The London Stock Exchange listed brokerage Plus500 (LON:PLUS) has just published its first quarter metrics, showing a strong performance for the three months period which ended on the 31st March 2016. The firm reports both new record quarterly revenues and record active customers.

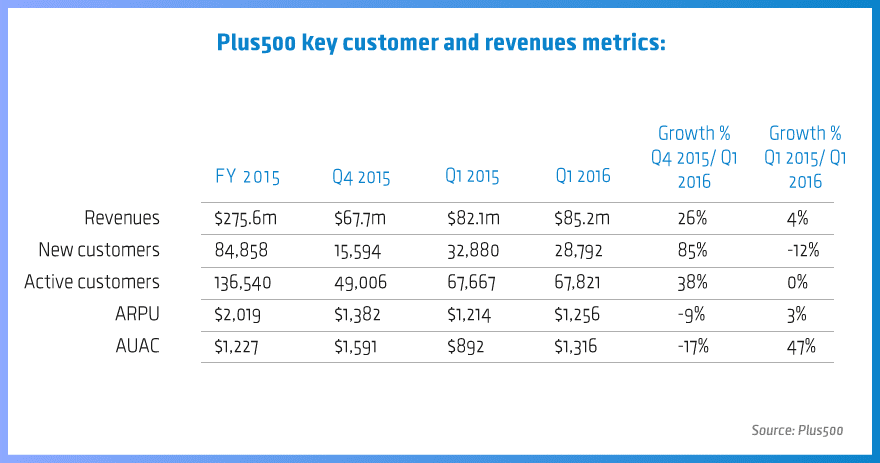

Looking at the actual figures, Plus500 reached quarterly revenues of $85.2 million (up 26% QoQ and 4% YoY) as well as 67,821 active customers (just slightly higher Q1 2015 but 38% higher from the previous quarter). The reason for the weaker yearly comparison is that the operation benefited greatly from the CHF crisis in Q1 2015 - which was a one-off event. This is also evident in Plus500's total Q1 2016 new customer numbers - 28,792 - down 12% year on year, but 85% higher than Q4 2015.

Asaf Elimelech, CEO, Plus500

Asaf Elimelech, the new Chief Executive of Plus500, commented: "We are very pleased with our first quarter performance which is significantly ahead of the last quarter of 2015, and compares favorably against a very strong first quarter last year. We continue to benefit from volatile market conditions which are stimulating new customer additions and trading activity."

"As we noted in February at the time of the 2015 results, we have more high value customers, an enhanced Trading Platform , more robust processes, a stronger brand and more routes to market, supported by a strong balance sheet. We are therefore confident that Plus500 will continue growing and believe we will have another successful year," he added.

Plus500 is retaining its guidance that it will achieve a higher EBITDA margin than that achieved in 2015. The firm reaffirms its base 60% pay-out ratio dividend policy, while it also retains the flexibility to pay special dividends or buy back shares when it generates surplus cash.