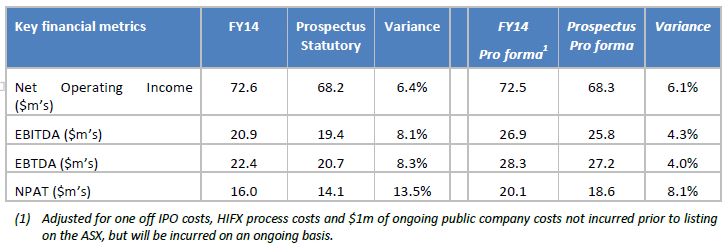

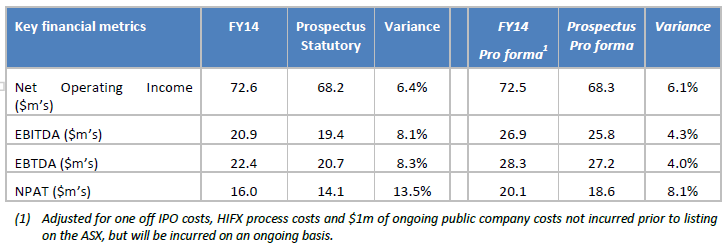

OzForex Group today reported results for its year ending March 31, 2014, with Net Profit After Tax (NPAT) of $20.1 million on a pro forma prospectus forecast basis –beating expectations of the proforma forecast of $18.6 million.

Net operating income of $72.5 million was reported this year, which was 6.1% higher than the forecast of $68.3 million, and up 39.1% Year-over-Year.

The number of active clients was up by 31% to 120,500 in FY2014, but missed prospectus forecast by a small margin of 2%.

A dividend of 2.375 cents per share will be distributed on June 27, 2014, and represents circa 70% of NPAT since listing, the company said it was on track to meet its September 30, 2014 prospectus forecast.

Commenting in the official press release, Neil Helm, OzForex CEO, said, "We've established a highly successful and market leading position in the international Payments sector as a result of our scalable technology platform and attractive customer proposition," and added, "We've helped over 120,000 clients make international payments this year. Clients are attracted to our business for a combination of reasons including competitive pricing, ease of use and the outstanding customer service."

Mr. Helm concluded, "We are constantly looking to innovate, scale and provide better payment solutions for our clients as we expand globally. We continue to invest in our people and our technology to remain a high growth company while maintaining a clear focus on giving clients the best possible experience when making an international payment."

The company was just listed on the Australia Securities Exchange (ASE) towards the end of last year, under the symbol OFX, and trading today around time of publication was down 2.64% at 2.5800 AUD per share.