Plus500, the CFD broker, has been making headlines recently. The company went public in July of this year with an IPO on the London Stock Exchange’s Alternative Investment Market (AIM) and its shares have soared since, performing much better than most publicly listed FX firms. Plus500 also pioneered Bitcoin CFD trading and was the first to offer clients the ability to trade on the price of Litecoin.

In April of this year, Plus500 was the first broker to start offering trading on the price of Bitcoin. At the start, trading on Bitcoin was offered with leverage, but after the price skyrocketed the company had to change the trading conditions. And just 2 days ago, Plus500 was the first broker to offer Litecoin trading, breaking ground again.

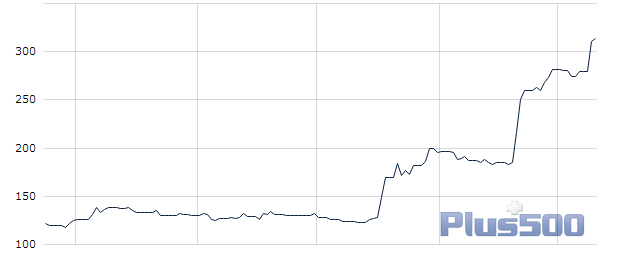

When the firm went public the initial stock price was just £1.15, however, since then it has risen as high as £3.14, an increase of about 170% and looking at valuations. Plus500 is now worth £361.9 Million, equating to more than $590 Million, which is more than that of long established GAIN Capital, just a number of months after the IPO.

Plus500 share price, IPO to date, in G.B.Pence:

Forex Magnates discussed with Gal Haber, the CEO of Plus500 what factors are attributable to the company’s rapid stock growth and trading on Digital Currencies.

How do you explain the massive stock rise? Where do you think the price of the stock should get to reflect the true value of the company?

As your readers may recall, our IPO was successful both in terms of level of funds raised and the strong support from institutional investors. How the stock has performed since then is a combination of demand from the market and our own strong organic performance to date. We believe the rise in our share price and subsequent valuation reflects this performance.

As for the valuation of Plus500, we are a publicly traded stock which means it is out of our hands. That being said, I believe that if we continue to exceed the markets' growth projections, which we have now done twice, much more is possible.

The basics of our job is to make sure that Plus500 continues to grow, maintain a progressive dividend policy and act in the interest of our shareholders.

How do you think the company can generate the same level of growth for investors, will you have to expand to new markets for it?

We first want to keep growing in our existing markets which to date cover over 50 countries globally. Our market share in many is still relatively small so we have a lot of room to expand, which is a key part of our IPO strategy. We are, naturally, looking at new markets where we believe a CFD Trading Platform could thrive. However, looking at our own geographic footprint, the UK and Australia continue to offer excellent growth potential.

Please explain how you see the risks and opportunity for brokers offering trading on Bitcoin and Litecoin CFDs since they offer considerable volatility.

We have seen an ever-increasing interest, and now more recently a demand in Bitcoin and to a lesser degree in Litecoin. As a result, we have added CFDs on them and have seen strong pick up from customers. The challenge for companies offering these CFDs is the risk involved due to the large volatility, which is something we do.