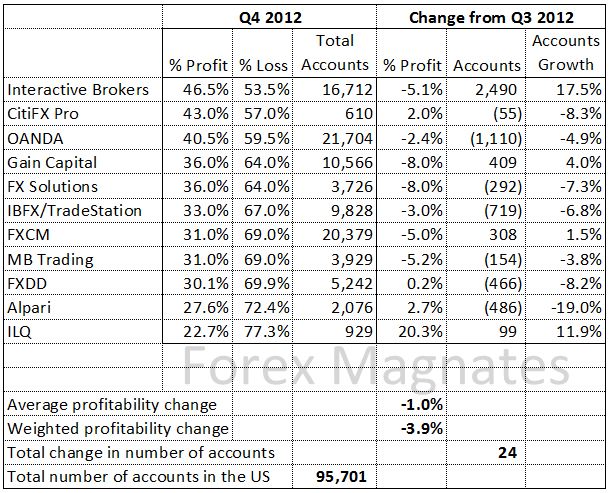

Updated: Interactive Brokers and Citi updated their numbers, with IB's number of accounts being different by more than 6k from the previous report so instead of rewriting the post we are posting both the New and the Previous tables.

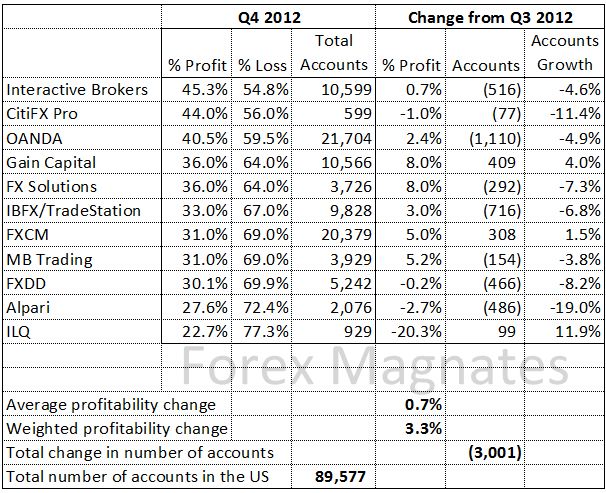

New:

Q4 2012 was the 3rd quarter in a row in which the number of US retail Forex traders declined. In Q1 2012 the number of traders technically grew by meagre 120 accounts - and this was probably due to Interactive Brokers calculating the number of accounts not according to NFA's requirements (this changed in Q2). Discarding this error - since the beginning of profitability numbers being published the number of US forex traders grew only in three quarters: +111 in Q3 2011, +621 in Q1 2011 and +657 in Q4 2010.

The change in number of accounts since the beginning (Q3 2010) is difficult to accurately calculate since brokers often reported differently to NFA's requirements (OANDA and IB) or have changed their numbers slightly after publishing (shall we call this forex backdating?) and some brokers came (IB, ILQ) while many more left (PFG, GFT, Forex Club, Advanced Markets and IG Markets). However if calculating these changes while factoring in the known differences we can see that the number of accounts dropped from 110,000 in Q4 2010 to less than 90,000 two years later. That's close to 20% drop.

The number of US forex brokers plummeted as well: PFG, GFT, Forex Club, Advanced Markets, IG Markets, Easy Forex and dbFX were here two years ago but have since either collapsed (PFG) or simply exited the US forex market as the NFA made it increasingly difficult for brokers to stay competitive.

18 brokers were accepting US traders 2 years ago, now there are only 11 which equals to staggering 33% drop. It doesn't take a genius to predict that two years from now there will be only a handful of US forex brokers left to continue this report, if at all.

US forex traders profitability in Q4 2012:

- Total of 89,577 active traders

- 11 reporting brokers

- Interactive Brokers back to being most profitable for clients, with CitiFX Pro right behind it

- 3,001 accounts were lost since Q3 2012 (discarding GFT's exit, home to 8,442 accounts)

- Only Gain Capital, FXCM and ILQ managed to grow the number of their accounts

- In range trading markets clients' profitability is slightly up

Previous

Q3 2012 report here, Q2 2012 report here, Q1 2012 and rest of reports here.