The fund manager of Odey Asset Management, James Hanbury, has reportedly made a profit of £110 million betting against the Great British Pound (GBP) ahead of the UK’s EU Referendum vote, according to coverage by Mail Online.

James Hanbury

Odey Asset Management is a UK-based firm that oversees funds with over $10b in assets, and Mr. Hanbury - a borderline millennial at the age of 36 – had carried out a survey which showed sentiment towards the Remain campaign leading by a slight margin. Yet, he decided to take a contrarian position anyway.

Despite the consensus he obtained from the private poll, he speculated that the UK's currency would depreciate, and as such downside risks were underpriced. That decision was rewarded with a significant positive return, as per the £110 million profit attributed by Mail Online coverage.

Betting on a GBP plunge

The historic drop in the value of the GBP relative to currencies such as the USD caused an otherwise year-to-date loss for one of Mr. Hanbury’s funds to turn into a profit, reportedly, as the amount was enough to offset the negative YTD return of -5% last Friday.

The Brexit result had caused historic Volatility in a number of currencies including the pound sterling, and other financial markets last Friday. Certain brokerage clients had positioned themselves properly include at firms such as Saxo Bank and eToro, as shared with Finance Magnates in related posts.

In addition to its other broad range of investments, Odey Asset Management has stakes in public companies such as Plus500 – an online foreign exchange and CFD broker that is listed in the UK, as per regulatory filings.

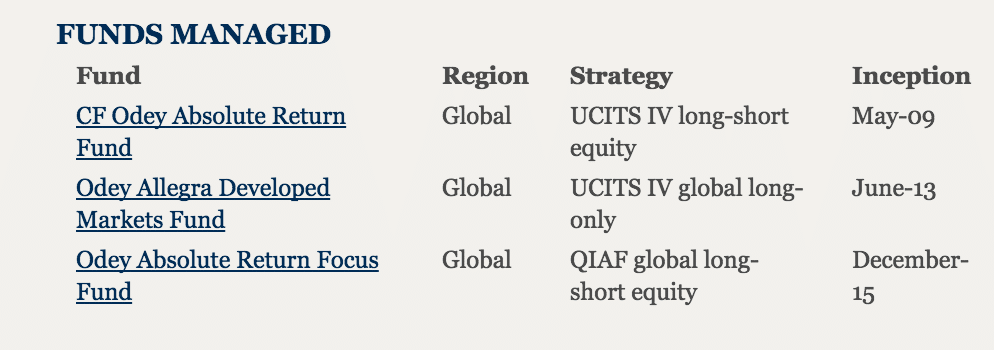

An excerpt below from the firm's website shows a number of funds that Mr. Hanbury oversees, as part of his position as a Partner and co-head of research:

Odey Asset Management

Channeling the Soros Trade

While the profit Mr. Hanbury has reportedly netted is quite significant for such an astute trader of his caliber, its dwarfed by nearly ten times the amount that renowned currency speculator, billionaire George Soros, had made nearly a quarter of a century ago.

On September 16th 1992 (known as Black Wednesday), Mr. Soros had bet that the British Pound would fall when the UK had to opt-out from joining the European Exchange Rate Mechanism (which later led to the Euro currency), and that trade almost broke the Bank of England, while netting himself a profit of over 1billion GBP.

Mr. Hanbury's bet is reminiscent of the Soros trade of 1992 and the closest one to it - in terms of profit size - that has since be divulged in wake of last Friday's market moves. In a related post on Brexit trading tactics from last week, leading into the UK vote, I explained that large players may come into to make big bets as volatility was expected.

Almost ironically, this time around with Brexit, Soros didn’t have the same luck with the GBP - as he was long the currency leading into last week’s brexit vote.

Mr. Soros has apparently suffered losses on long GBP positions leading into last week’s Brexit vote, yet may have averted a loss due to diversification across other investments that he benefitted from due to last Friday’s historic price action.

According to reports by Reuters, quoting a spokesperson of one of Soros’ companies, "George Soros did not speculate against sterling while he was arguing for Britain to remain in the European Union. However, because of his generally bearish outlook on world markets, Mr. Soros did profit from other investments."