Monex Group Inc (TYO:8698) has released its monthly revenues data for October. The Japanese company has experienced a slowdown just like its industry peers in the world’s largest retail market by volumes. Earlier this month many Japanese brokers, including Monex, GMO Click and DMM Securities, have reported monthly volumes figures that were materially lower than throughout 2015.

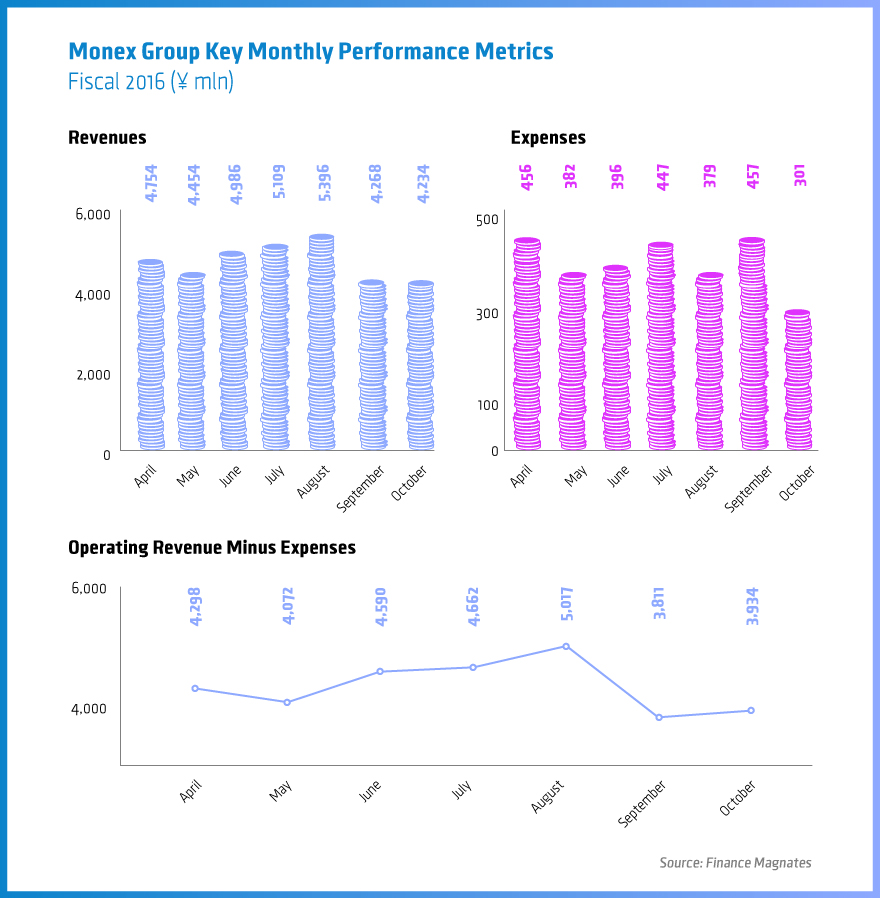

As a result the company’s revenues have also dropped to their lowest level for the year. The decline has been quite small, with the monthly revenues figures marking less than a percentage point to the downside to ¥4.26 billion ($34.7 million).

Monex Group's Key Performance Metrics for fiscal 2016 ending on March 31st next year

On the bright side the company’s financial expenses figure has also declined. The figure came out lower by 34 per cent at ¥301 million ($2.45 million), which is also the lowest level for the year.

As a result the operating revenue after financial expenses for the year is not the lowest on record for the year, marking ¥3.94 billion ($32 million) which is higher than for the month of September.

No more monetary policy easing despite recession

The Japanese market has been facing headwinds in the past couple of months as the Bank of Japan has refrained from taking additional easing steps despite the economic recession. The failure of the Abenomics policy which massively depreciated the Japanese yen through quantitative and qualitative easing (QQE) did not Yield a sustainable result.

Traders are looking for new clues about the plans of the Bank of Japan to meet its inflation target, yet the monetary policy governing body in the country is so far restraining from expanding an already failing effort.

The QQE policy has depreciated the currency, eroding the purchasing power of households and dampening economic expectations.

According to research by Barclays, the bank is no longer expecting additional easing from the BoJ.

given the declining efficacy of QQE, a sharp JPY depreciation is unlikely

A note in the Barclays’ “Global FX Quarterly” report says that “any further easing to occur as a reaction to risk events such as a sharp JPY appreciation, a worsening in the inflation outlook, political pressure, or a significant deterioration in the external environment.”

If such a scenario materialized, the slowdown for Japanese brokers that started in September could well last until the end of the year. The main risks to the Japanese yen market are entered in rapid appreciation of the currency as a result of a global risk event which typically boosts the value of the JPY.

“The first action in such an event would likely entail some expansion of the QQE program. While such measures could offset some currency appreciation pressures, they would be unlikely to generate a sharp JPY depreciation given the declining efficacy of QQE,” Barclays’ research on the matter stated.