders can expect an interim dividend of JPY 1,100, marking a record high for the firm.

On home territory, MONEX has made a further senior management change, with existing Executive Director of MONEX Group, Takuma Miyoshi assuming the post of Representative Director and Deputy President.

The company arrived at the end of the second quarter of this fiscal year with a total of JPY 812.1 bn in assets, and JPY 733.3 bn in liabilities, placing the Group in the black by a margin.

Quarter 1 Comparative to Quarter 2