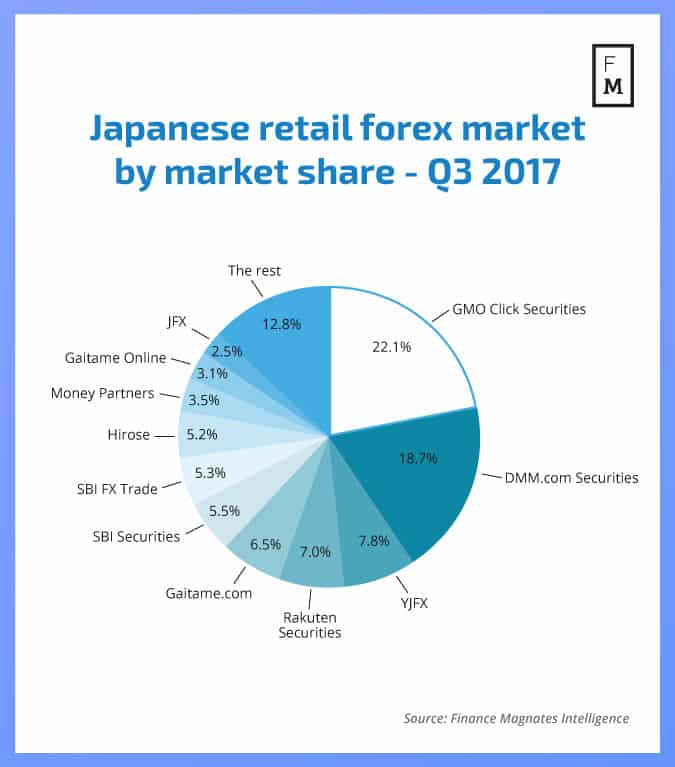

Rakuten Securities Inc. (RSI) has become a major player in the FX industry over the past few years. Headquartered in Japan, RSI’s market share in Asia remains one of the highest among global FX service providers. RSI is a subsidiary of Rakuten Inc, servicing over 2.2 million clients in the APAC region alone.

Discover credible partners and premium clients at China’s leading finance event!

RSI has made substantial moves in its quest to become an industry leader. In 2015, the company successfully completed the acquisition of FXCM Japan Securities for $62 million, which was one of its biggest competitors in the region. The purchase substantially increased RSI’s market share in Japan.

[gptAdvertisement]

Earlier this month, the company expanded to Australia, launching the retail FX brokerage Rakuten Securities Australia (RSA). The move signified Rakuten’s efforts to continues its ascent toward the top of the industry, leveraging its capacity toward additional large-scale markets.

In an exclusive interview with Finance Magnates, Nick Twidale, COO of Rakuten Australia, discusses the expansion in more depth.

Why did you choose Australia as a destination market for Rakuten?

Australia is an attractive place for a retail FX broker because of a favourable and sensible regulatory environment. Another reason is that greater leverage than in many other countries is available in this market.

Our research also shows a digitally savvy generation of investors has led to a higher demand for alternative investments such as online FX trading.

Do you intend to enter other countries in the APAC region? What about Europe?

We have a Hong Kong office and a Malaysian joint venture. At this point, we are not considering opening an additional office in the region. Depending on client demand, having a European office in one of the financial hubs may be beneficial to the global business in the future.

How do you intend to target this market (in terms of marketing, etc.)?

We provide a market leading product, offering some of the cheapest and most transparent pricing in the retail FX market. With pricing defined out of Tokyo, this allows us to make economies of scale and provide tight pricing for our clients. We believe this will attract traders in this market.

Education and research is a key focus for us in Australia and we offer our traders daily market commentary, updates on the FX market as well as webinars.

Do you have specific targets set for trader numbers and volume levels?

Our goal is to expand aggressively and we expect to see high volume levels as we continue to market our product offering in Australia.

Rakuten is a Japanese FX brokerage choosing to enter the Australian market at a time when Forex is on the decline in Japan and crypto on the rise. What is your plan to adjust to this new situation?

Retail FX in Japan is a very mature market, Online Trading globally is on the rise and is still in its infancy in many countries. We expect continued growth globally as tech savvy generations become a larger demographic. Cryptos are a prime example of the demand for higher risk growth assets. We believe Cryptos have a long way to come before becoming a mainstream asset class. Traditional currencies (digital or not) are most certainly here to stay. We invest in our product and service with a long term mindset.

Can you explain the recent decline in FX trading numbers in Japan? Other Japanese companies have already posted flatter data during 2017.

Yen volatility was low in 2017. Most Japanese traders just trade UsdJpy or Yen crosses. With less volatility comes less trading opportunities and lower volumes for brokers.

How was the process of entering the Australian market, in terms of regulation and other facets of the process?

Rakuten Securities took control of an ASIC regulated broker that was fully compliant with all ASIC requirements, so the process was relatively straightforward.

How did you prepare for ASIC regulation and its associated requirements? What were the challenges of this regulation? How does it compare to Japan?

Rakuten Securities hired experienced Australian industry professionals from day 1 to ensure it was compliant with all ASIC requirements. There are differences with the Japanese FSA and therefore each subsidiary has independent compliance departments.