According to minutes from the meeting of creditors and clients of Alpari UK with representatives from the special administrator KPMG and the Financial Services Compensation Scheme (FSCS), there have been no bids submitted for Alpari Japan.

The special administrator announced that it sought the sale of the Japanese subsidiary of Alpari UK, however, at the time of the meeting, which was yesterday the 12th of March, no offers had been received.

The minutes also reveal that the company's biggest shareholder, Andrey Dashin, has secured the trademarks, domain names and licences owned by Alpari UK for $6 million in February.

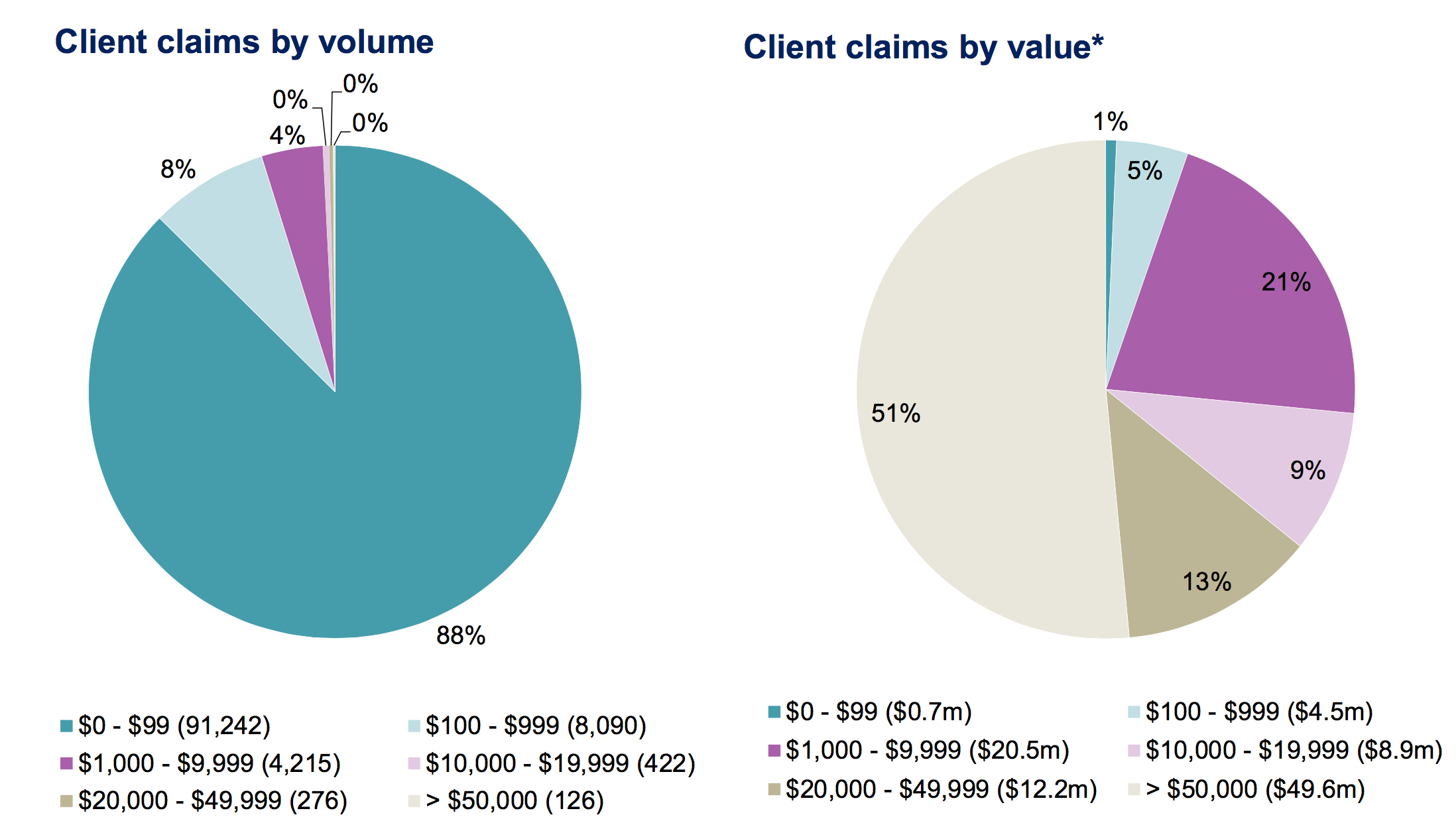

Meanwhile, the meeting provided key details about the structure of claims which clients of Alpari UK are entitled to. Just over 13,000 clients are awaiting to recover over $100, with about 90,000 clients of the bankrupt broker having access to the claims portal devised by KPMG entitled to amounts between $0 and $99, totaling $0.7 million.

Alpari UK Client Claims Structure, Source: KPMG

Clients of the broker with over $50,000 in deposits have the largest amount to recover, totaling almost $50 million. KPMG stated that for the time being just over 4,500 clients entitled to make a claim have logged into the specially devised Claims Portal to do so.

Currently, a touch over 83,000 clients have access to the portal, while the total amount of clients who have agreed upon their claims is 2,812 totaling $13.4 million.

The majority of clients who have agreed to the claims portal chose to assign their claims to the FSCS.

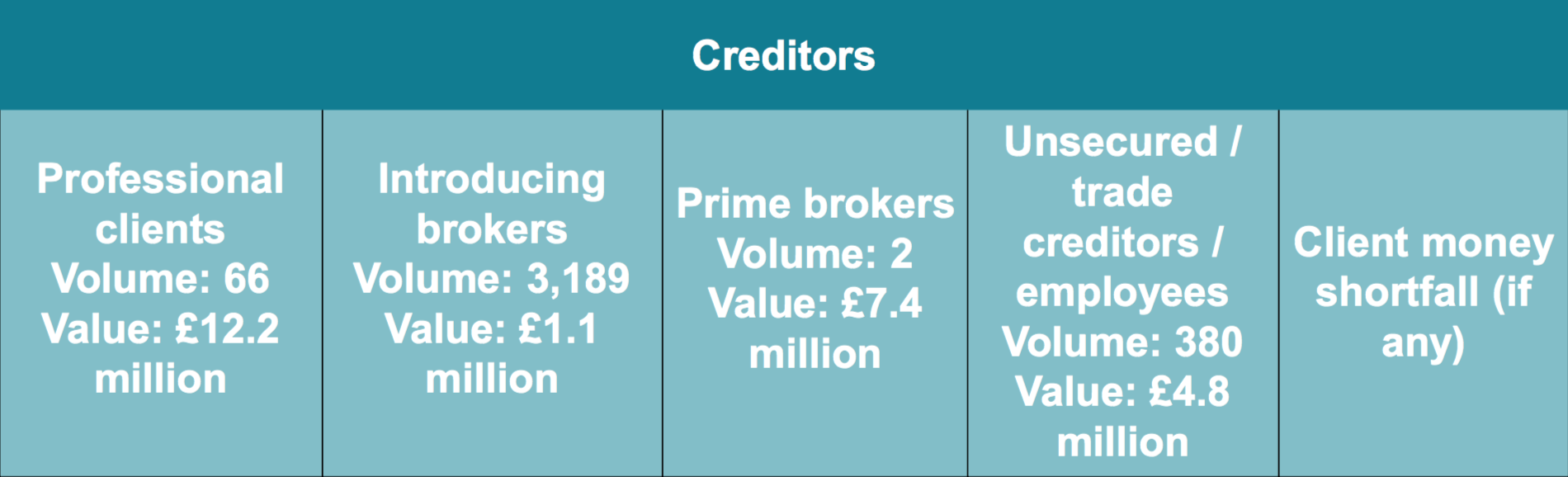

Alpari UK Creditors

The structure of the Alpari UK creditors has also been published in full with professional clients and prime brokers having the biggest claims. A total of £12.2 million ($18 million) are owed to professional investors, £7.8 million ($11.5 million) to Citi and FXCM, while introducing brokers are seeking £1.1 million ($1.6 million).

Alpari UK Creditors Structure, Source: KPMG

Another £4.8 million ($7 million) is owed to unsecured creditors, trade creditors and employees of the company. All creditors will have to submit a statement of claim to the special administrator.

Important Information for Clients

All of Alpari UK's clients who have agreed to their claims and have confirmed that they are going to assign them to the FSCS are going to be contacted by the compensation fund directly. Once a claim has been assigned, the FSCS will receive any dividends in respect of that claim.

While clients who have chosen to accept FSCS compensation and pass their rights to claim dividends from the administration of Alpari UK, effectively are not incurring any financial losses in doing so, as the FSCS will pay clients amounts that they would otherwise have received if the client had accepted dividends before claiming from the compensation fund.

The clients will receive funds each time the FSCS receives dividends from the sale of Alpari UK assets, and in the end will not profit in any way from its action as it is not making profits from assigned claims.

By design, the FSCS rules require that a client is no worse off whether he or she claims from the FSCS first or the appointed special administrator.

Below is the full summary of the meeting of KPMG representatives with creditors and clients of the company.