It’s been six months since the brokerage industry faced the doldrums of the new ESMA regulations in the EU. As largely expected, the industry got hit hard, primarily due to rising acquisition costs and a sharp decline in trading volumes.

After a brief period of shock and downgrades in the outlook for major brokerages, the market appears to have fully discounted the impact from the new ESMA regulations as of the beginning of December.

Around that time, the industry got the news from the FCA that European regulators intend to make the temporary product intervention measures permanent. The uncertainty which dominated the market was finally gone, and brokers accepted the new status quo in the EU market.

Publicly Traded Brokers

Today’s market open in London brought a rally to the sector. As June Felix bought a second batch of 17,000 shares worth around £100,000, investors interpreted the move as a signal of returning confidence.

The notion that the worst is now behind us was reinforced in conversations with multiple executives from the industry sharing their views on the impact of ESMA’s measures. Most companies appear to have adapted to the new environment in one way or another.

Publicly-traded brokers who do not have the flexibility that smaller market players do have adopted their own approach to the market. Turning retail clients into professional is one of the themes which mitigated the impact from ESMA’s new regulatory move last year.

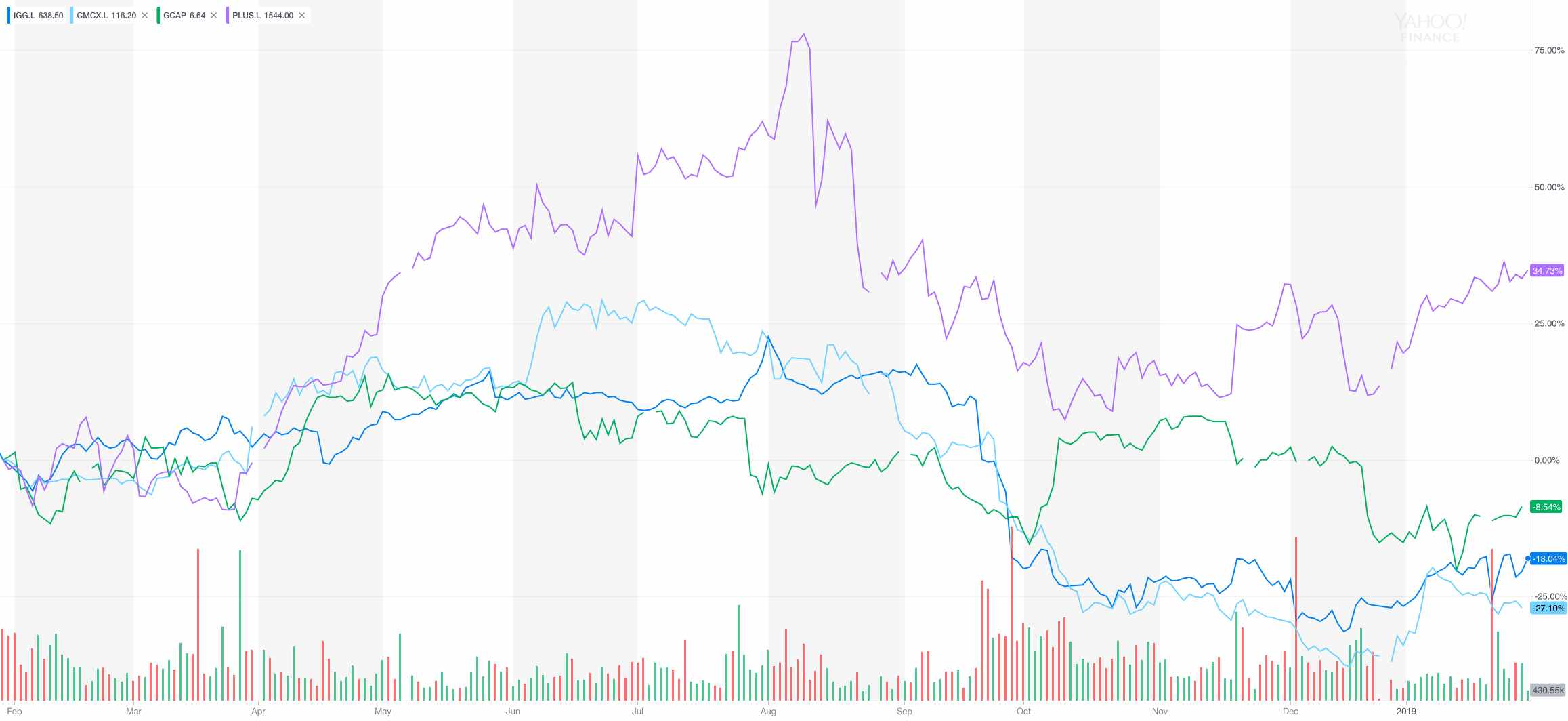

Examining the year-on-year performance of publicly-traded brokers, we identify one outlier: Plus500. The company’s extraordinary run into the crypto space last year managed to keep it well bid even throughout the low Volatility of 2018.

Bottoming Out… for Now

The final months of the year and a tumultuous equities market in the final quarter caused the firm to upgrade its guidance for the second half. As a result, shares of the company traded about 35 percent higher year-on-year.

CMC Markets is at the bottom when it comes to raw share price performance. The company’s stock is trading lower by 25 percent when compared to last February. IG Group’s performance is a touch better as it trades lower by 18 percent over the same period of time. GAIN Capital’s buyback program stabilized the firm’s shares as it traded only 8.5 percent lower when compared to a year ago.

Moves in shares of publicly-traded brokers, Source: Yahoo Finance

The common denominator for all companies, however, is that they are all trading higher than in the final months of 2018. Looking at the companies’ year-to-date performance, all publicly-traded brokers are performing steadily.

CMC is up 13.7 percent in 2019, followed by Plus500 at 12.8% and IG Group at 12.1%. GAIN Capital’s performance YTD is slightly weaker as the company’s shares rallied only 7.8% so far.

In tandem with rising acquisition costs in Europe, firms have also doubled down on their efforts to attract clients from outside of the EU. While publicly-traded companies have focused on regulated markets, other market players have adopted a more flexible approach.

Offshore Branches and Brands

A number of companies from the industry have chosen different diversification tactics to mitigate the impact. While publicly-traded brokers have strictly focused on regulated markets, other companies took advantage of regulatory arbitrage opportunities.

Some companies opened offshore branches, while others started new brands for their subsidiaries located in remote island areas. Companies holding Australian licenses capitalized in a big way, while smaller firms turned to island jurisdictions like The Bahamas, Vanuatu, and Seychelles.

Despite card deposit difficulties, the new subsidiaries found different ways to process deposits and withdrawals. This part of the industry appears to have moved away from jurisdictions like Cyprus and even the FCA to open subsidiaries that can remain competitive in the current market.