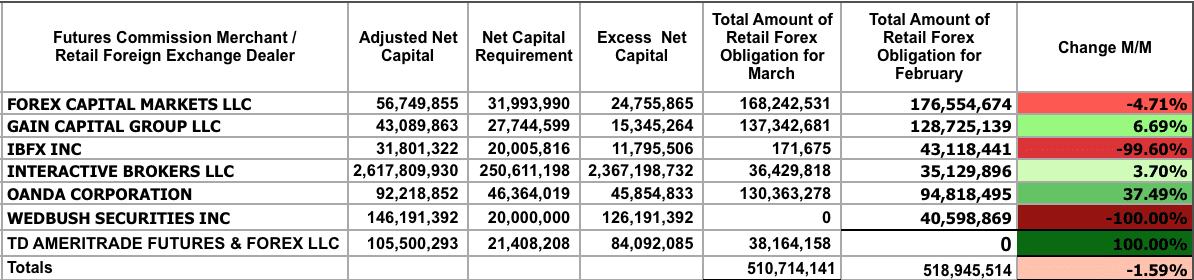

OANDA has gained a substantial amount of client deposits from its deal with IBFX according to the latest batch of CFTC Futures Commission Merchants data. The brokerage gained about $35 million in client funds, gaining 37.5 per cent to a total of 94.8 million in retail Forex obligations in March. The figure is somewhat less than the $43 million total which clients of IBFX held at the brokerage as of the end of February.

The $35 million estimate is not exact, since there is no separate information about how did OANDA's numbers changed month-on-month excluding the effects of the acquisition of clients of IBFX.

The number of migrations is higher than was expected by Finance Magnates and counters the opinion that few clients of IBFX would migrate to OANDA in light of the absence of the TradeStation platform. OANDA itself is gearing up for the launch of a new Trading Platform in the coming weeks. The second generation of the platform is likely to enable hedging for European and Australian clients of the company, and deliver a revamped and more powerful solution globally.

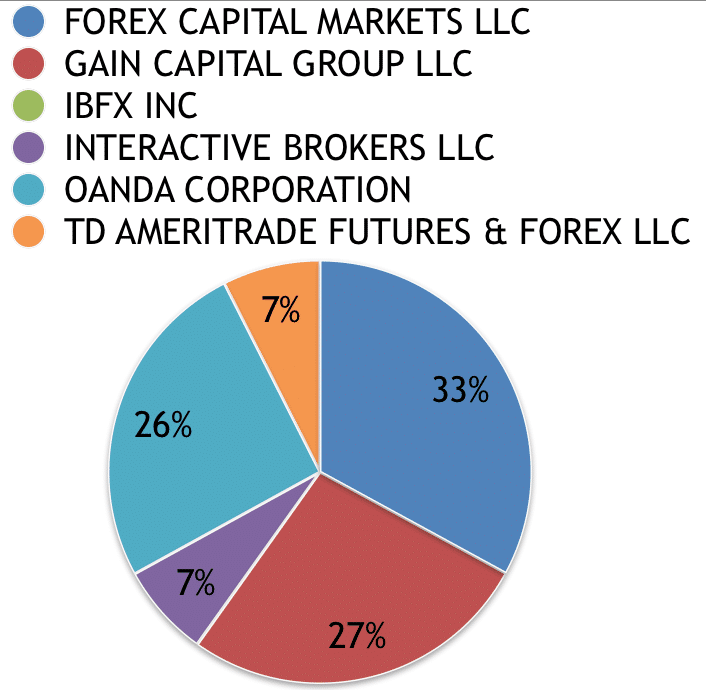

Looking at the total amount of retail forex obligations, the number has barely budged from February with a decline of 1.59 per cent to a total of $510.7 million.

OANDA is now firmly contesting with GAIN Capital for second spot as predicted by Finance Magnates earlier this week, when the February retail forex funds data was released. Looking at the top spots, FXCM has lost its gains made in February and shed 4.71 per cent. GAIN Capital has gained some new deposits, with the month end figure rising by 6.69 per cent.

Competition for second spot between GAIN Capital and OANDA is now intense

New data has also become apparent for the funds held at Wedbush Securities. The company has turned out to be the custodian for trading accounts of clients of none other than TD Ameritrade. The funds have now been transferred to the accounts of TD Ameritrade and are displayed as such in the newest batch of data.

With GAIN Capital and OANDA clinching for second spot, TD Ameritrade and Interactive Brokers are the ones competing for fourth.