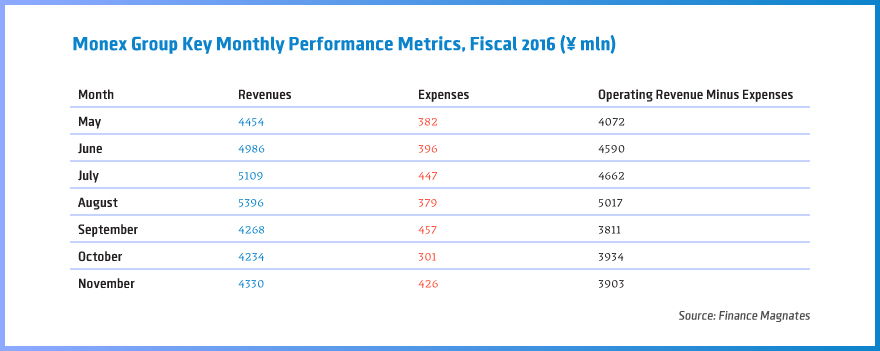

Monex Group Inc (TYO:8698) has released its monthly revenue data for November of fiscal 2016. Regarding expenses, following a record low in the previous month, November saw a return to average levels. Operating revenue rose JPY 96 million to 4,330 million, while financial expenses soared JPY 125 million to 426 million.

As a result of higher expenses, operating revenue minus expenses fell JPY 31 million lower from October, reaching 3,903 million. Compared to November 2014, this year's Monex performance was lower, with revenue minus expenses falling from last year's figure of JPY 4,038 million.

Low Volume Levels

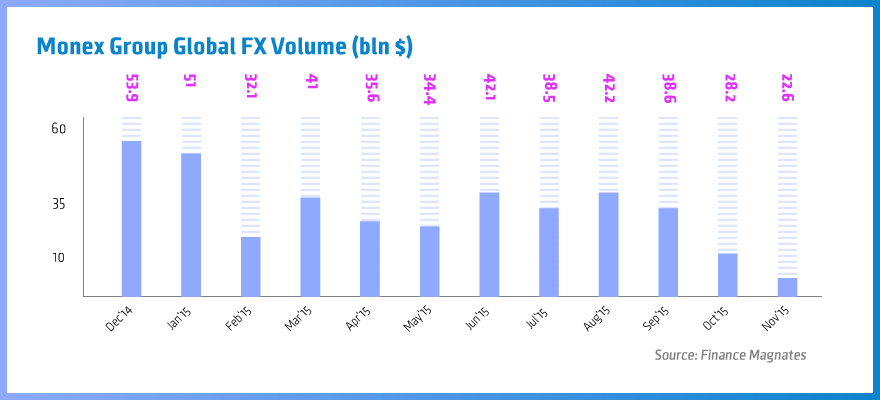

Decline in revenues in November was anticipated, in parallel with low trading volumes. As November ended, Monex published volume data, revealing a record low since the company began publishing the figures in 2011. The declining Volatility in the Japanese yen and the decreasing appetite of Japanese investors to engage in carry trades are taking their toll on the performance metrics of Japanese brokers.

Trading volumes at Monex continue trending lower

Looking at the specifics, the November figures declined by 20 per cent when compared to October, marking JPY 2.72 trillion. The state of the market in Japan proves to be widely dependent on the stimulus measures which the Bank of Japan has in place.

Retail traders have been keen to divest their savings and the Japanese have proven to have one of the most developed investment cultures in the world, housing the biggest brokers by volume, GMO Click and DMM Securities. With the Leverage limited at 25:1, the scope of the popularity of foreign exchange trading in the country can be put into perspective when compared to the rest of the world.

If we look at the general trend for trading volumes this year however, we are observing a substantial decline for a third consecutive month.