It has been about a year since the ESMA mandated brokers onboarding retail clients in the EU to cut the maximum Leverage they can use to 30:1 on major FX pairs. Moreover, the rules on other CFD products, like indices and commodities, have been changed even more drastically. According to the ESMA, the changes were implemented to protect consumers, but did the regulator achieve its goal?

Almost a year after the new rules have taken effect across the EU, we are taking a revised look at the profitability rates of retail clients. As we will see in the following lines, while there has been a decline in the percentage of losing accounts, the factors behind those numbers are more correlated to the booming offshore industry, instead of more stringent margin requirements.

Profitability Numbers

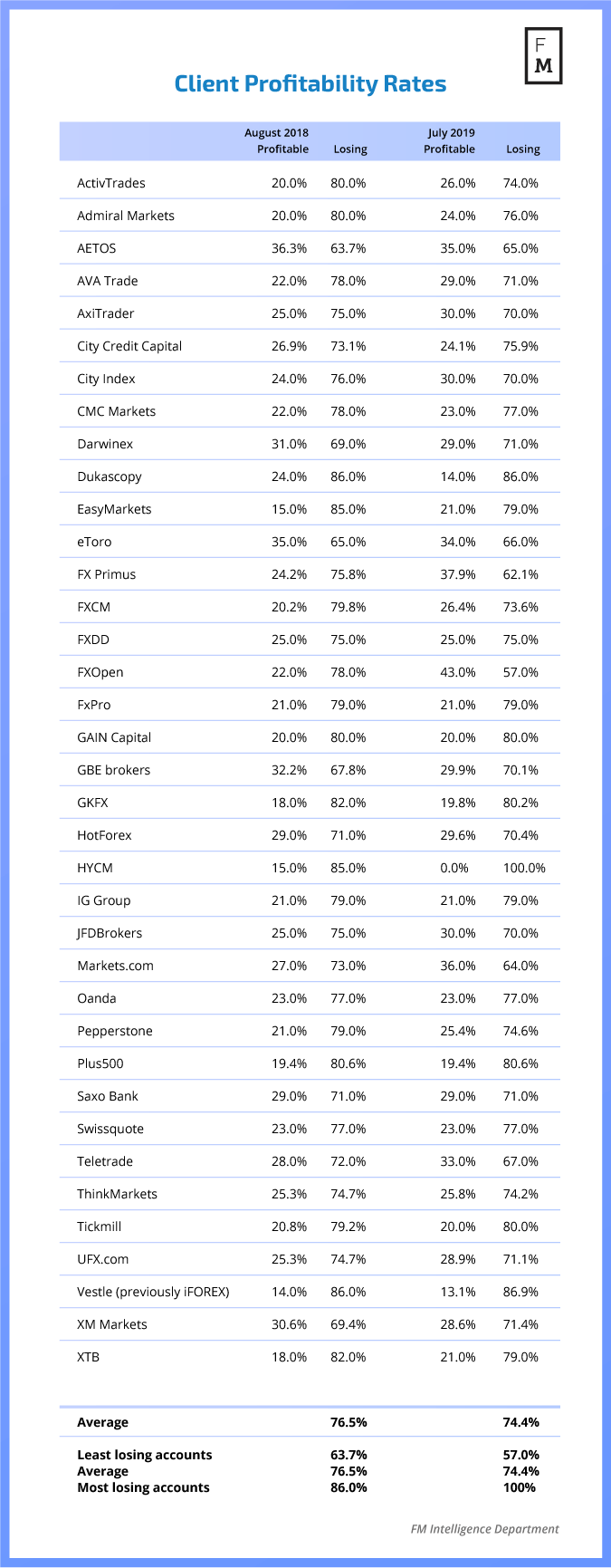

As you can see from the chart we have compiled below, the list is very diverse. Some brokers retained clients who are more profitable than a year ago, others haven’t. We even have one broker who states on its page to have only clients that lose money (!).

Client profitability rates of EU-regulated brokers, Source: FM Intelligence

The list is compiled alphabetically this time around for a reason. We can speculate on many fronts whether brokers are updating this data as frequently as every month. We can certify that some firms have shared with Finance Magnates that they are regularly updating the metric, but we can’t vouch for all.

What we see however is, that client outcomes at 17 out of 35 brokers have improved. A total of 9 brokers report no changes, while nine others are reporting worse outcomes for clients. On average, the number of profitable retail clients increased from 23.5 percent a year ago, to 25.1 percent as of this July.

The Devil is in the Details

One would think that the drastic changes to the policy of brokers should have yielded significantly better outcomes for the traders, at least the ESMA had us believe so. The regulator repeatedly stated that providing clients with high leverage is the main reason for them to lose money.

As it turns out, the statistical data which we currently have doesn’t support this view. On the contrary - considering the number of clients which have moved away from the EU to known and unknown overseas jurisdictions, the profitability of retail clients could have been mainly affected by the fact that the most risk-hungry clients simply decided to open an account offshore.

Another data point which is distorting the stats on a year-on-year basis is the recategorization of a number of clients to professionals. We don’t have reliable statistical input whether those clients have been mostly on the winning or the losing side.

Considering the relative enthusiasm on the part of publicly-listed companies, many of which are mostly making the market for the CFD products they offer, the likelihood that they are also on the losing side of the market is significant.

National Regulators Taking Over

With the anniversary of the ESMA’s rules, all of the national regulators will be taking matters into their own hands starting from the 1st of August 2019. We are only weeks from the final lapse of the 3rd three-month extension to the initial ESMA rules, and different national regulators are taking a different approach as to how to combine the risk appetite of retail clients with high-risk products.

Western-European financial regulators are more or less universal in their approach towards retail brokers, as they have made the ESMA’s temporary measures permanent. On the other side of the EU, Cyprus and Poland seem to be the main countries which are proposing a different approach.

Both national regulators are proposing a category for experienced traders that are allowing them to use leverage of up to 50:1. The CySEC proportionately is deliberating with the industry another category which limits the available margin to up to 20:1 in cases where customers don’t have much experience trading financial markets.

There is no silver bullet to the issue of client profitability and the ESMA, and national regulators will need to continue monitoring the market closely. That said, the silver bullet that leverage was supposed to be for client outcomes don’t seem to do the job very well.

One certain outcome from the ESMA’s measures from last year is that too many European clients who have been enjoying the protection of the EU’s regulatory framework are now trading offshore. Meanwhile, too many bad actors from the industry have shifted operations outside of the EU and are continuing to operate unabated if not facilitated by the lack of strict regulatory frameworks outside of the EU and G7 countries.