Gambling software company Playtech (LSE: PTEC) today revealed ‘administrative errors’ related to its previously announced €40 million ($45million) share buyback scheme, blaming one of its existing corporate brokers.

The company said, in a filing with London Stock Exchange , that its broker Goodbody has reported inaccuracies with regards to repurchase transactions of 1,267,429 ordinary shares. As a result, Playtech informs stockholders that it canceled buyback transactions undertaken by Goodbody on 22, 25, 26 and 27 February 2019.

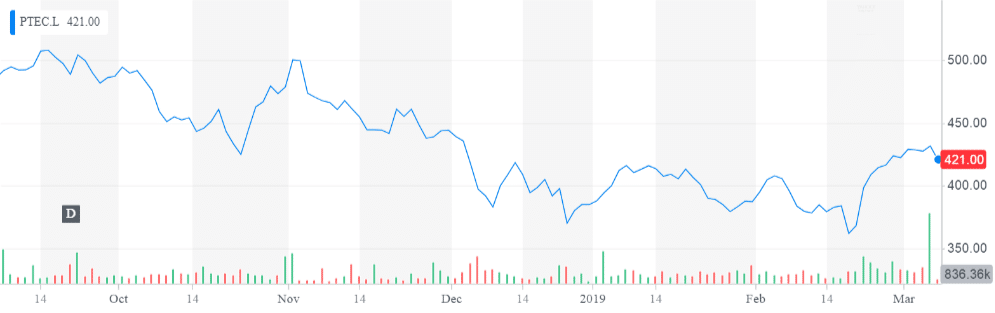

Following this news, Playtech’s stock fell from above 430p to as low as 421p within about an hour, although the stock has since bounced back. The stock traded recently at 424p, down over two percent on the day.

The company further explains in its statement: “As a consequence, the updated number of total ordinary shares in issue and total voting rights in the Company is 316,280,000. This figure for the total number of voting rights may be used by shareholders as the denominator for the calculation by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company under the FCA's Disclosure Guidance & Transparency Rules.”

Strong financial results boosted by Snaitech acquisition

Playtech, which makes gambling software and content for casinos and sports betting, announced on February 21 it will soon be buying back around 8 million of its issued ordinary shares. The FTSE 250 company said the move demonstrates the substantial opportunities that are available to drive future growth, as well as its high cash generation.

Around this time, Playtech posted a 54 percent increase in its 2018 revenue which amounted to €1.24 billion, buoyed by the first contributions from acquired Italian betting and gaming firm Snaitech SpA. The company’s financial division also achieved a 9 percent rise in revenue and earnings.

The company, which was founded by Israeli entrepreneur Teddy Sagi and counts Ladbrokes and Coral as customers, has been trading on the London Stock Exchange since 2006.