Going public this week after an initial soft launch is the rebranded Alpha Capital Markets, which is now named simply 'Alpha', and is a B2B facing operation. Operating as a retail trader facing broker since 2012, Alpha is pivoting in a new direction with a newly established executive team and corporate strategy.

Heading the company is Muhammad Rasoul as the broker’s CEO. For Rasoul, his arrival at Alpha comes after having left GAIN Capital as its CPO last year and formerly having co-founded GFT Markets. Along with Rasoul are forex and CFD industry veterans, including several who had worked with Rasoul at GFT including Roger Hambury, Scott Sandat, Kurt Hoeksema and Des Grech.

B2B Focus

With the new approach, Alpha will be focusing on B2B relationships. As such Alpha will be providing services to businesses such as brokers and introducing brokers, by providing solutions such as end to end branded white label trading solutions, Risk Management support, Liquidity and DMA execution services.

Muhammad Rasoul, CEO, Alpha

Speaking with Rasoul, he explained that what appealed to him about Alpha was the lack of a conflict of interest compared to working at a broker that both offered institutional and direct to retail customer services. According to Rasoul, the conflicts go beyond just the problem that a retail broker ultimately competes with its partners for clients.

Rasoul explained that operationally, there is a conflict. This includes the constant decisions related to where a broker should focus items such as manpower, technology development and marketing spend between its B2B and B2C businesses.

According to Rasoul, by focusing exclusively on B2B relationships, this strategy provides benefits for their customers as he stated “everything we have done, and are doing is from the perspective of the partner”. Rasoul added that as the firm is officially launching, he and his team spend a lot of their initial setup phase with each partner to better understand their needs now, but also “where they want to go in the future in order to customize their offering to meet their long term vision”.

“Boutique trading firm”

For Rasoul, the entrance to the B2B market comes as he had earlier stated to Finance Magnates that he didn’t expect a return to the retail market. He explained that due to competition, he believed you need to have a unique offering or large pockets to be successful selling direct to retail.

In this regard, Rasoul mentioned that he viewed the B2B sector as offering an opportunity and decided it was best done by “building a boutique trading firm to focus only on partnerships”. He added that to do this right meant having a very experienced team that have various areas of expertise such as in risk management, technology and supporting B2B customers. Rasoul said: “The team at Alpha has been making markets and trading for decades, throughout a variety of volatile market conditions, and with vastly different types of customer order flows."

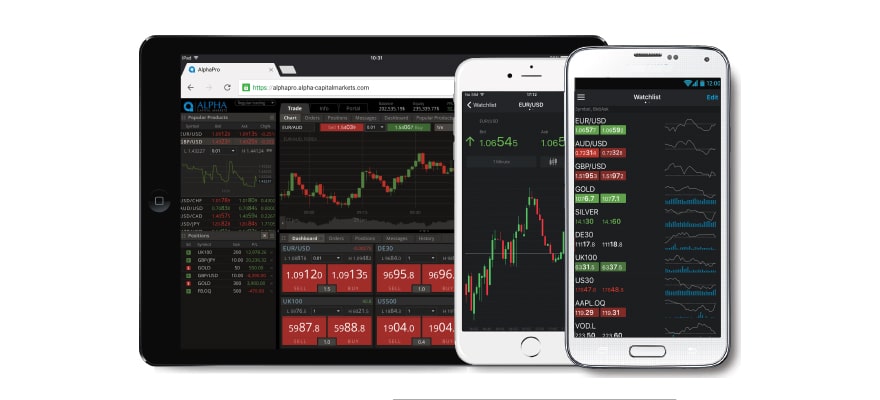

Coming to market, Alpha is offering both MetaTrader 4 and their Alpha Pro proprietary trading platform to customers. Rasoul stated that “having MT4 is important for partners” but also wanted to have the availability of a multi-asset proprietary system that they can optimize for each of their partner clients’ bespoke needs. Along with forex, Alpha’s product lineup consist of CFD’s, financial spread bets and a DMA FX and equities service.