Japanese FX giant Invast Securities has today released a set of performance statistics which demonstrate that the company's Australian division has experienced a steady increase in FX trades during the last three months.

Brendan Gunn, CEO Invast Securities AU

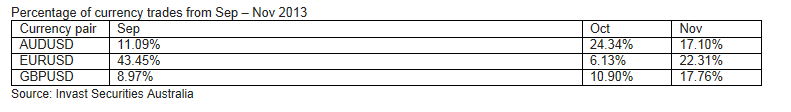

A quarterly review of Invast Australia’s trade volume by the company showed that trades in the AUD/USD pair accounted for 11.9 per cent of total trades in September 2013. This jumped to 24.34 per cent in October, which coincided with the Australian dollar's rise to as high as US$0.97571 which occurred on October 23, 2013.

Just last week, the company's Japanese headquarters detailed to Forex Magnates its intention to engage in an absorption-type corporate partition agreement between Invast Securities and CyberAgent FX, as well as the sale of securities which resulted in a substantial profit for the company.

Opposite Direction To Trend

Despite many FX firms worldwide having begun to experience a downward turn in trading activity compared with that achieved during the inaugural months of 2013, the figures released by Invast Securities' Australian operations run counter to this trend.

The company's CEO, Brendan Gunn today stated on behalf of the firm that he considers “The strong moves in the Aussie dollar have been a major factor.”

Mr. Gunn has become increasingly aware of a bigger trend which is driving the rise of FX trading in Australia. “What we’re finding is that private individual traders as well as money managers are looking for other investment and trading instruments outside of shares as opposed to traditional Equities ,” he said.

Managed Account Activity

Often, retail FX firms look favorably upon PAMM accounts which are operated by portfolio managers as a means of gaining many accounts at once from just one source, constituting an often large initial deposit making for long-term trading, and due to the professional nature of the trader responsible for the main and sub-accounts, higher trading volume than a standard retail FX account.

In the Asia-Pacific region, there are a great many FX portfolio managers to whom companies located in Australia are favorable due to the respected regulatory structure and strong economy in the region. Pepperstone CEO, Owen Kerr detailed some reasons for Australian FX firms' strength in a dialog with Forex Magnates earlier this year.

“There’s a strong interest from money managers for our FX offerings. This is a sign that investors and fund managers are trying to diversify and find new vehicles that will potentially deliver better returns than what they can get from shares,” is Mr. Gunn's view.

On this basis, Invast has also signed up several FX portfolio managers managers over the past few months.

“It may seem a challenging market out there, but we’re pleased with the growth and market share that we’ve generated over the past few months. And with Invast's history dating back to 1960 in Japan, we feel we are in a fantastic position to offer a comprehensive suite of FX products, suitable for both retail traders right up to the professional money manager," continued Mr. Gunn.