This Thursday, Britons will go to the polls to vote on whether or not to leave the European Union. The referendum has been billed as the single biggest currency event of 2016 and has the potential for causing extreme volatility in GBP and EUR based currency pairs regardless of the outcome.

Pepperstone joins the growing number of brokers who have introduced amendments to their trading conditions to reflect the possibility of market volatility leading up to the referendum.

As a result of this expected volatility, the company has made temporary changes to its trading terms for margins on GBP and EUR based pairs as well as certain index markets. These leverage changes came into effect on 18 June and are effective until further notice.

The new maximum leverage/margin requirements for GBP pairs and UK100 is 50:1 and 100:1 for EU pairs and EU indices.

As with other brokerages, Pepperstone has asked its clients to consider potential trading conditions in the lead up to the event including extreme volatility on GBP, EUR, CHF currency pairs and on UK and European indices. There is also the propensity for Liquidity providers to significantly limit their liquidity, leading to a considerable widening of spreads as well as potential increased amounts of slippage on executed orders.

FreshForex

FreshForex has also just announced a series of new margin requirements that will apply to all currency pairs with the British pound (GBP), euro (EUR) and Swiss franc (CHF) and contracts for the European indexes (CAC40, ESTX50, FTSE100). A full breakdown of the new requirements is listed on the company website and will come into force on 22 June until the market closes on 27 June.

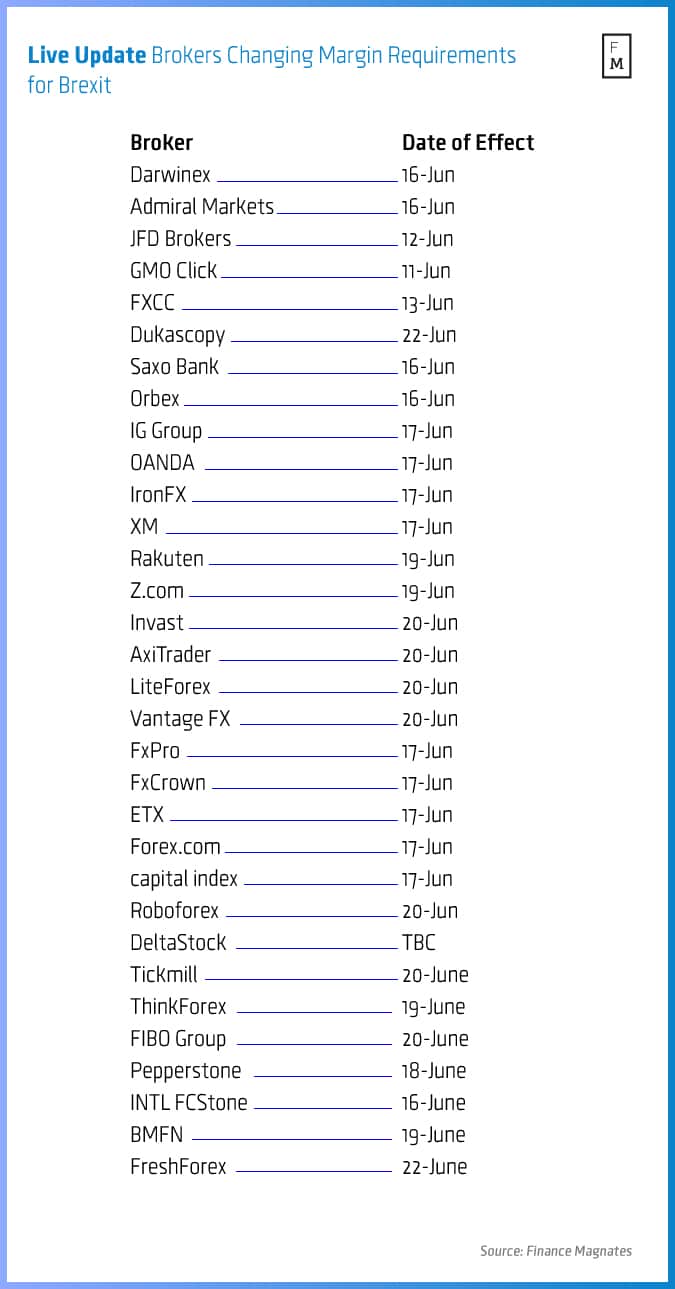

Finance Magnates has reported on an increasing number of brokerages making related changes which can be seen in the list below.

Finance Magnates