Playtech has reported its full year earnings for 2015, revealing that its financial trading subsidiary TradeFX which the company acquired in early 2014 has contributed roughly 10 per cent to the revenues of Playtech throughout the year, or about €60 million ($66 million).

The Markets.com business has managed to net $100 million in revenues for the full year including the figures before the takeover. The Acquisition by Playtech was concluded in April 2015, and the parent company reported today that its financial trading subsidiary registered growth in CFDs trading clients, netting 30 per cent. First time depositors have also grown by 25 per cent throughout the year.

As Finance Magnates reported first in December 2015, the company has undertaken a restructuring effort in order to optimize its business across the board. The firm has refocused its efforts on developing automation when dealing with clients and has laid off a number of employees in Bulgaria and Israel.

“Our newly created Financials division is developing well and we have further improved its business model”, the chairman of Playtech, Alan Jackson, stated.

Margins totaled 26 per cent with low markets Volatility in the latter half of 2015 being the leading cause behind the comparatively low number. Adjusted EBITDA of the financial division stood at $17.8 million (€15.9 million). The company has mentioned in its statement that “improvements to the business model were made to further enhance compliance”.

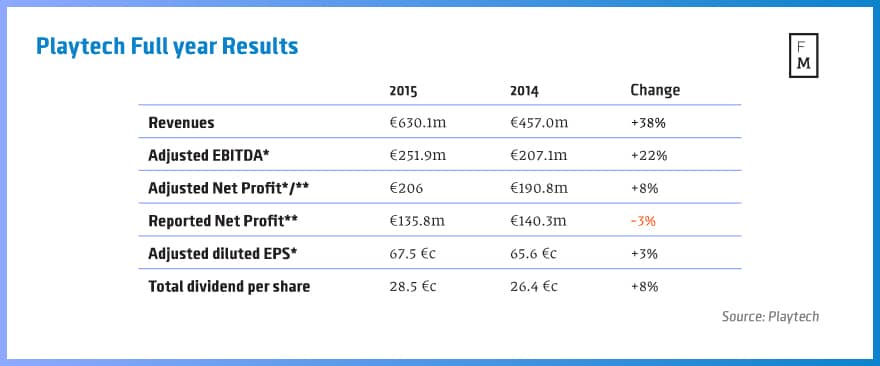

As for the broad business of the company, total revenues went up 38 per cent year-on-year in 2015 to €630.1 million, while adjusted EBITDA was higher by 22 per cent at €252 million.

Looking at M&A the company has refocused its efforts into gaming to make use of its massive cash reserves that total €857.9 million ($945.5 million).

“We have many opportunities for further growth, both organically and through M&A, with active discussions on a number of potential acquisitions in the Gaming division. Should suitable acquisitions not be available, consideration will be given to returning cash to shareholders as we look to maintain an efficient capital structure,” Jackson stated.

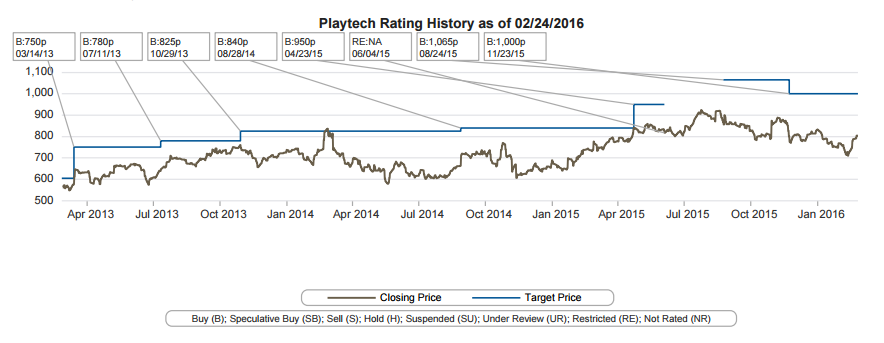

An Analyst Report from Canaccord Genuity's UK division maintained its Buy recommendation and 1000 pence target based on a cash adjusted FY17E price earning multiple (MEP) of 14.0 times, and EV/EBITDA ratio of 12.0 times.

The UK Analyst cited strong growth drivers, and underlying industry momentum, among other points such as a healthy pipeline and paraphrased the management's points on an efficient balance sheet regarding acquisitions.

The report also noted that Markets.com started Q1 very well amid market volatility but how management is adjusting the business model investing in regulatory infrastructure and in its B2B platform, which can impact short-term profits but help drive medium term gains in the future.

History of Ratings versus Share price for Playtech

source: Canaccord Genuity