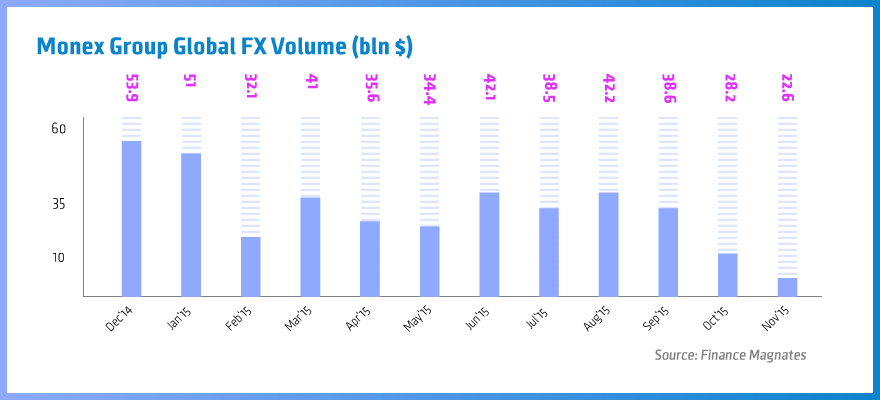

The foreign exchange trading volumes at Monex Inc have dropped to the lowest level recorded since the company began publishing the figures in 2011. The declining Volatility in the Japanese yen and the decreasing appetite of Japanese investors to engage in carry trades are taking their toll on the performance metrics of Japanese brokers.

Looking at the specifics, the November figures declined by 20 per cent when compared to October, marking $22.6 billion. The state of the market in Japan proves to be widely dependent on the stimulus measures which the Bank of Japan has in place.

Trading volumes at Monex continue trending lower

Retail traders have been keen to divest their savings and the Japanese have proven to have one of the most developed investment cultures in the world, housing the biggest brokers by volume, GMO Click and DMM Securities.

With the Leverage limited at 25:1, the scope of the popularity of foreign exchange trading in the country can be put into perspective when compared to the rest of the world.

If we look at the general trend for trading volumes this year however, we are observing a substantial decline for a third consecutive month.

Ever since the Bank of Japan’s board of governors expressed doubt about the effectiveness of further easing, the Japanese yen has paused its decline and has settled within trading ranges. Expectations about the prospect of the Federal Reserve tightening rates in two weeks time and for the ECB easing later today have also kept volatility under the lid.

Looking ahead, we don’t expect tradingonetary policy action fro volumes of Japanese brokers to rebound substantially until we see more mm the Bank of Japan, a scenario which would become likely only after another quarter of negative growth.

TradeStation figures

The performance metrics for the brokerage unit of Monex Inc in the U.S. have also declined. The company reported a total of 114,622 Daily Average Revenue Trades (DARTs) per day thorughout the month of November, which is the third consecutive monthly decline and a drop month-on-month by 4 per cent.

The figure is also lower when compared to a year ago by almost 7 per cent.