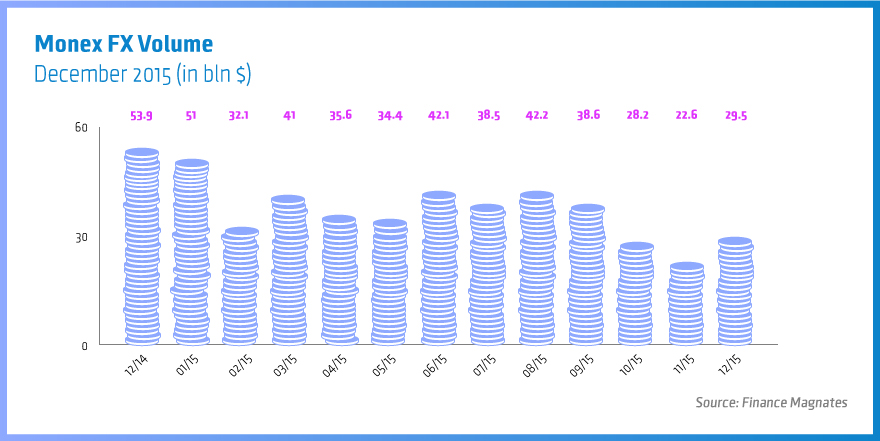

Japan’s Monex Group has today reported its business metrics for the month ending December 2015, showing the first recovery in its FX volumes since suffering declines for three consecutive months. The monthly FX trading value for all subsidiaries of Monex Group Inc totaled $29.5 billion in December, up about 30.5% from $22.6 billion in November 2015 and above October's figure of $28.2 billion.

It is of course good news for the Japanese brokerage that it was able to stop the month over month decline in FX trading volumes, but in truth the December rebound isn't very impressive, all things considered. First of all, the two previous months were both the lowest on record in terms of FX trading volume in 2015. Secondly, looking at the figure with a year-over-year comparison, we see just how low the bar was set as the figure is down over 45% from December 2014’s $53.9 billion. We can also see that the monthly recovery can be explained in part by the fact that the number of trading days in December 2015 was 21, while November only had 19 full business days in Japan.

Taking a closer look at the December data, we can see that the number of OTC FX accounts increased from 219,007 to 220,363 and the number of active OTC FX accounts was up from 63,110 to 63,225. Average trade value per business day in OTC FX recovered from 108,017 to 129,259 (in million yen). The Daily Average Revenue Trades (DARTs) for the Monex Group were also up slightly in December 2015 MoM, from 280,599 to 282,969. In contrast to the Japanese figures, the group's American subsidiary, TradeStation, experienced a monthly decline in DARTs in December, down from 114,622 to 110,051 per business day.

Last month Monex also released its monthly revenue data for November 2016. Regarding expenses, following a record low in the previous month, November saw a return to average levels. Operating revenue rose JPY 96 million to 4,330 million, while financial expenses soared JPY 125 million to 426 million.