We all knew that it was coming sooner or later, the hard crackdown on the part of global regulators on an industry that had been aggressive at selling to retail clients.

Discover credible partners and premium clients at China's leading finance event!

It didn’t matter that only some retail trading shops went overboard with binary options, the attention that forex and CFDs brokers gathered from global watchdogs especially in the aftermath of January 2015 was bound to reshape the industry.[gptAdvertisement]

First Quarter

The first quarter of 2017 started with the shutdowns of major binary options brands. After years of fines and regulatory issues, Banc de Binary was closed at the start of the year, continuing a trend that eventually left the binary options industry operating mainly in countries that do not provide consumer protection online. Several other shops have closed in the preceding and following months, leading up to the complete ban in the UK that was unveiled at year-end.

Finance Magnates

FXCM’s troubles in the aftermath of the January 2015 mayhem continued, as the company was forced out of the US and its accounts were taken over by GAIN Capital. Not only that, but the firm was fined $7 million for failing to comply with the harsh US regulatory framework.

While 2016 ended with the beginning of the end of loose regulation in the EU, it was a big market outside of the EU that started the major reshaping of the industry in 2017. A harsh crackdown on maximum leverage in Turkey forced brokers out of the country.

After years of misconduct, the Cypriot regulator, CySEC , finally withdrew the license of ACFX, but to date clients of the company have not been fully compensated. Authorities are yet to trigger the investor compensation fund to refund clients.

Second Quarter

Poland was next in line amongst major regulators across the globe, as the country’s watchdog took steps to limit the access of unregulated brokers to the marketplace. The tough fight against brokers that are soliciting clients without the appropriate authorization is one of the pillars of the new regulatory framework that EU members are mulling over. But going too far too fast might have unintended consequences, such as a drive of traders offshore.

Russia started its official regulatory framework in May, driving offshore brokers away with several steps against popular local search engines. For the time being, operating in Russia as a foreign broker is technically illegal, however, enforcement of the law when it comes to a country that is at geopolitical odds with the Western part of the hemisphere remains loose for now.

Gallant Capital filed for bankruptcy, spurring a raft of comments from industry insiders about the state of the industry in what have been relatively tough market conditions throughout the year. The main difficulties that brokers had were lackluster markets all across the board. There was only one asset class that was ceaselessly catching trader attention, and that was cryptocurrency.

A push on the part of brokers to MetaTrader 5 was driven by the growing push on the part of software developer MetaQuotes to shift legacy platform users from MT4 to multi-asset MT5.

MetaTrader 5 Android Interface

Third Quarter

Continuing its efforts from the second quarter and in line with what would likely be the EU-wide framework for addressing leverage limitations, Poland officially stated that it is looking to cap leverage on FX trading.

In the meantime, the last binary options operator standing, IQ Option, smoothly transitioned into CFDs and went all in on Cryptocurrencies . The latter step became a big trend in the industry as major asset classes were lacking volatility despite the ongoing political volatility around Trump.

While the crypto-craze prompted brokers to start offering trading via CFDs, the markets in this new asset class were incredibly volatile, especially after China officially banned exchanges and locals were officially left with only mining as a means to acquire the most sought-after asset of 2017.

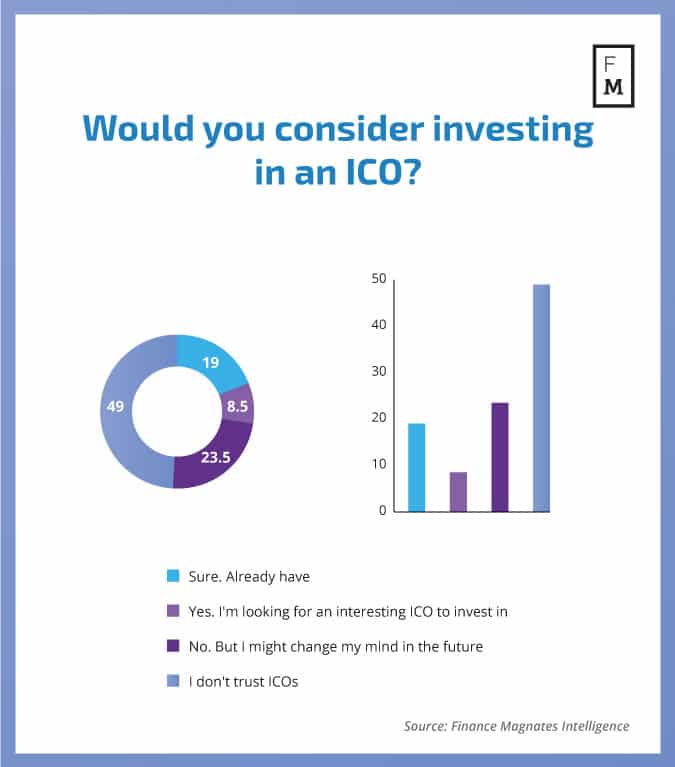

In the meantime, regulators worldwide turned their attention to the ICO market, that was heavily influencing venture capital raising efforts. While some brokers pondered whether to enter the fray and list their companies’ own tokens, others bravely did just that. However to date, no major capital raising effort for brokers and their crypto-subsidiaries resulted in major success.

FM survey on ICO investment among FX traders

Fourth Quarter

The end of the year started with the conclusion to the Polish regulatory saga, as the country introduced a hard cap at 1:50. The position of local authorities turned out to be relatively liberal, as at the end of the quarter we found out that ESMA’s official proposal is to limit leverage to a maximum of 1:30.

The numbers above would not satisfy the authorities in Japan, where the official cap has been 1:25 since 2011. This didn’t stop the local financial regulator from starting deliberations on whether to cap the figure to 1:10, a step too far in the views of Japanese traders and an effort to push all trading to the government-owned Tokyo exchange, in the views of some industry insiders from Japan.

The NFA mandated brokers to provide additional insights for traders that are looking to check the execution of their orders, a step that ensures transparency. While FXCM considered exiting the market, IG Group might be stepping in to fill the gap, as the former's publicly listed entity left after the SNB demise, Global Brokerage, filed for bankruptcy protection.

Brokers have started realizing the risks associated with offering cryptocurrencies to their clients. News that several brokers took a massive hit from traders that simply buy and hold cryptocurrencies prompted some brokers to reply with measures that limited incentives to hold positions overnight. Others have outright suspended a lot of their offerings in this asset class.

The Finance Magnates London Summit in 2017 was once again an iconic event for the industry, where hundreds of senior executives exchanged ideas and views on the market while networking. The successful expansion of the industry's annual reunion in London is sure to keep your favourite industry news website well supported over 2018. We wish you a prosperous and merry new year and are looking forward to hearing and seeing more of you in the coming quarters!

FM London Summit 2017