Expanding the feature set on their client retention package, Optimove has recently launched OptiTrack. A provider of client relationship tools, Optimove’s main offering provides online businesses such as forex and binary options brokers a tracking solution to monitor and engage customers. Among their product’s main features is the ability to highly filter client types, such as by active, beginner, gold traders, etc. Upon creating client segments, brokers have the ability to send customized marketing messages to these customers, as well as track follow on trading activity which their campaigns trigger. After building enough data, the package can then identify expected lifetime values of different types of clients.

For brokers, the expected lifetime values assists them in understanding how much they should be paying to target specific types of customers, and whether to alter existing marketing campaigns. As a data driven tool, Optimove isn’t alone in providing tools for online firms to better understand their client’s behavior and lifetime value calculations, but is one of the few directly involved with the forex and binary options market.

As understanding client behavior is the key to their data Analytics , their newest feature, OptiTrack, follows on that path of ‘knowing your customer’. The product operates as a cookie placed on client-side applications, allowing the Optimove platform to gather information on how traders are using a broker’s product. For example, OptiTrack can determine if a customer is interested in gold based on the client reading gold articles on a broker’s website. Tracking can also be embedded within a broker’s web-based and mobile applications to gather information on what charts a trader may be looking at. For brokers, the data insight provides a detailed look at customer interests which can be used to target marketing campaigns and calculate lifetime value.

Demoing OptiTrack’s features, Forex Magnates spoke with Optimove's Head of Marketing, Amit Bivas, Head of Marketing and New Business Manager, Howard Bick. Summarizing the significance of the product, they explained, “It is unique as it is on the single trader level." This means that unlike their legacy product which can be customized to categorize clients along many different group levels, OptiTrack allows for individual customer-based data to be collected. For brokers, this offers both a sales conversion and retention opportunity via knowing more about their customers' interests.

As an example, Bivas and Bick gave a scenario where a retention manager can look at a client’s account to gain insight on what securities they are trading. With OptiTrack, they can also determine if they are spending a lot of time looking at charts or reading analysis on other products which they still haven’t traded yet. The broker can then target a message with a pop-up or email notification in relation to the new asset type.

While the data from OptiTrack provides additional insight about users, it also raises the questions of whether it is ‘data overload’ for brokers. While data mining has become a great buzzword of the last few years, the reality is that it also requires companies to be attentive to the data and understand how to use it. In this regard, summarizing this dilemma well was Derek Sammann, Senior Managing Director, Commodity and Options Products at the CME Group, during the 2013 Forex Magnates' London Summit FX Liquidity Panel. As the discussion began to cover the topic of using big data, Sammann stated a bit humorously, “Over the years I have managed relationships purely without data, and I have tried to manage relationships purely with data. Neither one of them works.” The point being, that a mix of both a personal and data-driven approach is often the correct approach.

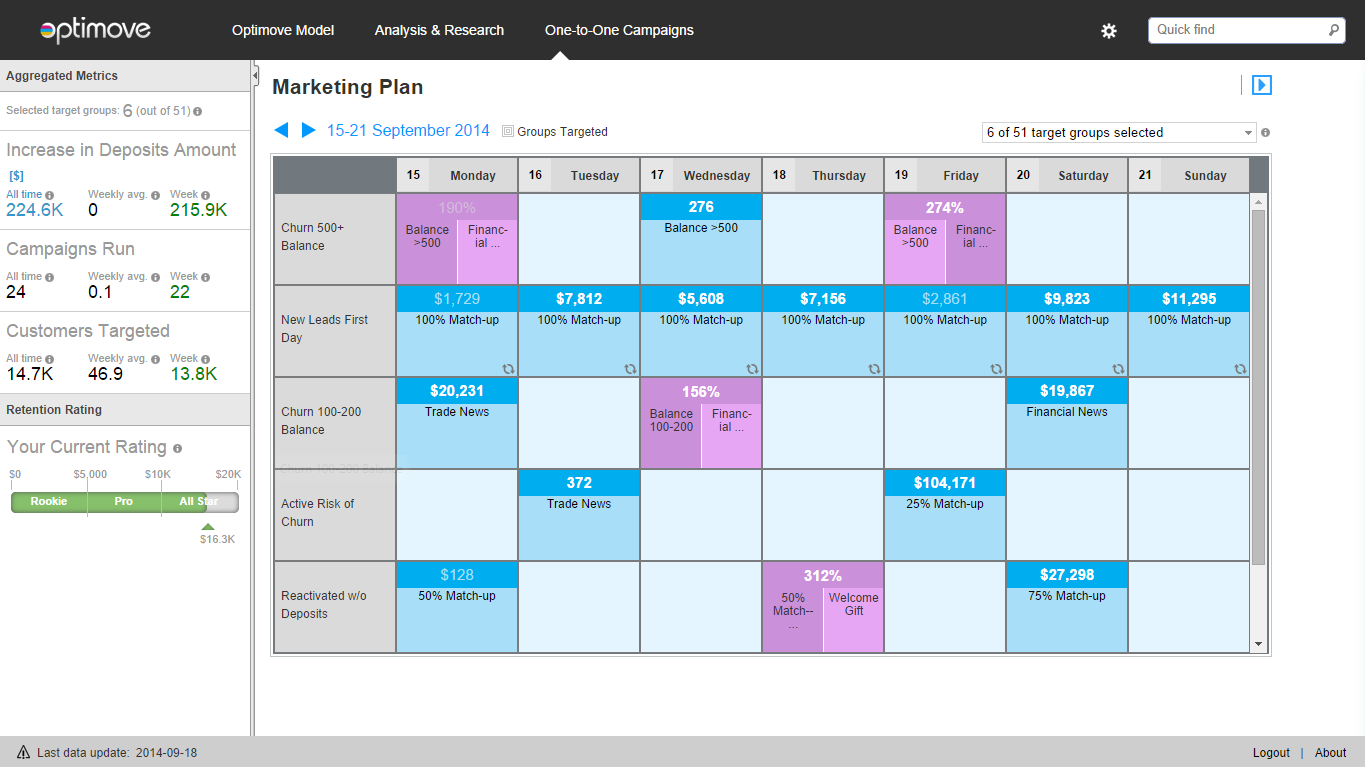

In relation to their product, Bivas and Bick explained that there is no need for an organized hierarchy for handling data provided from Optimove. They envisioned that two or three key marketing and data specialists would be devoted to the product, establishling targeted campaigns and evaluating the data. Those specialists would then be responsible for educating sales and support that can view Optimove client information within their CRM platforms on the meaning of the data. This would lead to what they described as, an end result of “providing specific info about customers to personalize call center personal approach."