As if eToro raising $15 million, Currensee raising $2 million and Tradeo raising $1 million was enough to indicate how attractive this space is for brokers and investors here comes OANDA with its own proprietary social forex trading platform. OANDA is now just the second Forex broker with completely own social Trading Platform after eToro, but is surely not the last.

NEW YORK, April 3, 2012 — OANDA Corporation, provider of innovative online foreign exchange trading, has launched OANDA fxUnity, a new spot forex trading platform for aspiring currency traders. The platform is another way that OANDA is making currency trading more accessible, open, and mobile.

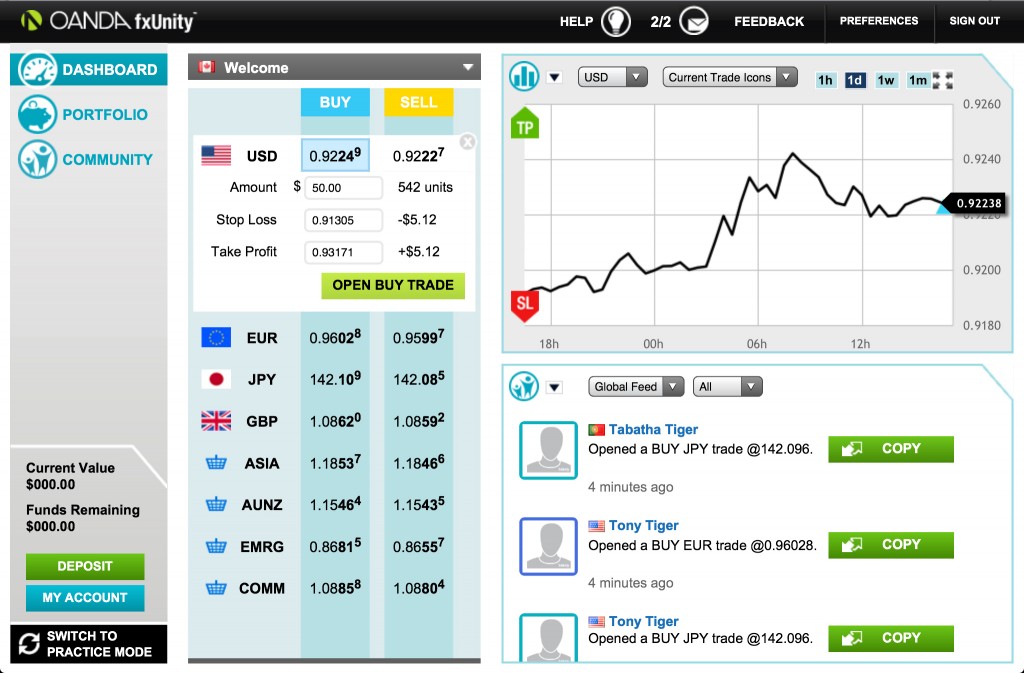

OANDA fxUnity represents a new approach to trading currencies. The platform has an engaging interface that integrates social networking so traders can share their experiences with friends and the fxUnity community. OANDA fxUnity is accessible on the Web or via mobile devices, and is designed to provide a more intuitive way to learn about, and act on, currency movements.

“With fxUnity we’ve reinvented spot forex trading to incorporate community and social sharing in a highly visual, user-friendly platform,” says Alex Case, Product Manager for OANDA fxUnity. “Our goal is to appeal to the next generation of traders by providing the modern, clean, mobile-friendly interface expected in today’s market.”

Forex trading comes with its share of financial risks, so OANDA has designed fxUnity with limited leverage available to traders. The platform provides a user-friendly, interactive dashboard so traders can monitor their funds closely and follow the activities of fellow fxUnity traders to shed light on market sentiment. Following the initial rollout, additional features and functionality will be introduced on an ongoing basis.

“Interest in forex as an asset class has continued to grow in spite of the global financial crisis and turmoil in the European sovereign bond market. With more people trading forex, we saw an opportunity to diversify how we deliver trading experiences,” says Michael Stumm, President and CEO of OANDA Corporation. “Since 2001, when we launched our first trading platform, our goal at OANDA has always been to make forex trading more accessible and open. Yet over the years, we have observed that spot forex trading interfaces can be more complicated than necessary for some traders. We’ve introduced the fxUnity platform to help these traders spend less time figuring out how to use the platform, and more time enjoying the experience of trading.”

About OANDA

OANDA Corporation has transformed the business of foreign exchange through an innovative approach to forex trading. The company’s leading online trading platform, fxTrade, introduced a number of firsts to the marketplace, including immediate execution; instant settlement on trades; trades and accounts of any size; 24/7 trading; and interest calculated by the second. OANDA was the first online provider of comprehensive currency exchange information, and today the company’s OANDA Rate® data are the benchmark rates for corporations, tax authorities, auditing firms, and central banks. OANDA also offers global currency transfers at ultra-competitive prices through a fast, efficient, automated platform.

OANDA Corporation has eight offices worldwide, in Dubai, Chicago, London, New York, Singapore, Tokyo, Toronto, and Zurich. OANDA is fully regulated by the U.S. Commodity Futures Trading Commission (CFTC), the U.S. National Futures Association (NFA), the Monetary Authority of Singapore (MAS), the Dubai Financial Services Authority (DFSA), the Investment Industry Regulatory Organization of Canada (IIROC), the UK Financial Services Authority (FSA), and the Japanese Financial Services Agency (FSA).