Monex Group Inc today published its financial results for the second quarter of the fiscal year ending on the 31st March, 2017 showing a further decline in both revenues and profits explained a series of factors including declining trading volumes and costs associated with a new brokerage system which has impacted on the brokerage's bottom line.

The FM London Summit is almost here. Register today!

Financial Metrics

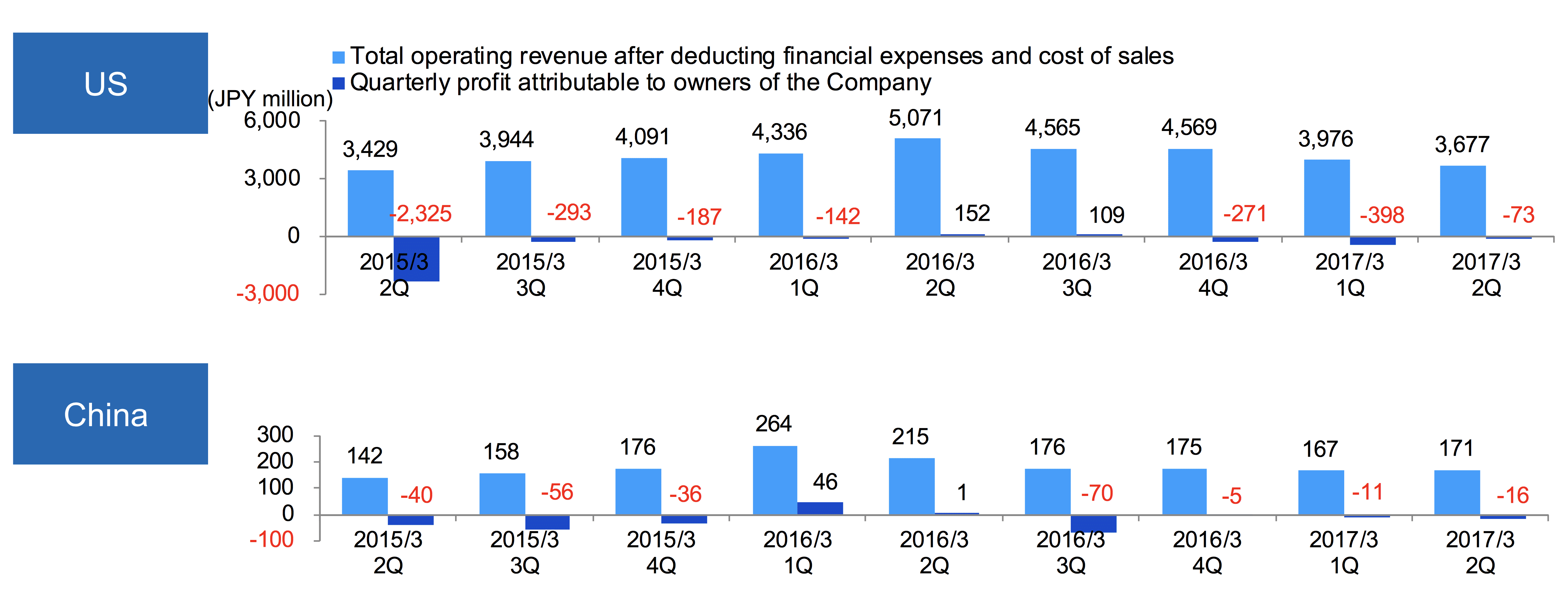

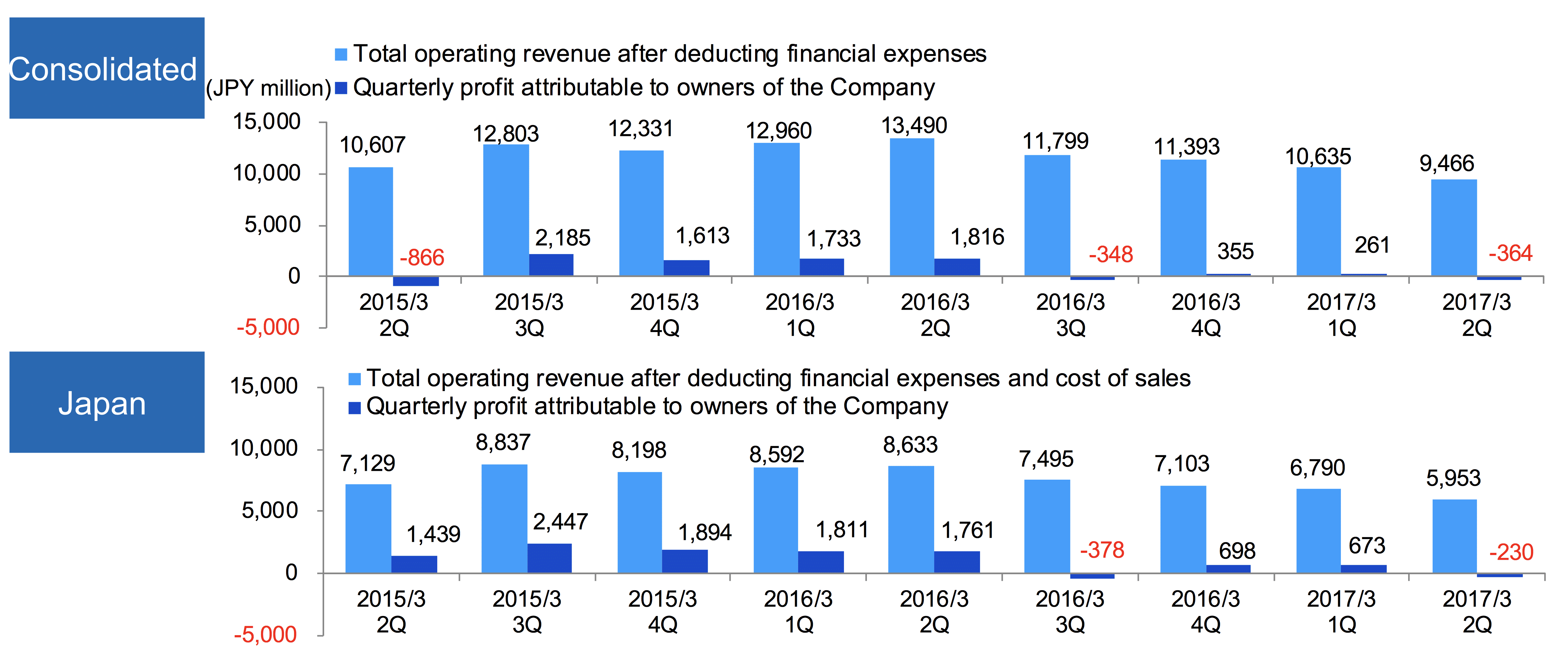

For Q 2016, Monex’s results showed a total operating revenue of $90.2 million (¥9.46 billion), revealing a further consecutive quarterly decline of -11.0 percent quarter-on-quarter over Q1 2017’s figures of $101.4 million (¥10.63 billion) and a year-on-year decline of -30 percent over Q1 2015 figures of $128.8 million (¥13.5 billion).

Monex also reported a consolidated net loss of -$3.47 million (-¥364 million) for the quarter compared with a net profit of $2.5 million (¥261 million) for Q1 2017.

Monex’s results are accounted for by a $2.19 million (¥230 million) net loss in the second quarter due to business environment deterioration together with the heavy cost burden arising from parallel operation of new/old backbone brokerage system.

After completion of the parallel operation within this fiscal year, around $95 million (¥1 billion) of system related expenses reduction per year is expected.

Furthermore, $696,731,00 (¥73 million) net loss for the period has been accounted for due to lower trading volumes. The brokerage has noted, however, that the segment returned to profitability during the month of September.

Below is the detailed performance of the different regional business units of the company.

Outlook

In general, the declines can in part be explained by the lower risk appetite of retail investors on the back of structural changes in the Japanese stock market. The brokerage has recognized the necessity to rebuild the group’s business portfolio in the mid- and long-term.

The outlook is thus expected to be profitable on a quarterly basis from Q3 onwards as the company will reap the benefits of a lower fixed cost base due to headcount reduction which was announced in July.