If there had been any doubt about the increasing weight of mobile trading amongst retail clients of Forex and CFDs brokers, the numbers from Plus500 have put them to rest. The company released its annual report which contains extra information about the distribution of the company's revenue and on-boarding.

Even without seeing the detailed breakdown, industry insiders know how important it is to have a mobile Trading Platform , but the figures from the Israeli tech-focused brokerage demonstrate the magnitude of the shift from desktop to mobile trading.

[gptAdvertisement]

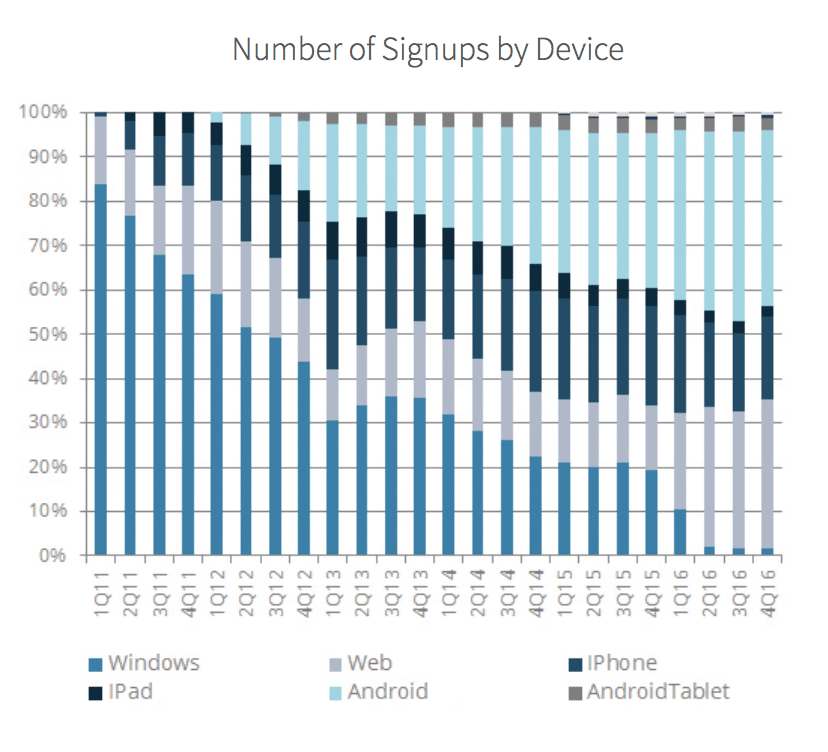

Plus500 Signups by device trends, Source: Plus500 Annual Report

The number of new client signups via the desktop platform of Plus500 has been tanking since the first quarter of 2011. As we can see on the chart above, the speed of the decline of windows-based solutions is astonishing with the end result being a shift to mobile and web-based experiences.

Finance Magnates Intelligence Report: Desktop Trading Still Overshadows Mobile

The development of HTML5 technology in recent years certainly has a role to play in these trends, but Android and iOS devices are taking the lead when it comes to growth. The plateau for the mobile industry comes at well over 60% in the first quarter of 2015 and has remained stable ever since.

Revenues from Mobile

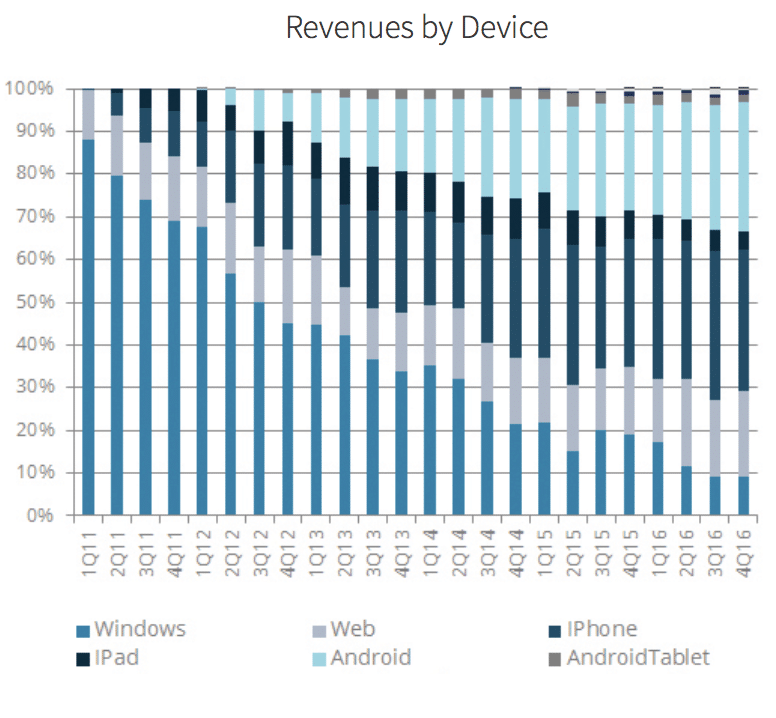

Plus500 Revenues by Device, Source: Plsu500 Annual Report

Looking at the revenues by device the results are even more striking and the trend even more established. The iOS share of devices including the iPhone and the iPad are clearly taking the lead on this end of the spectrum. Android users typically have less purchasing power on average, making Apple's ecosystem the top revenue growing generator for Plus500.

Looking at recent trends the decline in the share of trading volumes transacted via desktop is clearly outpaced by the share of iOS devices throughout 2016. Revenues from Android devices are also surpassing the desktop's share in the final two quarters of 2016.

Desktop platforms for retail traders are becoming less and less relevant when it comes to the entry type of clients which Plus500 is focusing on with its online marketing machine.

Online Marketing Machine

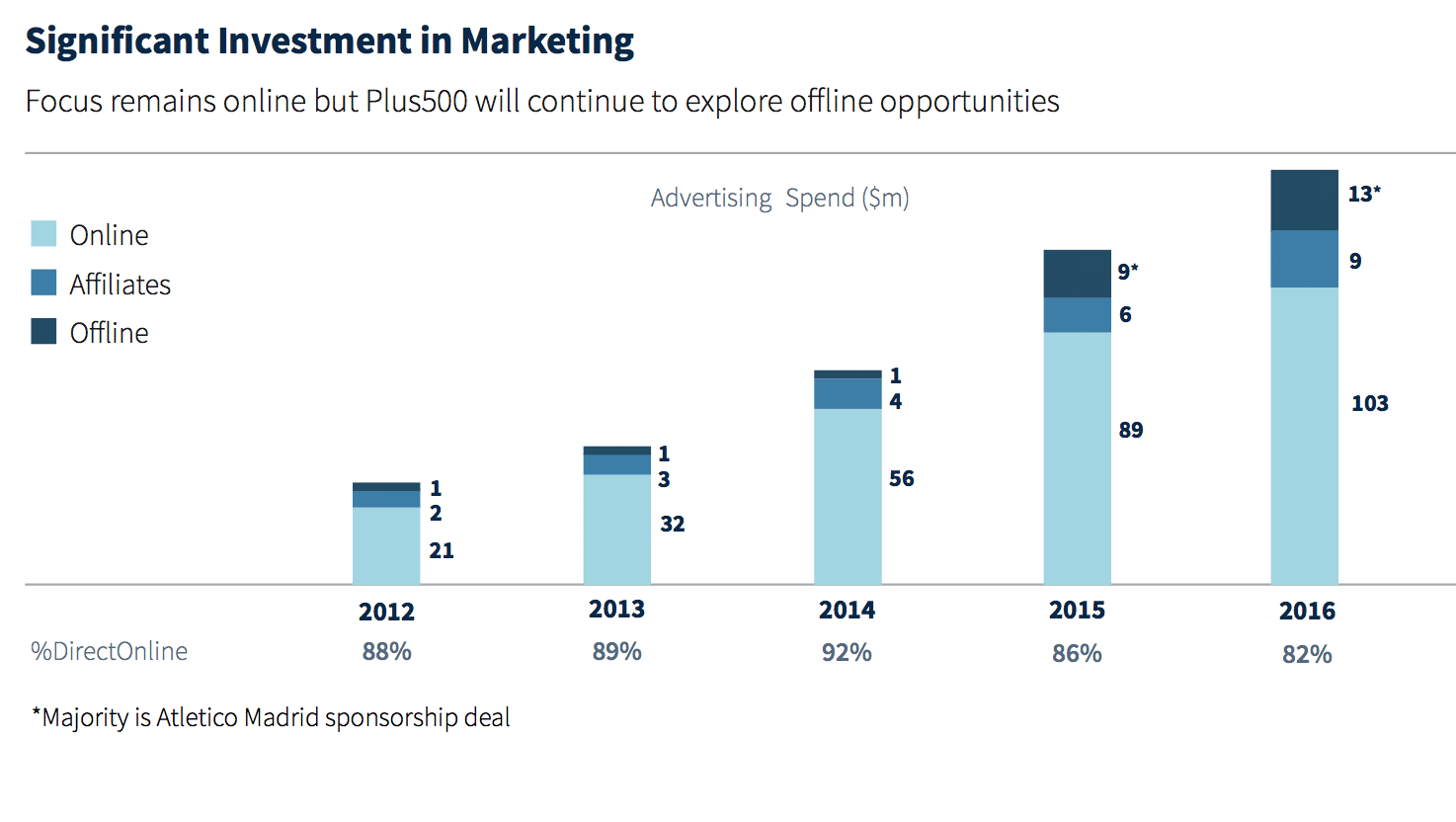

Plus500 Marketing Spend, Source: Plus500 Annual Report

The marketing machine through which Plus500 is maintaining its position of dominance on the market is continuing to post impressive results with the number of new clients of the firm hitting a new record in 2016, growing 46 percent year-on-year. The share of direct online advertisement last year decreased for the second year in a row to 82 percent of total spending on marketing.

The costs of the company have increased, but the efficiency of its online marketing machine has also increased, leading to a new record in both new and existing clients. The trends completely defy the UK FCA's measures against the company that materially impacted the company's valuation in 2015.

2017 will present new challenges with the UK watchdog challenging the whole industry this time around. Plus500's dominant position in the online marketing space will face new challenges such as a leverage cap for its clients in the UK and much tougher EU regulations. It remains to be seen whether the Israeli tech giant of the trading industry can successfully overcome the latest slew of challenges.