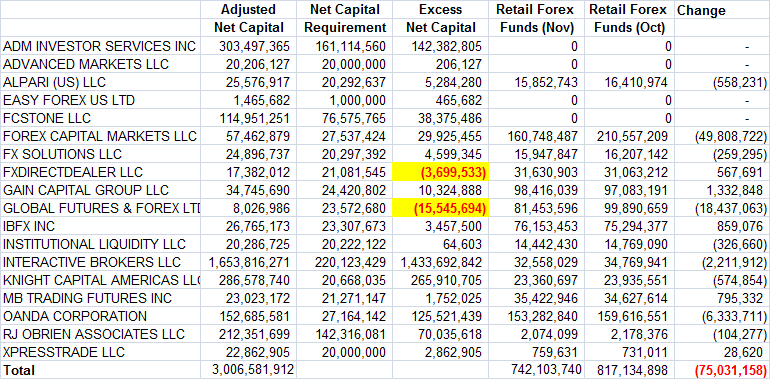

Yesterday we saw the publishing of the CFTC’s Q4 account profitability report, today we take a look at net deposits from FCMs as of November 30th 2012. In the past we have compared monthly ‘Adjusted Net Capital’ and ‘Retail Forex Funds’ figures and ignored the ‘Excess Net Capital’ number as firms were adequately capitalized (at least in their reports –ie. PFG Best), and there was rarely much of a surprise. However, for this time around we have replaced the month over month ‘Net Capital’ number with the ‘Excess Net Capital’ figure.

As can be seen below, both FXDD and GFT fell below their Excess Net Capital requirements at the end of November. The drop in FXDD was previously documented in the NFA’s memorandum they issued to the broker which had been disputed by FXDD. However, the GFT net capital drop is a huge surprise and apparently this was the point of contention between the CFTC/NFA and the broker. Based on numerous sources, we wrote in the past that the NFA had embarked on enforcing ignored accounting principles in regards to the pooling of funds from foreign subsidiaries. As can be seen below, the new accounting calculations had severe effects on both GFT and FXDD. It’s worth noting that among large brokers, with the exception of Oanda, firms experienced a drop in their ‘Adjusted Net Capital’.

In addition to the drop in Net Capital, during November US brokers also saw a huge fall in Retail Forex Funds. Account funds dropped over $75 million to $742,103,740 from $817,134,898, with FXCM responsible for 2/3 of the decline. Other than FXCM, the other notable drop in funds occurred from GFT. Overall, the drop in total retail account funds follows the negative trend in the US where the Forex industry has been contracting due to an exit of brokers, the MF Global and PFG scandal, a renewed interest in equity trading among retail customers, as well as fewer foreign clients due to the lack of CFDs and high Margin Requirements .