The Japanese financial services company MONEX Group announced its results today for the month ending December 2013, articulating a minor rebound in trading activity and trade valuations since last month, according to a MONEX monthly financial statement.

At first glance several key figures jump out, including the OTC average daily volumes of about $1.35 billion (JPY 140,647 million), constituting a 27.12% increase over the previous month, which saw a figure of just JPY 110,645 million. While this figure has steadfastly rallied over the past few months after dipping to a yearly low of JPY 99,856 million back in October, it ultimately represents a much leaner value when compared with Q1 2013, and a yearly high of JPY 242,260 million back in April.

MONEX Group Overall Trading Volumes Increase 5.95% From January 2013

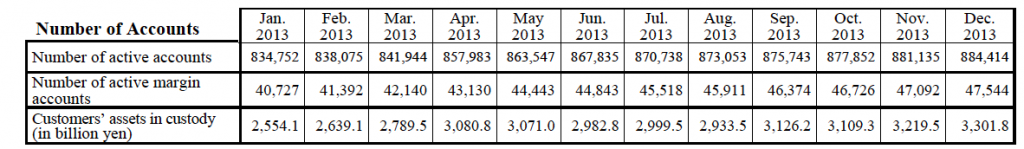

In addition to the overall trading volumes, the actual number of active FX accounts managed by MONEX Group came in at 884,414, notching a rather marginal gain of 0.37% since November, which reported 881,135 accounts. It is worth noting that the number of accounts has increased in each consecutive month this year, up 5.95% or 49,662 accounts since January 2013. In addition, the number of active margin accounts in December yielded a yearly high of 47,544 – once again only a slight growth from 47,092 accounts in November. Finally, a valuation of customers’ assets in custody was reported at JPY 3,301.8 billion, up from JPY 3,219.5 billion last month.

The 2013 calendar year has been an active one for MONEX Group, seeing a company restructure across aspects of its management at the senior level. The underlying move necessitated a genesis of new divisions within the firm itself aimed at concentrating on requirements within the industry itself.

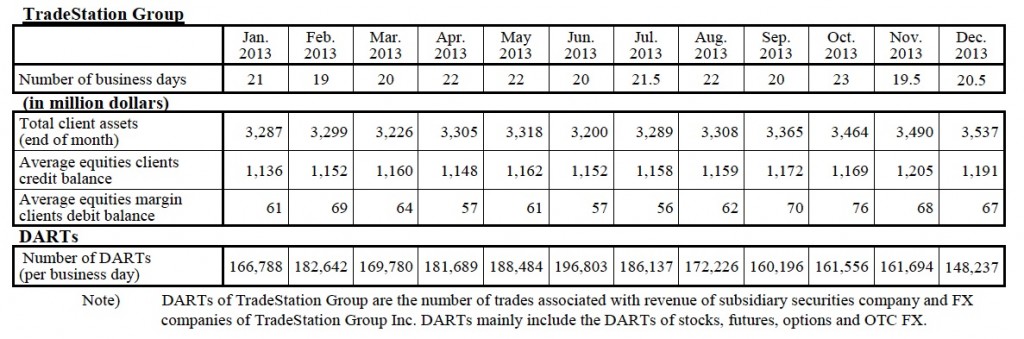

Tradestation Client Assets Rise, But FX Volumes Keep Falling

The TradeStation Group, MONEX’s American-based subsidiary, once again continued its gradual ascension of client assets, coming in at $3,537 million in the month of December, vs. $3,490 in November, a 1.3% increase. By contrast, the number of daily average revenue trades (DARTS) declined to $148,237 million in December, representing a notable decline from $161,694 million in November or a -8.3% loss MoM.

In FX, volumes at IBFX and TradeStation continued to decline as they fell to a multi-year low of about $15 billion. The figures were also 15% below November's trading. The continued decline in non-Japanese trading at Monex has been an ongoing trend since the end of Q1 2013. After non-Japanese volumes peaked at just above $40 billion in February 2013, December's figures show a near 2/3 contraction in activity.